Question: Required information O n January 1 , 2 0 2 2 , Pride Corporation purchased 9 0 percent o f the outstanding voting shares o

Required information

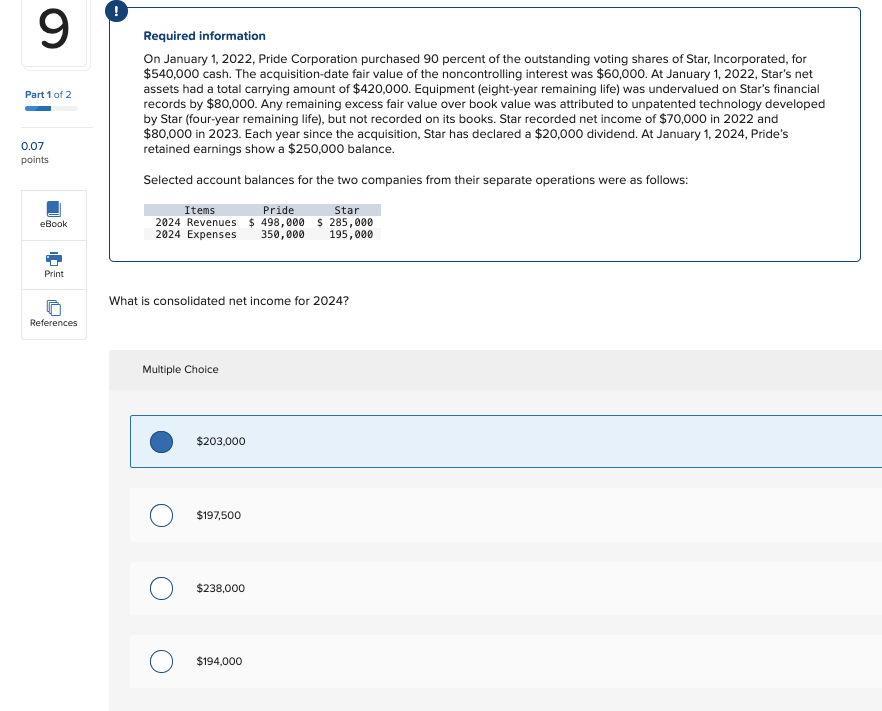

January Pride Corporation purchased percent the outstanding voting shares Star, Incorporated, for

$ cash. The acquisitiondate fair value the noncontrolling interest was $ January Star's net

assets had a total carrying amount $ Equipment year remaining life was undervalued Star's financial

records $ Any remaining excess fair value over book value was attributed unpatented technology developed

Star year remaining life but not recorded its books. Star recorded net income $ and

$ Each year since the acquisition, Star has declared $ dividend. January Pride's

retained earnings show $ balance.

Selected account balances for the two companies from their separate operations were follows:

What consolidated net income for

Multiple Choice

$

$

$

$

Required information

January Pride Corporation purchased percent the outstanding voting shares Star, Incorporated, for

$ cash. The acquisitiondate fair value the noncontrolling interest was $ January Star's net

assets had a total carrying amount $ Equipment year remaining life was undervalued Star's financial

records $ Any remaining excess fair value over book value was attributed unpatented technology developed

Star year remaining life but not recorded its books. Star recorded net income $ and

$ Each year since the acquisition, Star has declared $ dividend. January Pride's

retained earnings show $ balance.

Selected account balances for the two companies from their separate operations were follows:

Multiple Choice

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock