Question: ( ! ) Required information P 1 0 - 7 ( Algo ) Recording and Reporting a Bond Issued at a Discount (

Required information

PAlgo Recording and Reporting a Bond Issued at a Discount with Discount Account LO

The following information applies to the questions displayed below.

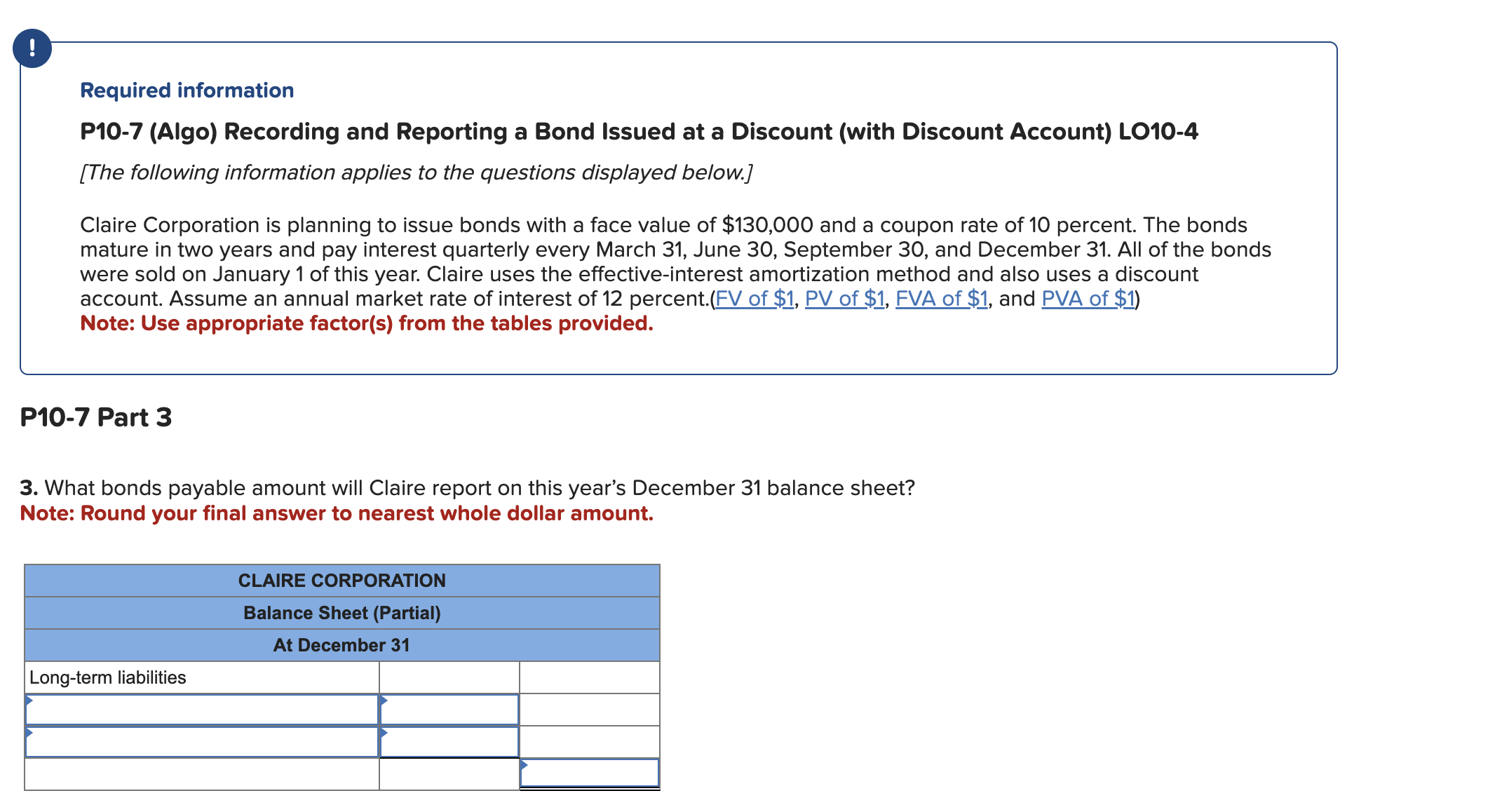

Claire Corporation is planning to issue bonds with a face value of $ and a coupon rate of percent. The bonds mature in two years and pay interest quarterly every March June September and December All of the bonds were sold on January of this year. Claire uses the effectiveinterest amortization method and also uses a discount account. Assume an annual market rate of interest of percent.FV of $ PV of $ FVA of $ and PVA of $

Note: Use appropriate factors from the tables provided.

P Part

What bonds payable amount will Claire report on this year's December balance sheet?

Note: Round your final answer to nearest whole dollar amount.

Required information

PAlgo Recording and Reporting a Bond Issued at a Discount with Discount Account LO

The following information applies to the questions displayed below.

Claire Corporation is planning to issue bonds with a face value of $ and a coupon rate of percent. The bonds mature in two years and pay interest quarterly every March June September and December All of the bonds were sold on January of this year. Claire uses the effectiveinterest amortization method and also uses a discount account. Assume an annual market rate of interest of percent. FV of $ PV of $ FVA of $ and PVA of $

Note: Use appropriate factors from the tables provided.

P Part

Provide the journal entry to record the interest payment on March June September and December of this year. Note: If no entry is required for a transactionevent select No journal entry required" in the first account field. Round your final answers to nearest whole dollar amount. answers to nearest whole dollar amount.

Answer is not complete.

begintabularcccccc

hline No & Date & & General Journal & Debit & Credit

hline & March & Interest expense &

& &

hline & & Bond discount & & &

hline & & Cash & & &

hline & & & & &

hline & June & Interest expense & checkmark & &

hline & & Bond discount & & &

hline & & Cash & checkmark & &

hline & & & & &

hline & September & Interest expense & checkmark & &

hline & & Bond discount & & &

hline & & Cash & checkmark & &

hline & & & & &

hline & December & Interest expense & checkmark & &

hline & & Bond discount & & &

hline & & Cash & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock