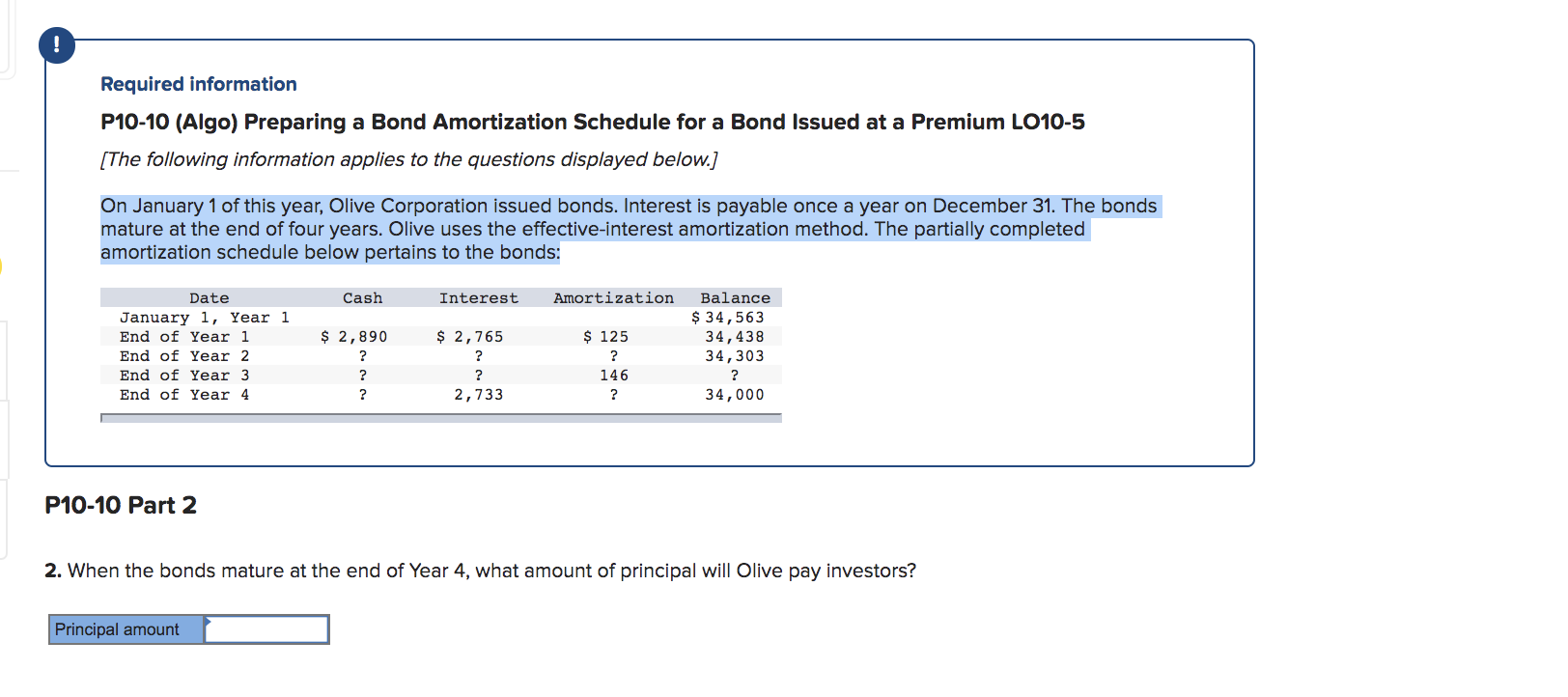

Question: Required information P10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium LO10-5 (The following information applies to the questions displayed

![questions displayed below.] On January 1 of this year, Olive Corporation issued](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f7c368a6160_44866f7c36859ad7.jpg)

Required information P10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium LO10-5 (The following information applies to the questions displayed below.] On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The partially completed amortization schedule below pertains to the bonds: Cash Interest Amortization Date January 1, Year 1 End of Year 1 End of Year 2 End of Year 3 End of Year 4 $ 2,890 ? ? ? $ 2,765 ? ? 2,733 $ 125 ? 146 ? Balance $ 34,563 34,438 34,303 ? 34,000 P10-10 Part 2 2. When the bonds mature at the end of Year 4, what amount of principal will Olive pay investors? Principal amount P10-10 Part 3 3. How much cash was received on the day the bonds were issued (sold)? Cash received P10-10 Part 4 4. Were the bonds issued at a premium or a discount? If so, what was the amount of the premium or discount? P10-10 Part 5 5. How much cash will be disbursed for interest each period and in total over the life of the bonds? Cash disbursed per period Cash disbursed in total P10-10 Part 6 6. What is the coupon rate? (Enter your answer as a percentage rounded to 1 decimal place (i.e. 0.123 should be entered as 12.3).) Coupon Rate % P10-10 Part 7 7. What was the annual market rate of interest on the date the bonds were issued? (Enter your answer as a percentage rounded to 1 decimal place (i.e. 0.123 should be entered as 12.3).) Market rate of interest % P10-10 Part 7 7. What was the annual market rate of interest on the date the bonds were issued? (Enter your answer as a percentage rounded to 1 decimal place (i.e. 0.123 should be entered as 12.3).) Market rate of interest % P10-10 Part 8 8. What amount of interest expense will be reported on the income statement for Year 2 and Year 3? (Round your final answers to nearest whole dollar amount.) Interest Expense Year 2 Year 3 P10-10 Part 9 9. What amount will be reported on the balance sheet at the end of Year 2 and Year 3? Bonds Payable Year 2 Year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts