Question: Required information P10-15 (Algo) Computing Amounts for a Bond Issued at a Discount and Comparing Effective-Interest Amortization to Straight-Line Amortization LO10-4 [The following information applies

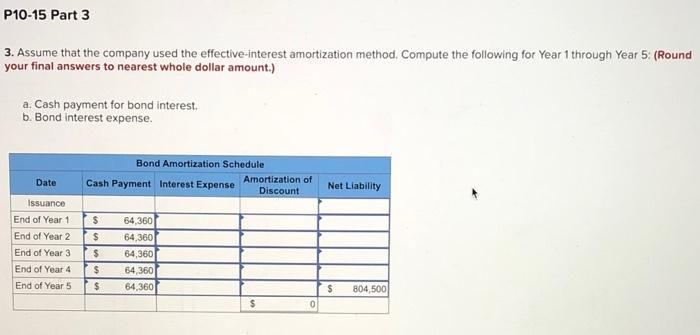

Required information P10-15 (Algo) Computing Amounts for a Bond Issued at a Discount and Comparing Effective-Interest Amortization to Straight-Line Amortization LO10-4 [The following information applies to the questions displayed below.] TeslaShock Corporation manufactures electrical test equipment. The company's board of directors authorized a bond issue on January 1 of this year with the following terms: (FV of \$1. PV of \$1, EVA of \$1, and PVA of \$1) (Use the appropriate factor(5) from the tables provided.) Face (par) value: $804,500 Coupon rate: 8 percent payable each December 31 Maturity date: December 31, end of Year 5 Annual market interest rate at issuance: 12 percent P10-15 Part 3 3. Assume that the company used the effective-interest amortization method. Compute the following for Year 1 through Year 5 : (Round your final answers to nearest whole dollar amount.) a. Cash payment for bond interest. b. Bond interest expense. 3. Assume that the company used the effective-interest amortization method. Compute the following for Year 1 through Year 5 : (Round your final answers to nearest whole dollar amount.) a. Cash payment for bond interest. b. Bond interest expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts