Question: Required information P12-6 (Static) (Supplement C) Preparing a Statement of Cash Flows, Indirect Method, Using the T-Account Approach [The following information applies to the questions

![the questions displayed below.] Hanks Company is developing its annual financial statements](https://s3.amazonaws.com/si.experts.images/answers/2024/08/66c621247b972_64366c62123ccaaa.jpg)

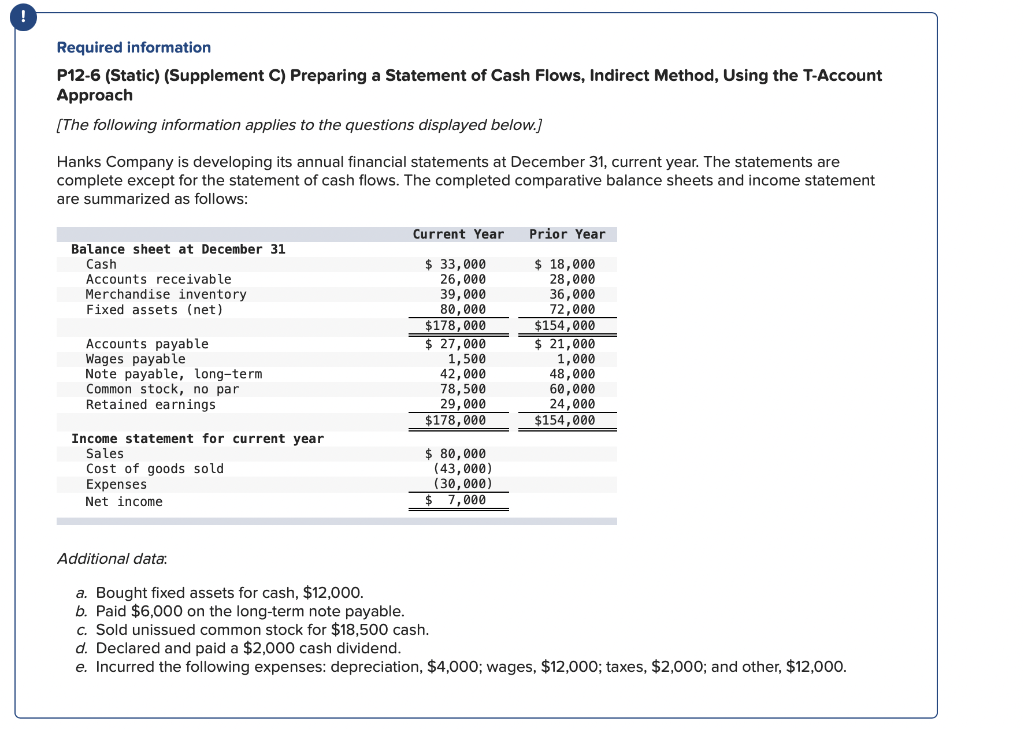

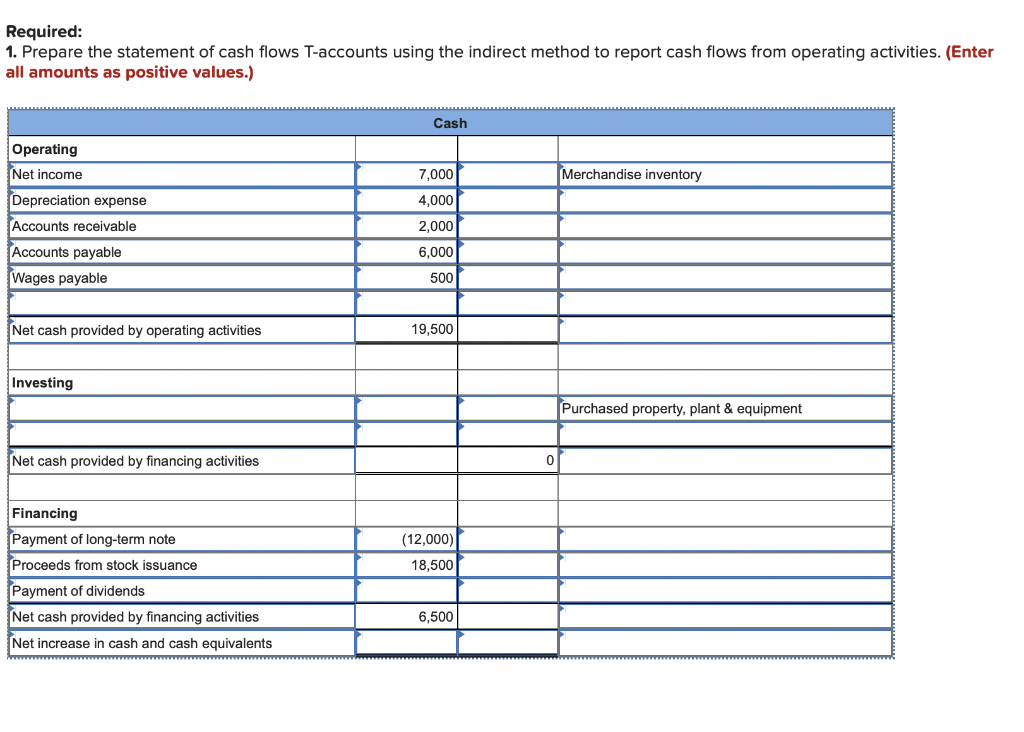

Required information P12-6 (Static) (Supplement C) Preparing a Statement of Cash Flows, Indirect Method, Using the T-Account Approach [The following information applies to the questions displayed below.] Hanks Company is developing its annual financial statements at December 31 , current year. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized as follows: Additional data: a. Bought fixed assets for cash, $12,000. b. Paid $6,000 on the long-term note payable. c. Sold unissued common stock for $18,500 cash. d. Declared and paid a $2,000 cash dividend. e. Incurred the following expenses: depreciation, $4,000; wages, $12,000; taxes, $2,000; and other, $12,000. Required: 1. Prepare the statement of cash flows T-accounts using the indirect method to report cash flows from operating activities. (Enter all amounts as positive values.) Cash Operating Net income Depreciation expense \begin{tabular}{l|l} (7) & 7,000 \\ \hline(0) & 4,000 \\ \hline(0) & 2,000 \end{tabular} Accounts receivable Sale of equipment Accounts payable Wages payable \begin{tabular}{|c|c} \hline () & 3,000 \\ \hline & 6,000 \\ \hline & 500 \\ \hline & 22,500 \end{tabular} Investing Payment of dividends Payment of long-term note 8,000 Financing Proceeds from stock issuance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts