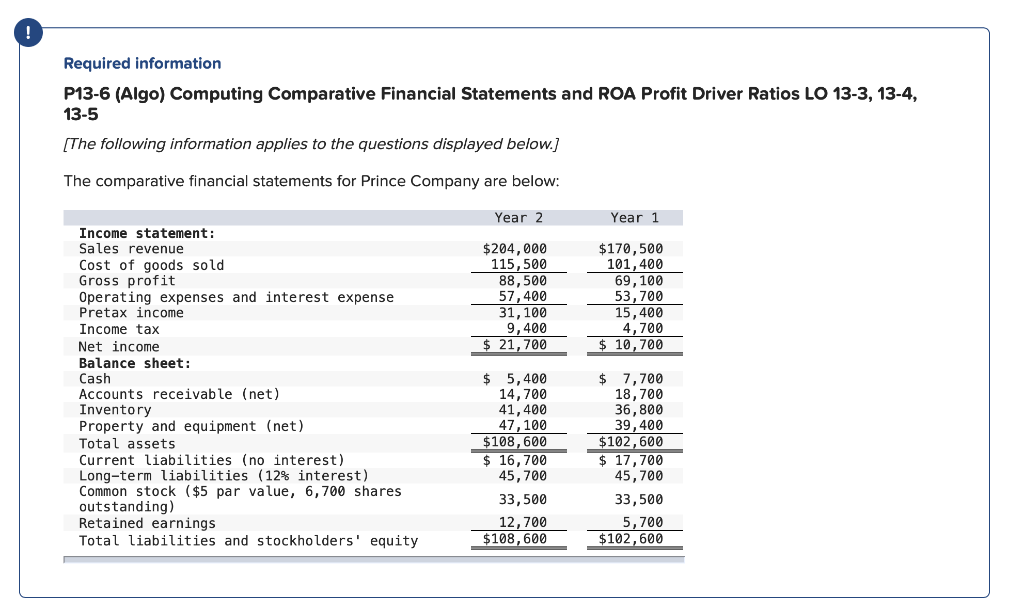

Question: Required information P13-6 (Algo) Computing Comparative Financial Statements and ROA Profit Driver Ratios LO 13-3, 13-4, 13-5 [The following information applies to the questions displayed

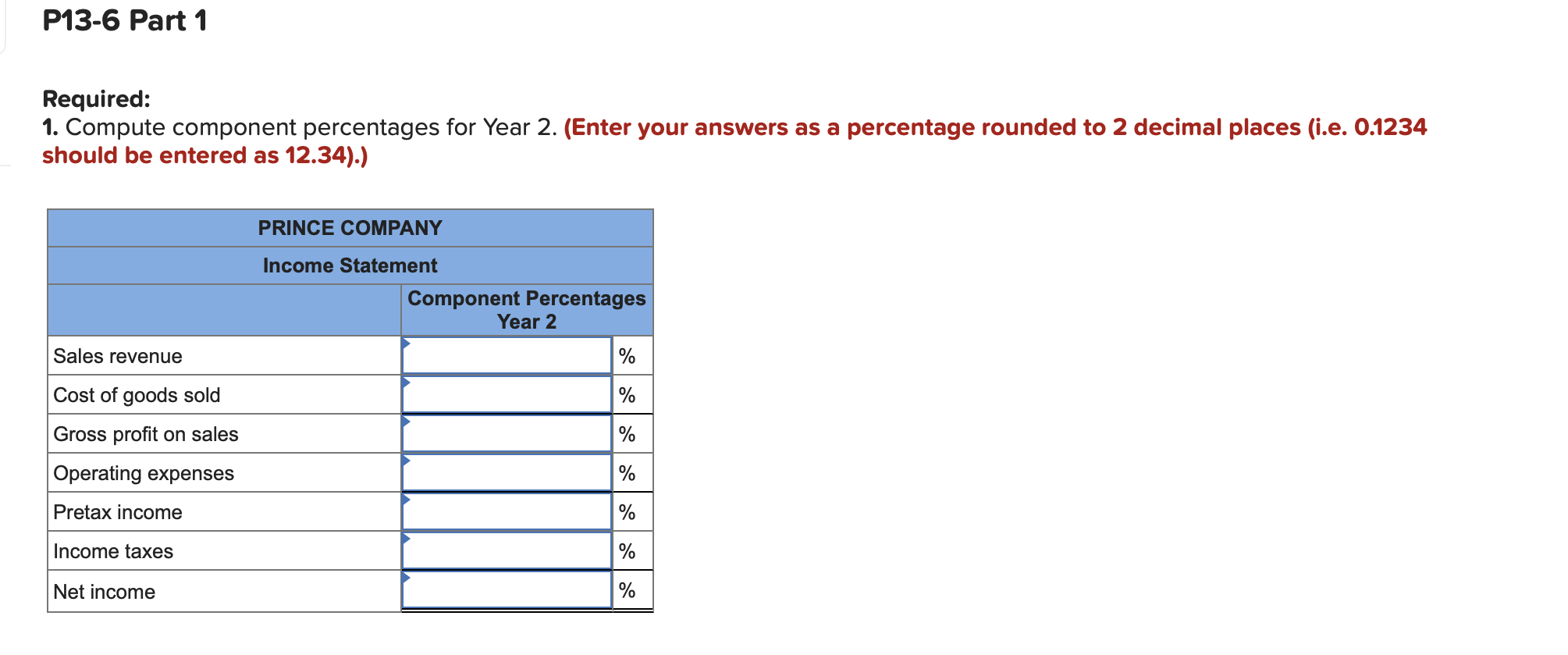

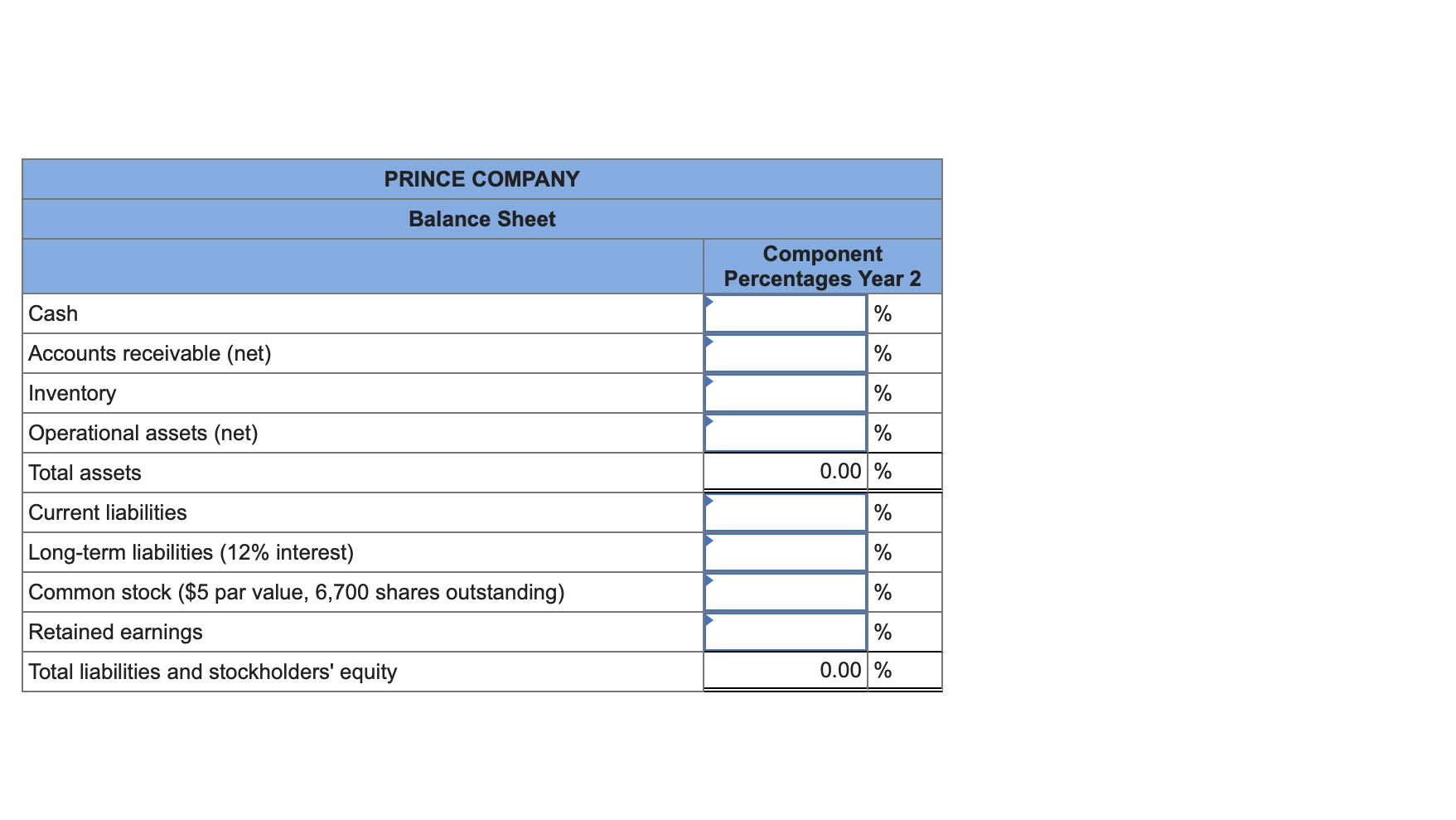

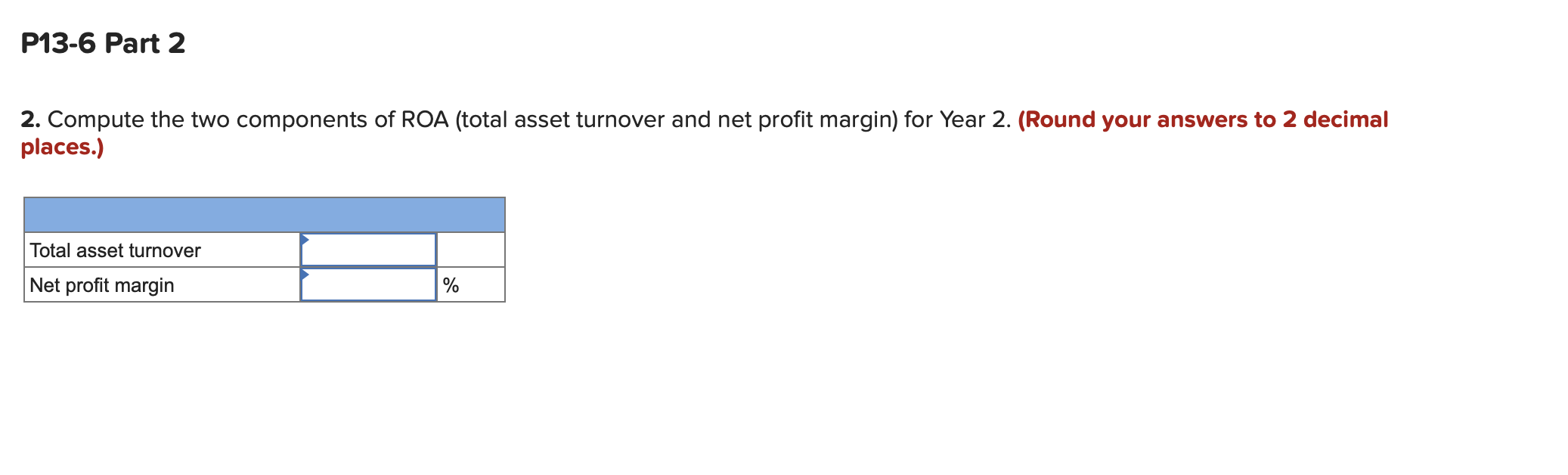

Required information P13-6 (Algo) Computing Comparative Financial Statements and ROA Profit Driver Ratios LO 13-3, 13-4, 13-5 [The following information applies to the questions displayed below.) The comparative financial statements for Prince Company are below: Year 2 Year 1 $204,000 115,500 88,500 57,400 31,100 9,400 $ 21,700 $170,500 101,400 69, 100 53,700 15,400 4,700 $ 10,700 Income statement : Sales revenue Cost of goods sold Gross profit Operating expenses and interest expense Pretax income Income tax Net income Balance sheet: Cash Accounts receivable (net) Inventory Property and equipment (net) Total assets Current liabilities (no interest) Long-term liabilities (12% interest) Common stock ($5 par value, 6,700 shares outstanding) Retained earnings Total liabilities and stockholders' equity $ 5,400 14,700 41,400 47,100 $108,600 $ 16,700 45,700 $ 7,700 18,700 36,800 39,400 $102,600 $ 17,700 45,700 33,500 5,700 $102,600 33,500 12,700 $108,600 P13-6 Part 1 Required: 1. Compute component percentages for Year 2. (Enter your answers as a percentage rounded to 2 decimal places (i.e. 0.1234 should be entered as 12.34).) PRINCE COMPANY Income Statement Component Percentages Year 2 Sales revenue % % Cost of goods sold Gross profit on sales Operating expenses % Pretax income % Income taxes % Net income % PRINCE COMPANY Balance Sheet Component Percentages Year 2 % Cash % Accounts receivable (net) Inventory Operational assets (net) % % Total assets 0.00 % Current liabilities % % % Long-term liabilities (12% interest) Common stock ($5 par value, 6,700 shares outstanding) Retained earnings Total liabilities and stockholders' equity % 0.00 % P13-6 Part 2 2. Compute the two components of ROA (total asset turnover and net profit margin) for Year 2. (Round your answers to 2 decimal places.) Total asset turnover Net profit margin %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts