Question: Required information P9-4 (Static) Record ing and Reporting Accrued Liabilities and Deferred Revenue with Discussion of Accrual versus Cash Accounting LO9-1 [The following information applies

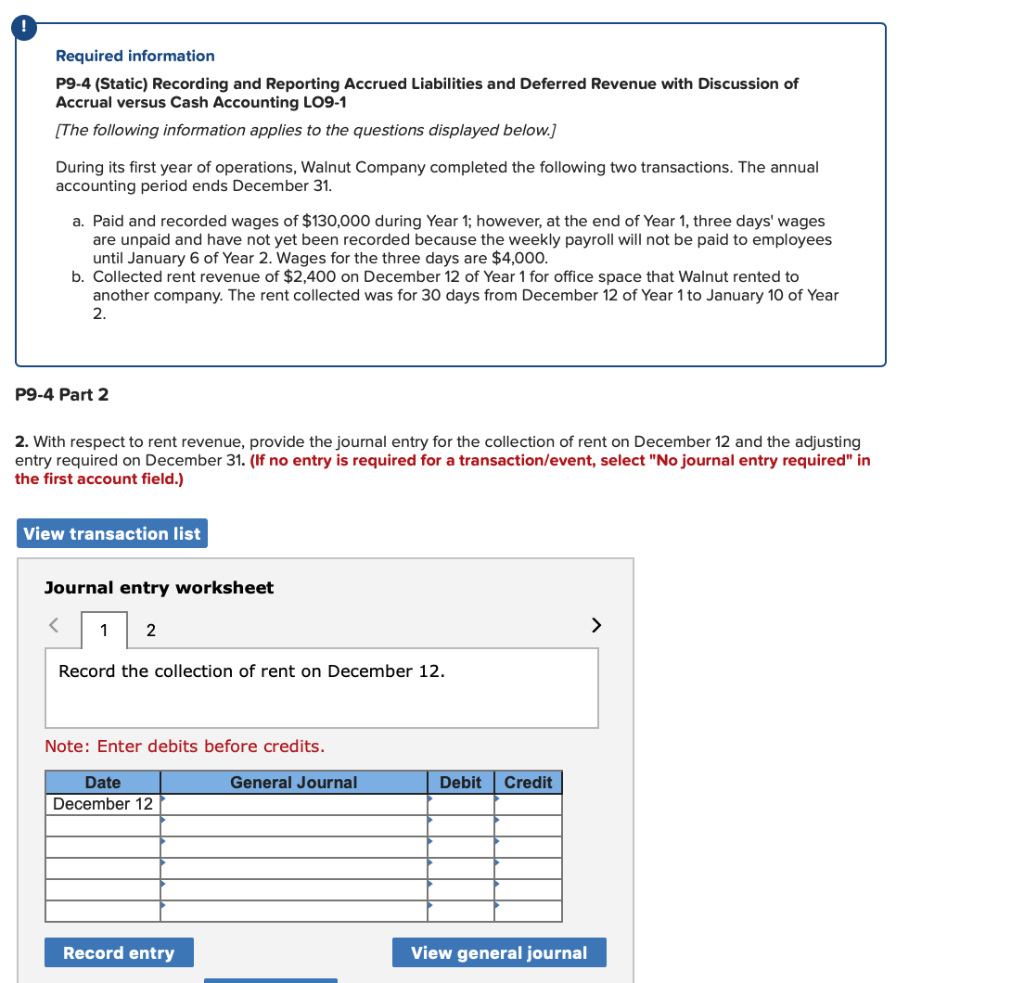

Required information P9-4 (Static) Record ing and Reporting Accrued Liabilities and Deferred Revenue with Discussion of Accrual versus Cash Accounting LO9-1 [The following information applies to the questions displayed below.] During its first year of operations, Walnut Company completed the following two transactions. The annual accounting period ends December 31 a. Paid and recorded wages of $130,000 during Year 1; however, at the end of Year 1, three days' wages are unpaid and have not yet been recorded because the weekly payroll will not be paid to employees until January 6 of Year 2. Wages for the three days are $4,000. b. Collected rent revenue of $2,400 on December 12 of Year 1 for office space that Walnut rented to another company. The rent collected was for 30 days from December 12 of Year 1 to January 10 of Year 2 P9-4 Part 2 2. With respect to rent revenue, provide the journal entry for the collection of rent on December 12 and the adjusting entry required on December 31. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 Record the collection of rent on December 12. Note: Enter debits before cred its. General Journal Credit Date Debit December 12 Record entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts