Question: Required information PA 5 - 3 ( Algo ) Identifying Outstanding Checks and Deposits in Transit and Preparing a Bank Reconciliation and Journal Entries [

Required information

PAAlgo Identifying Outstanding Checks and Deposits in Transit and Preparing a Bank Reconciliation and Journal Entries LO LO

Skip to question

The following information applies to the questions displayed below.

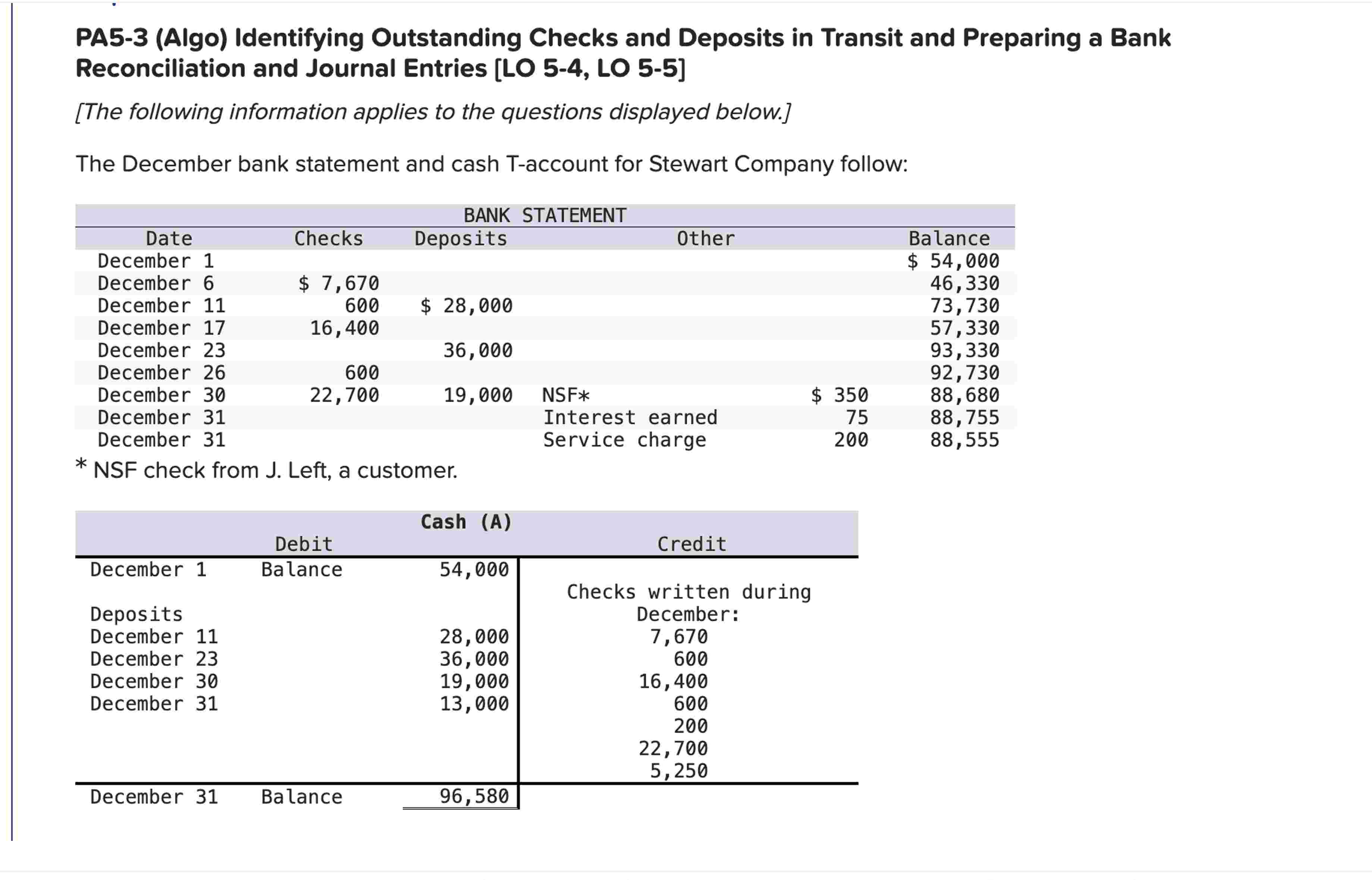

The December bank statement and cash Taccount for Stewart Company follow:

BANK STATEMENTDateChecksDepositsOtherBalanceDecember $ December $ December $ December December December December NSF$ December Interest earnedDecember Service charge

NSF check from J Left, a customer.

Cash ADebitCreditDecember BalanceDepositsChecks written during December:December December December December December Balance

There were no deposits in transit or outstanding checks at November

PAAlgo Part and

After the reconciliation journal entries are posted, what balance will be reflected in the Cash account in the ledger?

If the company also has $ of petty cash on hand, which is recorded in a different account called Petty Cash on Hand, what total amount of Cash and Cash Equivalents should be reported on the December balance sheet?

PAAlgo Identifying Outstanding Checks and Deposits in Transit and Preparing a Bank Reconciliation and Journal Entries LO LO

Skip to question

The following information applies to the questions displayed below.

The December bank statement and cash Taccount for Stewart Company follow:

BANK STATEMENTDateChecksDepositsOtherBalanceDecember $ December $ December $ December December December December NSF$ December Interest earnedDecember Service charge

NSF check from J Left, a customer.

Cash ADebitCreditDecember BalanceDepositsChecks written during December:December December December December December Balance

There were no deposits in transit or outstanding checks at November

PAAlgo Part and

After the reconciliation journal entries are posted, what balance will be reflected in the Cash account in the ledger?

If the company also has $ of petty cash on hand, which is recorded in a different account called Petty Cash on Hand, what total amount of Cash and Cash Equivalents should be reported on the December balance sheet? PAAlgo Identifying Outstanding Checks and Deposits in Transit and Preparing a Bank Reconciliation and Journal Entries LO LO

The following information applies to the questions displayed below.

The December bank statement and cash Taccount for Stewart Company follow:

NSF check from J Left, a customer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock