Question: Required information Part 5: Performance Evaluation and Analysis Problems [The following information applies to the questions displayed below] These problems relate to the integrated Analytics

![information applies to the questions displayed below] These problems relate to the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e6891833d8f_40766e68917cb855.jpg)

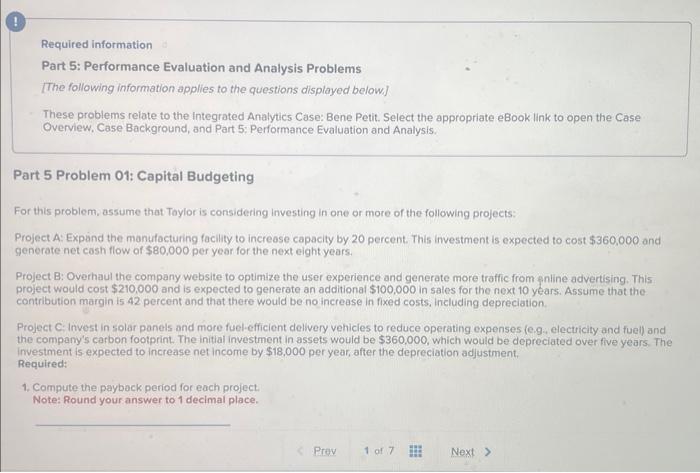

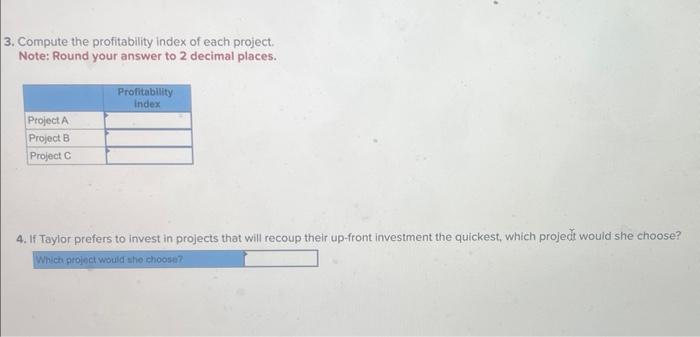

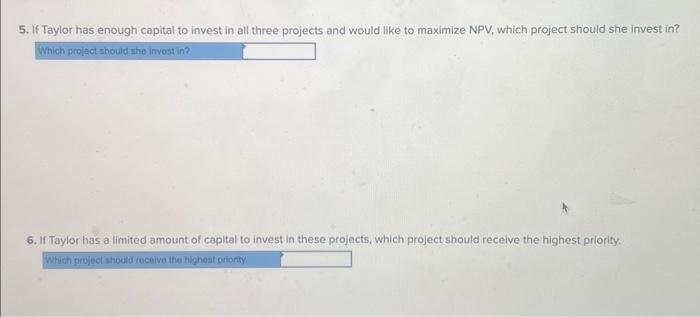

Required information Part 5: Performance Evaluation and Analysis Problems [The following information applies to the questions displayed below] These problems relate to the integrated Analytics Case: Bene Petit. Select the appropriate eBook link to open the Case Overview, Case Background, and Part 5: Performance Evaluation and Analysis. Part 5 Problem 01: Capital Budgeting For this problem, assume that Toylor is considering investing in one or more of the following projects: Project A: Expaind the manufacturing facility to increase capacity by 20 percent. This investment is expected to cost $360,000 and generate net cash flow of $80,000 per year for the next eight years. Project B: Overhaul the company website to optimize the user experience and generate more traffic from gniine advertising. This project would cost $210,000 and is expected to generate an additional $100,000 in sales for the next 10 years. Assume that the contribution margin is 42 percent and that there would be no increase in fixed costs. Including depreciation. Project C: Invest in solar panels and more fuel-efficient delivery vehicies to reduce operating expenses (e.gu electricity and fuel) and the company's carbon footprint. The initial investment in assets would be $360.000, which would be depreciated over five years. The Investment is expected to increase net income by $18,000 per year, after the depreciation adjustment, Required: 1. Compute the paybock period for each project. Note: Round your answer to 1 decimal place. investment is expected to increase net income by $18,000 per year, after the depreciation adjustment. Required: 1. Compute the payback period for each project. Note: Round your answer to 1 decimal place. 2. Compute the NPV of each project assuming the cost of capital is 10 percent. Note: Round your PV amounts to 4 decimal places. 3. Compute the profitability index of each project. Note: Round your answer to 2 decimal places. 4. If Taylor prefers to invest in projects that will recoup their up-front investment the quickest, which projedt would she choose? 5. If Taylor has enough capital to invest in all three projects and would like to maximize NPV, which project should she invest in? 6. If Taylor has a limited amount of capital to invest in these projects, which project should receive the highest priority. Required information Part 5: Performance Evaluation and Analysis Problems [The following information applies to the questions displayed below] These problems relate to the integrated Analytics Case: Bene Petit. Select the appropriate eBook link to open the Case Overview, Case Background, and Part 5: Performance Evaluation and Analysis. Part 5 Problem 01: Capital Budgeting For this problem, assume that Toylor is considering investing in one or more of the following projects: Project A: Expaind the manufacturing facility to increase capacity by 20 percent. This investment is expected to cost $360,000 and generate net cash flow of $80,000 per year for the next eight years. Project B: Overhaul the company website to optimize the user experience and generate more traffic from gniine advertising. This project would cost $210,000 and is expected to generate an additional $100,000 in sales for the next 10 years. Assume that the contribution margin is 42 percent and that there would be no increase in fixed costs. Including depreciation. Project C: Invest in solar panels and more fuel-efficient delivery vehicies to reduce operating expenses (e.gu electricity and fuel) and the company's carbon footprint. The initial investment in assets would be $360.000, which would be depreciated over five years. The Investment is expected to increase net income by $18,000 per year, after the depreciation adjustment, Required: 1. Compute the paybock period for each project. Note: Round your answer to 1 decimal place. investment is expected to increase net income by $18,000 per year, after the depreciation adjustment. Required: 1. Compute the payback period for each project. Note: Round your answer to 1 decimal place. 2. Compute the NPV of each project assuming the cost of capital is 10 percent. Note: Round your PV amounts to 4 decimal places. 3. Compute the profitability index of each project. Note: Round your answer to 2 decimal places. 4. If Taylor prefers to invest in projects that will recoup their up-front investment the quickest, which projedt would she choose? 5. If Taylor has enough capital to invest in all three projects and would like to maximize NPV, which project should she invest in? 6. If Taylor has a limited amount of capital to invest in these projects, which project should receive the highest priority

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts