Question: Required information Prepare the adjusting entries that are needed given the information below: Jay, Inc made all of the 2019 journal entries except the year-end

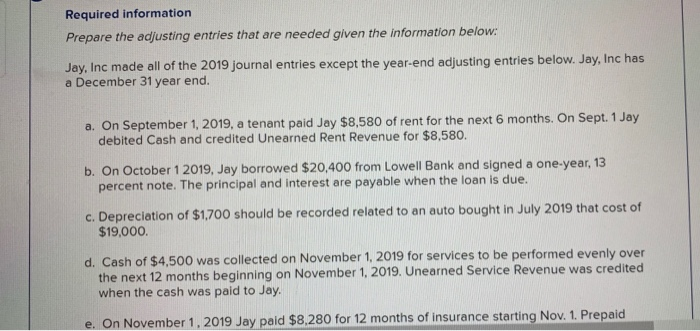

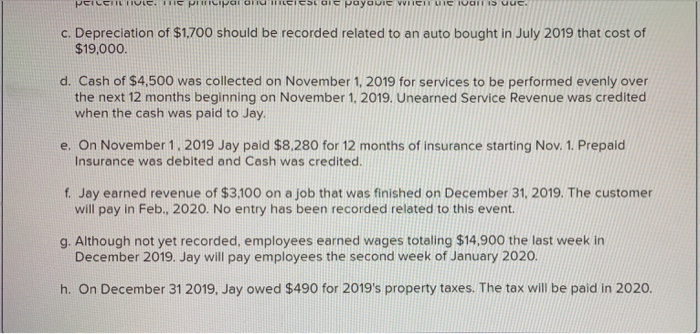

Required information Prepare the adjusting entries that are needed given the information below: Jay, Inc made all of the 2019 journal entries except the year-end adjusting entries below. Jay, Inc has a December 31 year end. a. On September 1, 2019, a tenant paid Jay $8,580 of rent for the next 6 months. On Sept. 1 Jay debited Cash and credited Unearned Rent Revenue for $8,580. b. On October 1 2019, Jay borrowed $20,400 from Lowell Bank and signed a one-year, 13 percent note. The principal and interest are payable when the loan is due. c. Depreciation of $1,700 should be recorded related to an auto bought in July 2019 that cost of $19,000 d. Cash of $4,500 was collected on November 1, 2019 for services to be performed evenly over the next 12 months beginning on November 1, 2019. Unearned Service Revenue was credited when the cash was paid to Jay. e. On November 1, 2019 Jay paid $8,280 for 12 months of insurance starting Nov. 1. Prepaid PEICCHU TULE. TTIE PHILIPara Tu CIESLGIC Payovie Wie uie U s Uue c. Depreciation of $1,700 should be recorded related to an auto bought in July 2019 that cost of $19,000. d. Cash of $4,500 was collected on November 1, 2019 for services to be performed evenly over the next 12 months beginning on November 1, 2019. Unearned Service Revenue was credited when the cash was paid to Jay. e. On November 1, 2019 Jay paid $8,280 for 12 months of insurance starting Nov. 1. Prepaid Insurance was debited and Cash was credited. f. Jay earned revenue of $3,100 on a job that was finished on December 31, 2019. The customer will pay in Feb., 2020. No entry has been recorded related to this event. g. Although not yet recorded, employees earned wages totaling $14.900 the last week in December 2019. Jay will pay employees the second week of January 2020. h. On December 31 2019, Jay owed $490 for 2019's property taxes. The tax will be paid in 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts