Question: ! Required information Problem 0 2 - 7 1 ( LO 0 2 - 4 ) ( Algo ) [ The following information applies to

Required information

Problem LO Algo

The following information applies to the questions displayed below.

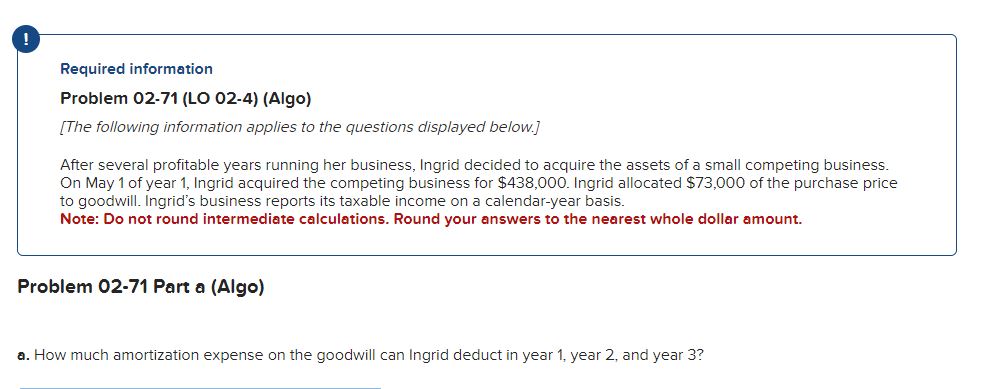

After several profitable years running her business, Ingrid decided to acquire the assets of a small competing business.

On May of year Ingrid acquired the competing business for $ Ingrid allocated $ of the purchase price

to goodwill. Ingrid's business reports its taxable income on a calendaryear basis.

Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.

Problem Part a Algo

a How much amortization expense on the goodwill can Ingrid deduct in year year and year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock