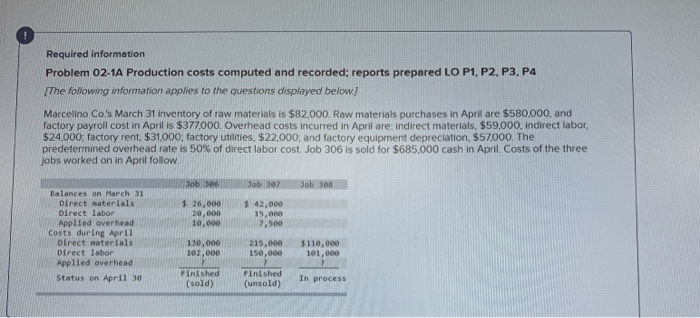

Question: Required information Problem 02.1A Production costs computed and recorded; reports prepared LO P1, P2, P3, P4 The following information applies to the questions displayed below]

![displayed below] Marcelino Co.'s March 31 Inventory of raw materials is $82,000.](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e60bfbe7ee5_37966e60bfb34064.jpg)

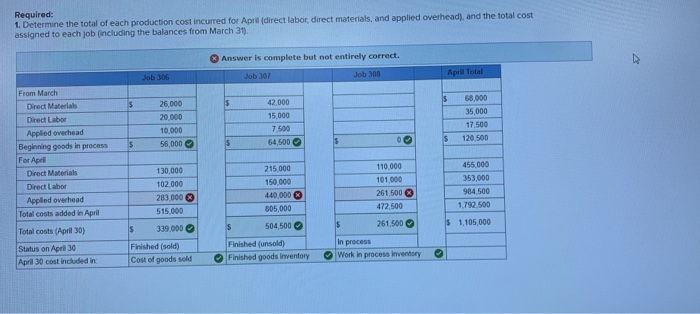

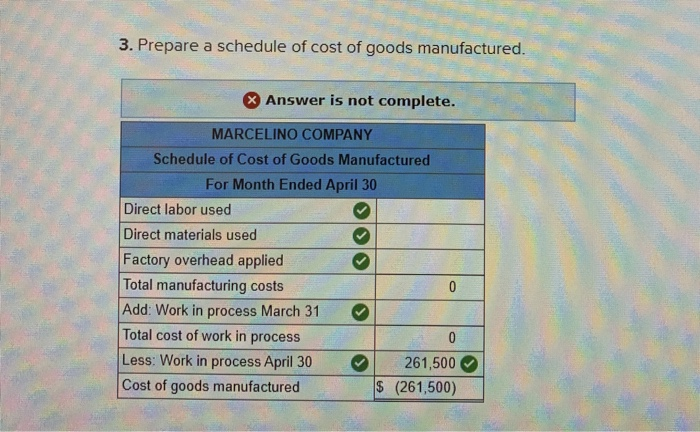

Required information Problem 02.1A Production costs computed and recorded; reports prepared LO P1, P2, P3, P4 The following information applies to the questions displayed below] Marcelino Co.'s March 31 Inventory of raw materials is $82,000. Raw materials purchases in April are $580,000, and factory payroll cost in April is $377.000. Overhead costs incurred in April are: indirect materials, $59,000 indirect labor, $24.000 factory rent, $31.000; factory utilities, $22,000, and factory equipment depreciation, $57,000. The predetermined overhead rate is 50% of direct labor cost. Job 306 is sold for $685,000 cash in April. Costs of the three jobs worked on in April follow Job 300 Job 307 Job 300 $ 26,000 20,00 10,000 $ 42,000 15,000 7,500 Balances on March 31 Direct materials Direct labor Applied overhead Costs during April Direct materials Direct labor Applied overhead Status on April 30 130,000 102,000 $110,000 101,000 215.000 150,000 7 Finished (unsold) Finished (sold) In process Required: 1. Determine the total of each production cost incurred for April (direct labor, direct materials, and applied overhead), and the total cost assigned to each job (including the balances from March 31). Answer is complete but not entirely correct. Job 307 Job 300 April Total Job 306 $ $ 5 42,000 68.000 35,000 26.000 20.000 10.000 56,000 15.000 7.500 64,500 17.500 120.500 $ $ 5 From March Direct Materials Direct Labor Applied overhead Beginning goods in process For April Direct Materials Direct Labor Applied overhead Total costs added in April Total costs (April 30) Status on April 30 April 30 cost included in 130,000 102.000 283.000 515.000 339.000 215,000 150.000 440,000 805,000 504,500 110.000 101.000 261,500 472,500 455.000 353,000 984,500 1.792.500 261,500 $ 5 $ 1,105,000 S Finished (sold) Cost of goods sold Finished (unsold) Finished goods Inventory In process Work in process inventory ! Required information No Transaction General Journal Debit Credit 1 a Raw materials inventory Accounts payable 580,000 580,000 2 b Work in process inventory Raw materials inventory 455,000 455,000 3 C Work in process inventory Cash 353,000 353,000 4 d. Factory overhead Cash 24,000 24,000 5 e. 176,500 Work in process inventory Factory overhead 176,500 6 59,000 Factory overhead Raw materials inventory 59,000 7 f(2) 31,000 Factory overhead Cash 31,000 O O 8 f(3) 22,000 Factory overhead Cash 22,000 9 f(4) > 57,000 Factory overhead Accumulated depreciation-factory equipment 57,000 10 9 Finished goods inventory Work in process inventory 843,500 843,500 3. Prepare a schedule of cost of goods manufactured. Answer is not complete. MARCELINO COMPANY Schedule of Cost of Goods Manufactured For Month Ended April 30 Direct labor used Direct materials used Factory overhead applied Total manufacturing costs 0 Add: Work in process March 31 Total cost of work in process 0 Less: Work in process April 30 261,500 Cost of goods manufactured $ (261,500) Compute gross profit for April. Gross profit $ 346,000 X $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts