Question: ! Required information Problem 08-44 (LO 08-2) (Algo) [The following information applies to the questions displayed below.] This year, Jack O. Lantern incurred a $84,000

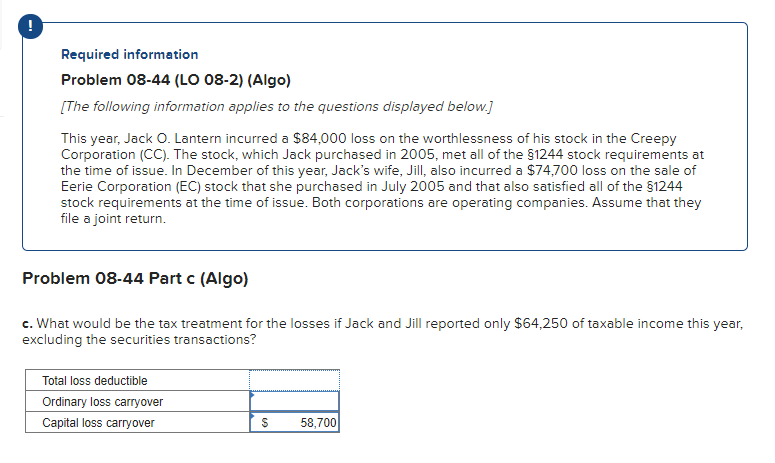

! Required information Problem 08-44 (LO 08-2) (Algo) [The following information applies to the questions displayed below.] This year, Jack O. Lantern incurred a $84,000 loss on the worthlessness of his stock in the Creepy Corporation (CC). The stock, which Jack purchased in 2005, met all of the $1244 stock requirements at the time of issue. In December of this year, Jack's wife, Jill, also incurred a $74,700 loss on the sale of Eerie Corporation (EC) stock that she purchased in July 2005 and that also satisfied all of the $1244 stock requirements at the time of issue. Both corporations are operating companies. Assume that they file a joint return. Problem 08-44 Part c (Algo) c. What would be the tax treatment for the losses if Jack and Jill reported only $64,250 of taxable income this year, excluding the securities transactions? Total loss deductible Ordinary loss carryover Capital loss carryover S 58,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts