Question: Required information Problem 1 0 - 4 8 ( LO 1 0 - 4 ) ( Algo ) The following information applies to the questions

Required information

Problem LO Algo

The following information applies to the questions displayed below

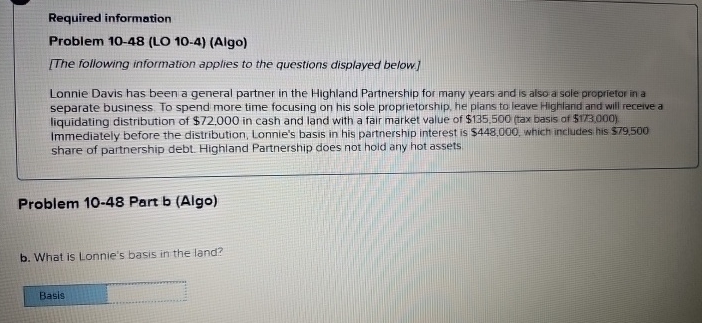

Lonnie Davis has been a general partner in the Highland Partnership for mary years and is also a sole proprietor in a separate business. To spend more time focusing on his sole proprietorship, he plans to leave Highland and will receive a liquidating distribution of $ in cash and land with a fair market value of $tax basis of $ Immediately before the distribution. Lonnie's basis in his partnership interest is $ which includes his $ share of partnership debt. Highland Partnership does not hoid any hot assets

Problem Part b Algo

b What is Lonnie's basis in the land?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock