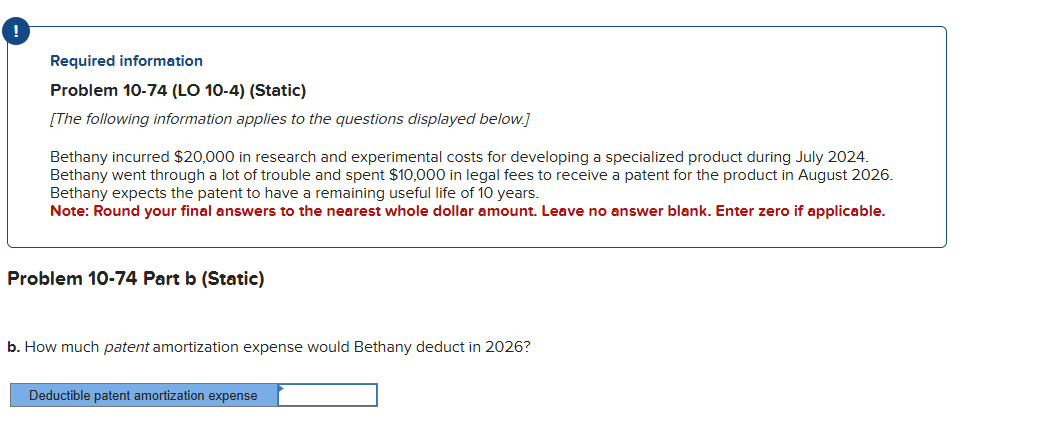

Question: ! Required information Problem 1 0 - 7 4 ( LO 1 0 - 4 ) ( Static ) [ The following information applies to

Required information Problem LO StaticThe following information applies to the questions displayed below. Bethany incurred $ in research and experimental costs for developing a specialized product during July Bethany went through a lot of trouble and spent $ in legal fees to receive a patent for the product in August Bethany expects the patent to have a remaining useful life of years. Note: Round your final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable. Problem Part b Static b How much patent amortization expense would Bethany deduct in Deductible patent amortization expense

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock