Question: ! Required information Problem 1 3 - 8 1 ( LO 1 3 - 4 ) ( Static ) [ The following information applies to

Required information

Problem LO Static

The following information applies to the questions displayed below.

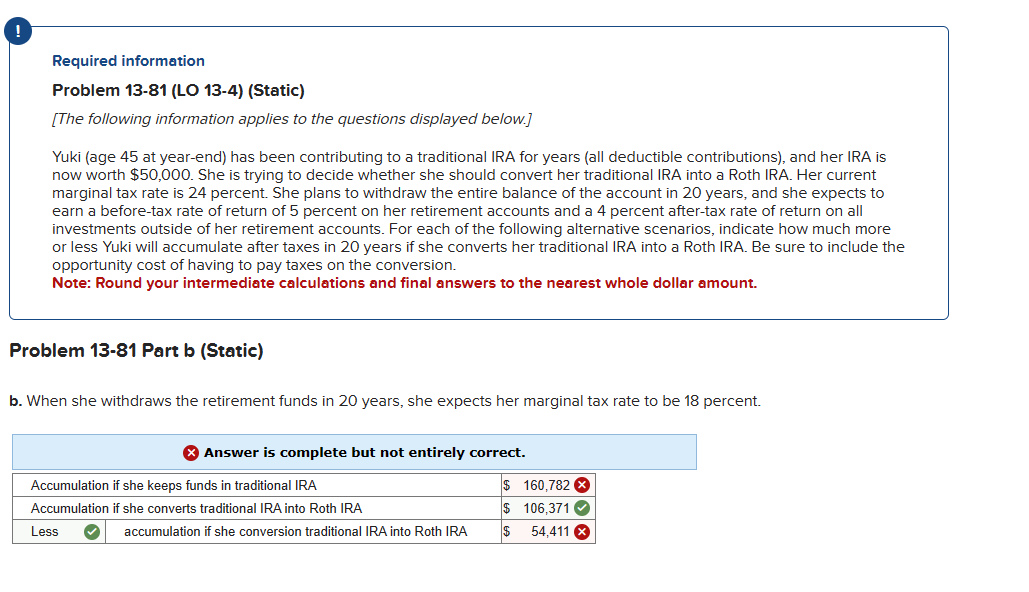

Yuki age at yearend has been contributing to a traditional IRA for years all deductible contributions and her IRA is

now worth $ She is trying to decide whether she should convert her traditional IRA into a Roth IRA. Her current

marginal tax rate is percent. She plans to withdraw the entire balance of the account in years, and she expects to

earn a beforetax rate of return of percent on her retirement accounts and a percent aftertax rate of return on all

investments outside of her retirement accounts. For each of the following alternative scenarios, indicate how much more

or less Yuki will accumulate after taxes in years if she converts her traditional IRA into a Roth IRA. Be sure to include the

opportunity cost of having to pay taxes on the conversion.

Note: Round your intermediate calculations and final answers to the nearest whole dollar amount.

Problem Part b Static

b When she withdraws the retirement funds in years, she expects her marginal tax rate to be percent.

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock