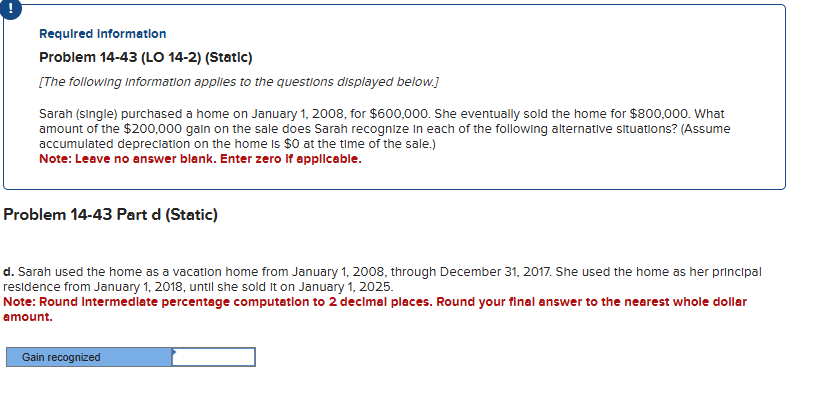

Question: ! Required Information Problem 1 4 - 4 3 ( LO 1 4 - 2 ) ( Statlc ) [ The following Information applies to

Required Information

Problem LO Statlc

The following Information applies to the questions displayed below.

Sarah SIngle purchased a home on January for $ She eventually sold the home for $ What amount of the $ gain on the sale does Sarah recognize in each of the following alternative sltuations? Assume accumulated depreciation on the home is $ at the time of the sale.

Note: Leave no answer blank. Enter zero If applicable.

Problem Part d Static

d Sarah used the home as a vacation home from January through December She used the home as her princlpal residence from January until she sold it on January

Note: Round Intermedlate percentage computation to declmal places. Round your flnal answer to the nearest whole dollar amount.

Required Information

Problem LO Statlc

The following Information applles to the questlons displayed below.

Sarah sIngle purchased a home on January for $ She eventually sold the home for $ What amount of the $ gain on the sale does Sarah recognize in each of the following alternative situations? Assume accumulated depreciation on the home is $ at the time of the sale.

Note: Leave no answer blank. Enter zero If applicable.

Problem Part b Static

b Sarah used the property as a vacation home through December She then used the home as her principal residence from January until she sold It on January

Note: Round Intermedlate percentage computation to mathbf declmal places. Round your flnal answer to the nearest whole dollar amount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock