Question: Required information Problem 1 4 - 4 3 ( LO 1 4 - 2 ) ( Static ) [ The following information applies to the

Required information

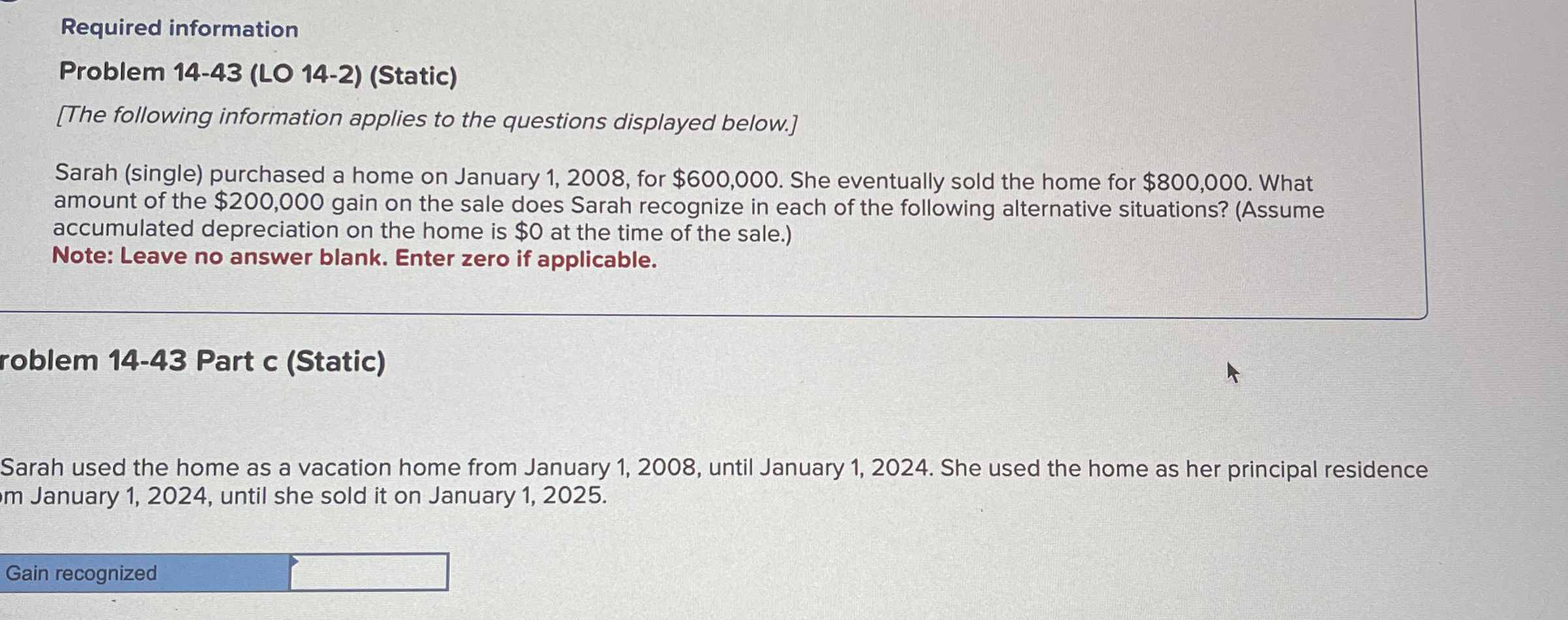

Problem LO Static

The following information applies to the questions displayed below.

Sarah single purchased a home on January for $ She eventually sold the home for $ What amount of the $ gain on the sale does Sarah recognize in each of the following alternative situations? Assume accumulated depreciation on the home is $ at the time of the sale.

Note: Leave no answer blank. Enter zero if applicable.

roblem Part c Static

Sarah used the home as a vacation home from January until January She used the home as her principal residence m January until she sold it on January

Gain recognized

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock