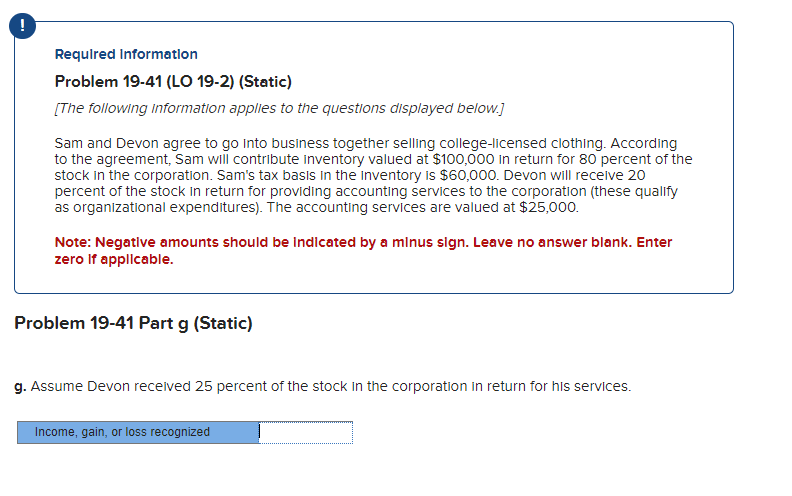

Question: ! Required Information Problem 1 9 - 4 1 ( LO 1 9 - 2 ) ( Static ) [ The following information applles to

Required Information

Problem LO Static

The following information applles to the questions displayed below.

Sam and Devon agree to go into business together selling collegelicensed clothing. According to the agreement, Sam will contribute inventory valued at $ in return for percent of the stock in the corporation. Sam's tax basis in the inventory is $ Devon will recelve percent of the stock in return for providing accounting services to the corporation these qualify as organizational expenditures The accounting services are valued at $

Note: Negative amounts should be Indlcated by a minus sign. Leave no answer blank. Enter zero if applicable.

Problem Part g Static

g Assume Devon received percent of the stock in the corporation in return for his services.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock