Question: Required information Problem 10-1A Plant asset costs; depreciation methods LO C1, P1 {The following information applies to the questions displayed below.) Timberly Construction makes a

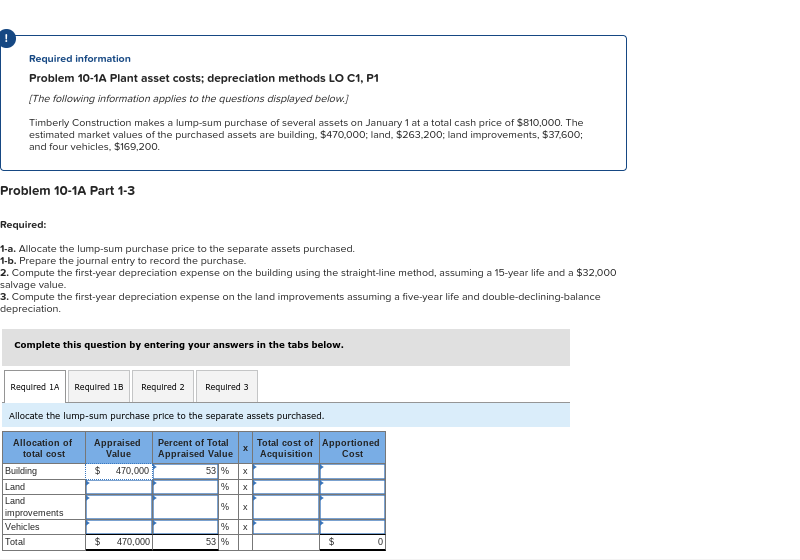

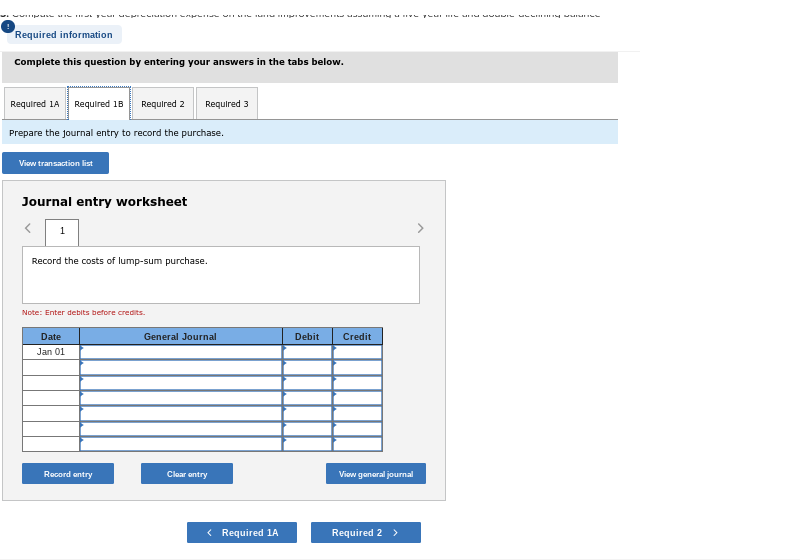

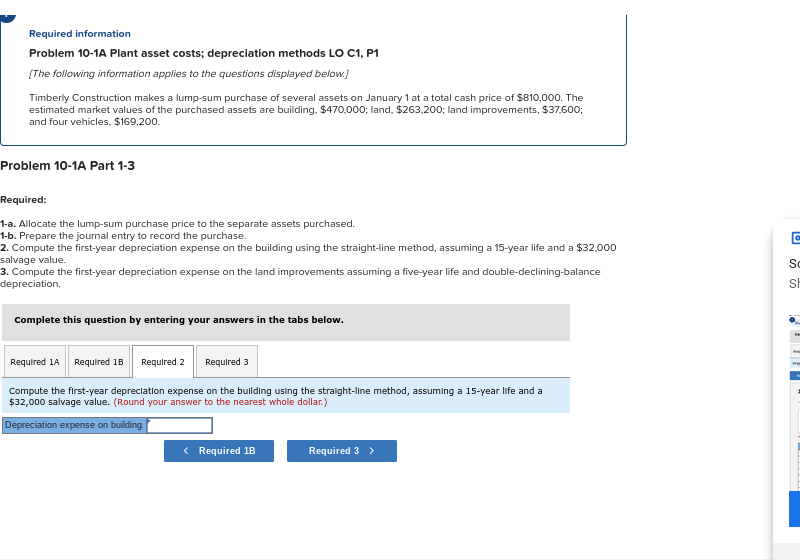

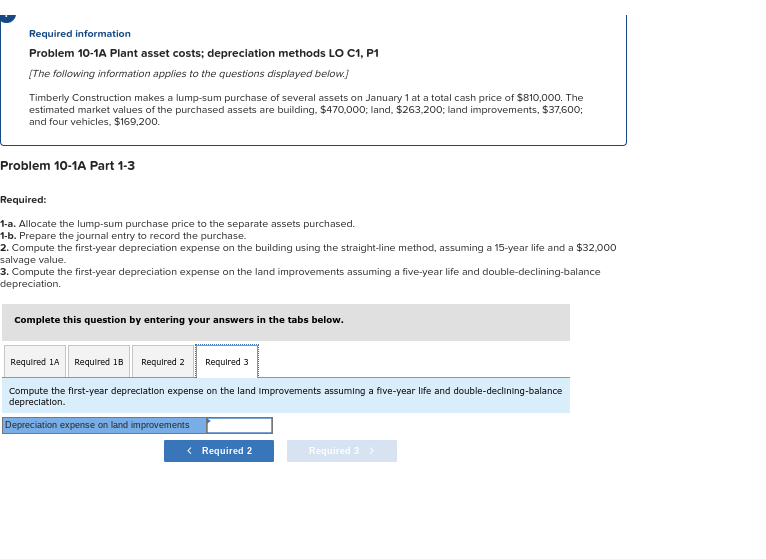

Required information Problem 10-1A Plant asset costs; depreciation methods LO C1, P1 {The following information applies to the questions displayed below.) Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $810,000. The estimated market values of the purchased assets are building. $470.000; land, $263,200; land improvements, $37,600; and four vehicles. $169,200. Problem 10-1A Part 1-3 Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $32,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining balance depreciation Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Required 3 Allocate the lump-sum purchase price to the separate assets purchased. Appraised Value $ 470,000 Total cost of Apportioned Acquisition Cost Percent of Total Appraised Value 53% % Allocation of total cost Building Land Land improvements Vehicles Total % x % 53 % $ 470,000 $ 0 ETIC HILJUTI HILI DICUCI WIRE Required information Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3 Prepare the journal entry to record the purchase. View transaction list Journal entry worksheet 1 Record the costs of lump-sum purchase. Note: Enter debits before credits General Journal Debit Credit Date Jan 01 Record entry Clear entry View general journal Required information Problem 10-1A Plant asset costs; depreciation methods LO C1, P1 (The following information applies to the questions displayed below.) Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $810,000. The estimated market values of the purchased assets are building. $470.000; land, $263,200; land improvements, $37,600; and four vehicles, $169,200. Problem 10-1A Part 1-3 Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $32,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining balance depreciation C Sc SI Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Required 3 Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $32,000 salvage value. (Round your answer to the nearest whole dollar.) Depreciation expense on building Required information Problem 10-1A Plant asset costs; depreciation methods LO C1, P1 (The following information applies to the questions displayed below.) Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $810,000. The estimated market values of the purchased assets are building. $470.000; land, $263,200; land improvements, $37,600; and four vehicles, $169,200. Problem 10-1A Part 1-3 Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $32,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining balance depreciation Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Required 3 Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Depreciation expense on land improvements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts