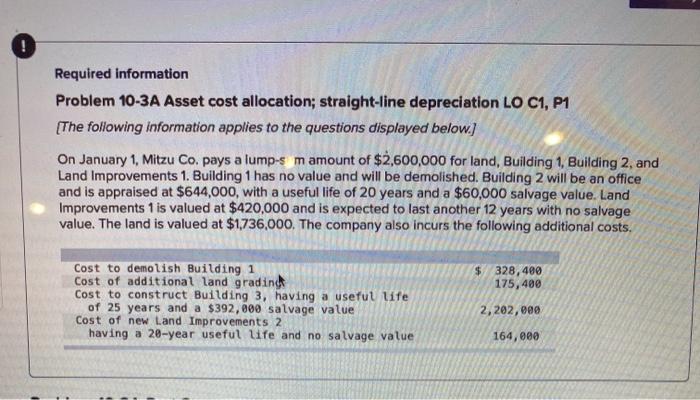

Question: ! Required information Problem 10-3A Asset cost allocation; straight-line depreciation LO C1, P1 [The following information applies to the questions displayed below.) On January 1,

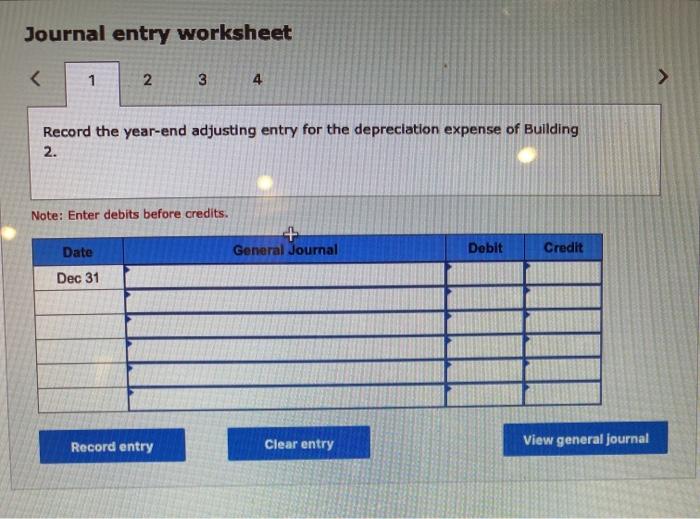

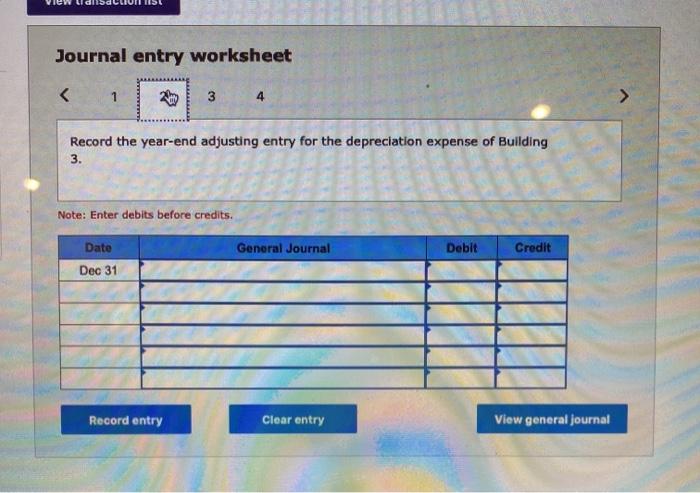

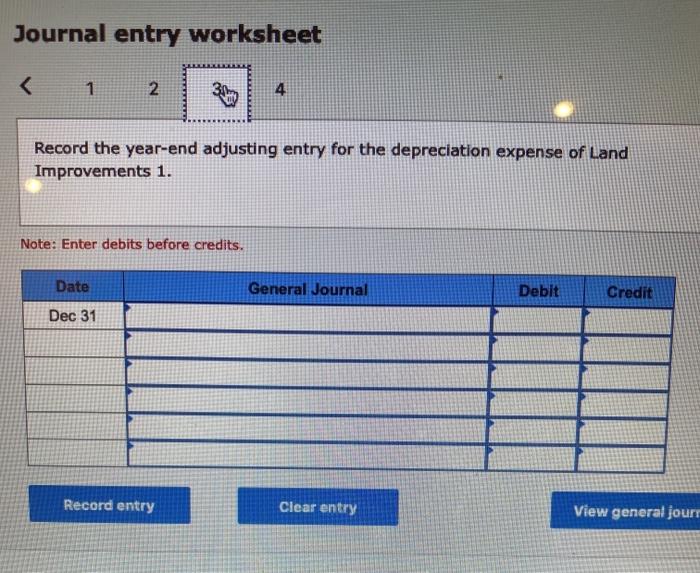

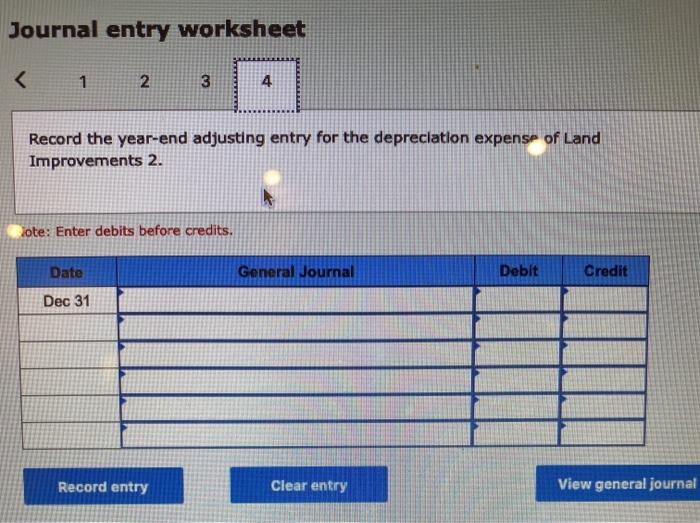

! Required information Problem 10-3A Asset cost allocation; straight-line depreciation LO C1, P1 [The following information applies to the questions displayed below.) On January 1, Mitzu Co. pays a lump-s mamount of $2,600,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $644,000, with a useful life of 20 years and a $60,000 salvage value. Land Improvements 1 is valued at $420,000 and is expected to last another 12 years with no salvage value. The land is valued at $1,736,000. The company also incurs the following additional costs. $ 328,480 175,400 Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $392,800 salvage value Cost of new Land Improvements 2 having a 20-year useful life and no salvage value 2,202,800 164,000 Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts