Question: Required information Problem 10-51 (LO 10-2) (Static) [The following information applies to the questions displayed below.] On November 10 of year 1 , Javier purchased

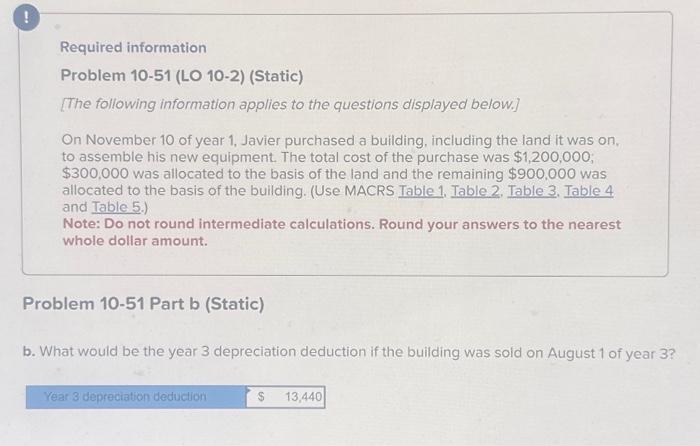

Required information Problem 10-51 (LO 10-2) (Static) [The following information applies to the questions displayed below.] On November 10 of year 1 , Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,200,000; $300,000 was allocated to the basis of the land and the remaining $900,000 was allocated to the basis of the building. (Use MACRS Table 1, Table 2. Table 3. Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. Problem 10-51 Part b (Static) b. What would be the year 3 depreciation deduction if the building was sold on August 1 of year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts