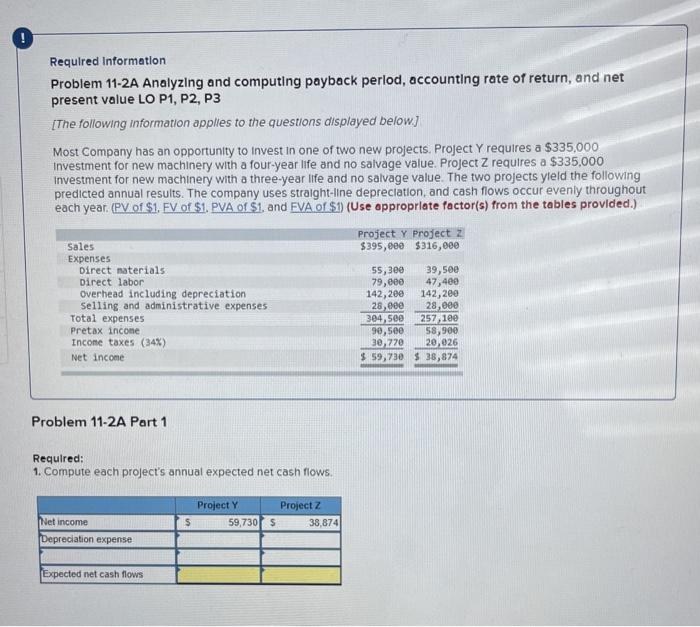

Question: ! Required Information Problem 11-2A Analyzing and computing payback period, accounting rate of return, and net present value LO P1, P2, P3 [The following information

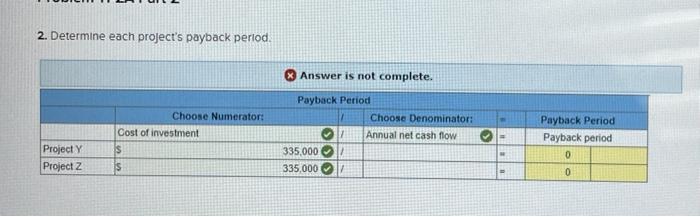

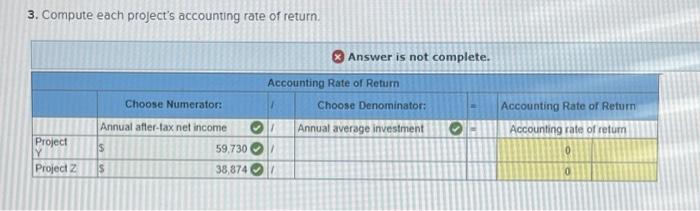

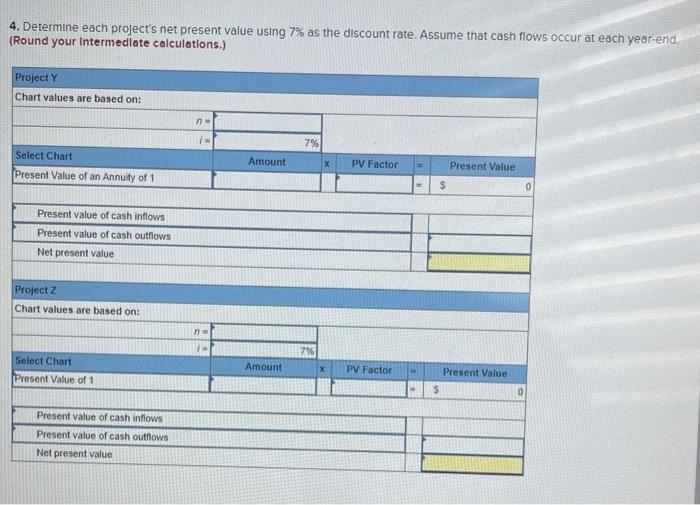

! Required Information Problem 11-2A Analyzing and computing payback period, accounting rate of return, and net present value LO P1, P2, P3 [The following information applies to the questions displayed below) Most Company has an opportunity to invest in one of two new projects. Project Y requires a $335,000 Investment for new machinery with a four-year life and no salvage value. Project Z requires a $335,000 Investment for new machinery with a three-year life and no salvage value. The two projects yleld the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year, (PV of $1. FV of $1. PVA of $1. and FVA of $1 (Use appropriate factor(s) from the tables provided.) Project Y Project 2 $395,000 $316,000 Sales Expenses Direct materials Direct labor Overhead including depreciation Selling and administrative expenses Total expenses Pretax income Income taxes (34%) Net income 55,300 39,5ee 79,000 47,400 142,200 142,2ee 28,eee 28,000 384,500 257,100 90,5ee 58,900 30. 770 20,026 $ 59,730 $ 38,874 Problem 11-2A Part 1 Required: 1. Compute each project's annual expected net cash flows. Project Y 59,730 s Project 38,8741 $ net income Depreciation expense Expected net cash flows 2. Determine each project's payback period. Answer is not complete. Choose Numerator: Cost of investment S Payback Period Choose Denominator: Annual net cash flow 335,000 335,000 Project Project 2 Payback Period Payback period 0 0 IS 3. Compute each project's accounting rate of return Answer is not complete. Accounting Rate of Return Choose Denominator: Accounting Rate of Return Annual average investment Accounting rate of return Choose Numerator: Annual after-tax net income 59.730 SI is 0 Project Y Project 2 s 38,874 0 4. Determine each project's net present value using 7% as the discount rate. Assume that cash flows occur at each year-end. (Round your Intermediate calculations.) Project Y Chart values are based on: n 7% Select Chart Present Value of an Annuity of 1 Amount X PV Factor Present Value $ 0 Present value of cash inflows Present value of cash outflows Net present value Project Z Chart values are based on: 7% Select Chart Present Value of 1 Amount PV Factor Present Value $ 0 Present value of cash inflows Present value of cash outflows Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts