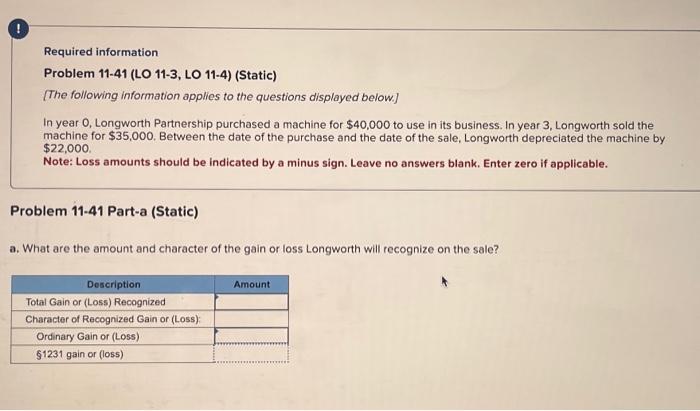

Question: Required information Problem 11-41 (LO 11-3, LO 11-4) (Static) [The following information applies to the questions displayed below.] In year 0, Longworth Partnership purchased a

![information applies to the questions displayed below.] In year 0, Longworth Partnership](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f791b1e3f87_72166f791b187a0c.jpg)

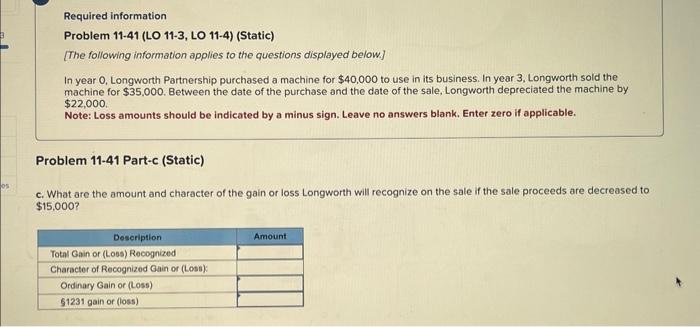

Required information Problem 11-41 (LO 11-3, LO 11-4) (Static) [The following information applies to the questions displayed below.] In year 0 , Longworth Partnership purchased a machine for $40,000 to use in its business. In year 3, Longworth sold the machine for $35,000. Between the date of the purchase and the date of the sale, Longworth depreciated the machine by $22,000 Note: Loss amounts should be indicated by a minus sign. Leave no answers blank. Enter zero if applicable. Problem 11-41 Part-a (Static) a. What are the amount and character of the gain or loss Longworth will recognize on the sale? Required information Problem 11-41 (LO 11-3, LO 11-4) (Static) [The following information applies to the questions displayed below.] In year 0, Longworth Partnership purchased a machine for $40,000 to use in its business. In year 3, Longworth sold the machine for $35,000. Between the date of the purchase and the date of the sale, Longworth depreciated the machine by $22,000. Note: Loss amounts should be indicated by a minus sign. Leave no answers blank. Enter zero if applicable. Problem 11-41 Part-b (Static) b. What are the amount and character of the gain or loss Longworth will recognize on the sale if the sale proceeds are increased to $45,000 ? Required information Problem 11-41 (LO 11-3, LO 11-4) (Static) [The following information applies to the questions displayed below.] In year 0, Longworth Partnership purchased a machine for $40,000 to use in its business. In year 3, Longworth sold the machine for $35,000. Between the date of the purchase and the date of the sale, Longworth depreciated the machine by $22,000. Note: Loss amounts should be indicated by a minus sign. Leave no answers blank. Enter zero if applicable. Problem 11-41 Part-c (Static) c. What are the amount and character of the gain or loss Longworth will recognize on the sale if the sale proceeds are decreased to $15,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts