Question: ! Required information Problem 11-44 (LO 11-3, LO 11-4) [The following information applies to the questions displayed below.] Moran owns a building he bought during

![information applies to the questions displayed below.] Moran owns a building he](https://s3.amazonaws.com/si.experts.images/answers/2024/07/668c39e65d1c5_893668c39e60112c.jpg)

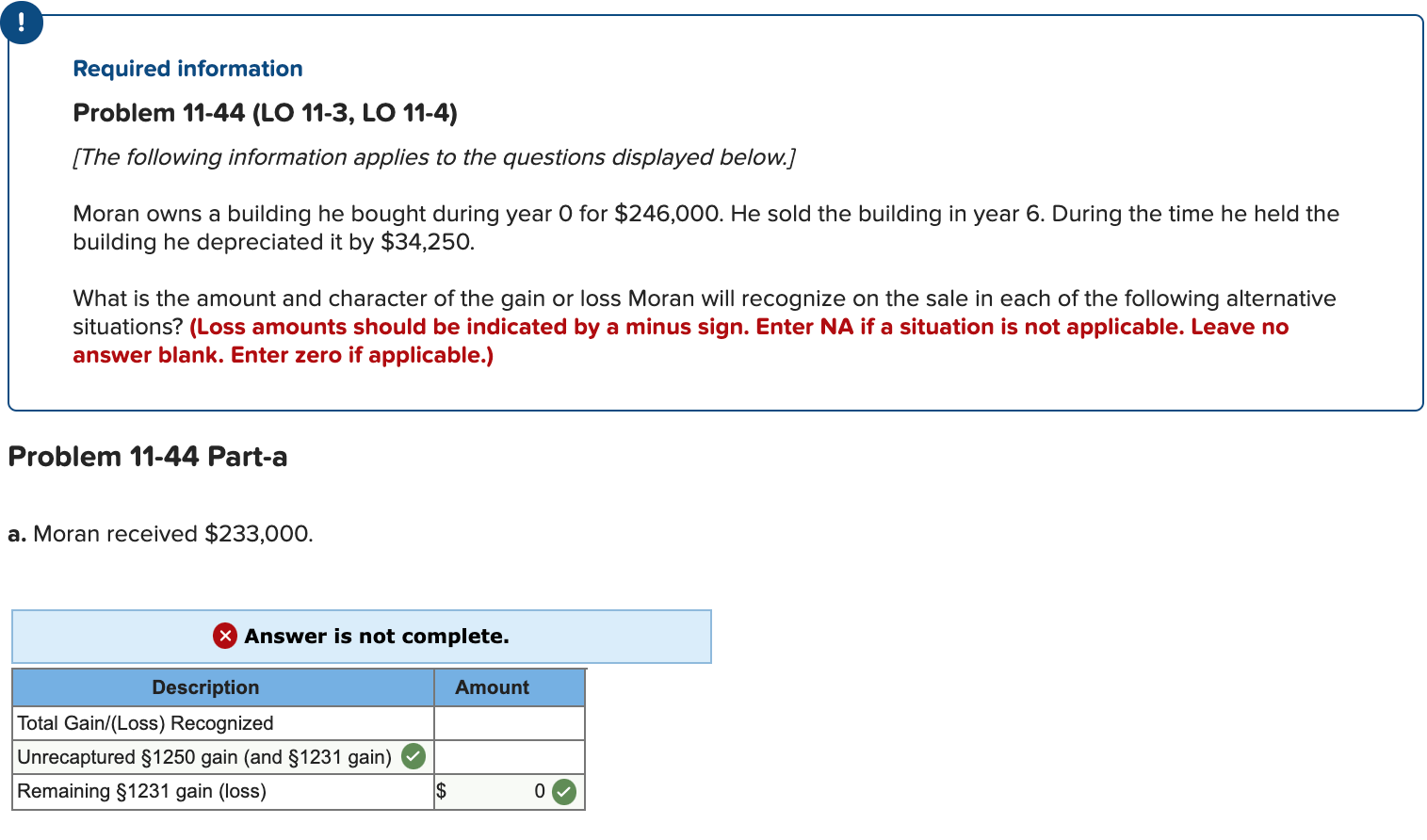

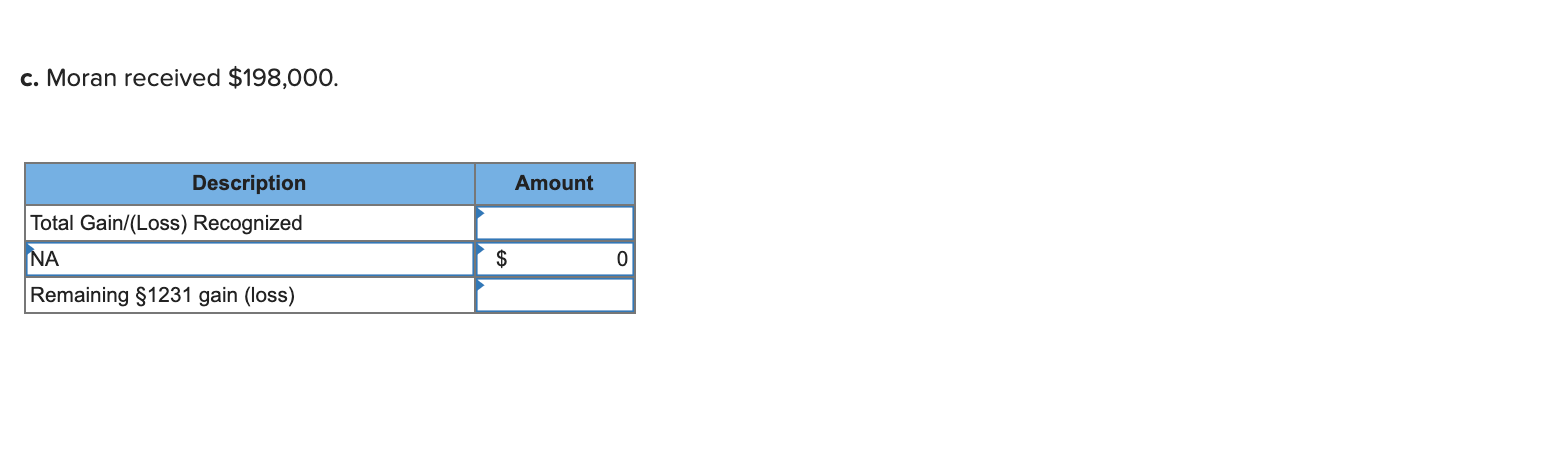

! Required information Problem 11-44 (LO 11-3, LO 11-4) [The following information applies to the questions displayed below.] Moran owns a building he bought during year O for $246,000. He sold the building in year 6. During the time he held the building he depreciated it by $34,250. What is the amount and character of the gain or loss Moran will recognize on the sale in each of the following alternative situations? (Loss amounts should be indicated by a minus sign. Enter NA if a situation is not applicable. Leave no answer blank. Enter zero if applicable.) Problem 11-44 Part-a a. Moran received $233,000. Answer is not complete. Amount Description Total Gain/(Loss) Recognized Unrecaptured $1250 gain (and $1231 gain) Remaining $1231 gain (loss) $ 0 b. Moran received $258,000. Amount $ 46,250 Description Total Gain/(Loss) Recognized Unrecaptured $1250 gain (and $1231 gain) Remaining $1231 gain (loss) c. Moran received $198,000. Amount Description Total Gain/(Loss) Recognized Remaining $1231 gain (loss) $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts