Question: Required information Problem 11.54 (LO 11-5) (Static) [The following information applies to the questions displayed below] Hans runs a sole proprietorship. Hans has reported the

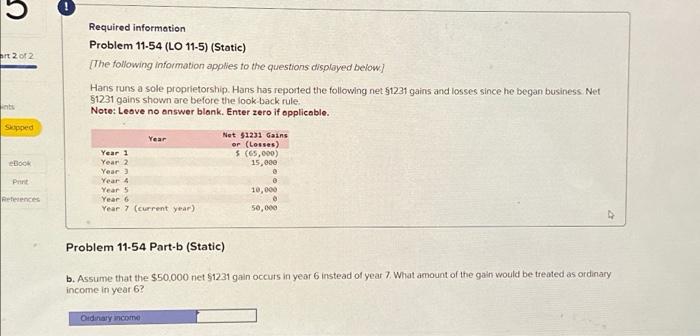

Required information Problem 11.54 (LO 11-5) (Static) [The following information applies to the questions displayed below] Hans runs a sole proprietorship. Hans has reported the following net \$1231 gains and losses since he began business. Net $1231 gains shown are before the look back rule. Note: Leove no onswer blank. Enter zero if opplicable. Problem 11-54 Part-b (Static) b. Assume that the $50,000 net $1231 gain occurs in year 6 instead of year 7 . What amount of the gain would be treated as ordinary income in year 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts