Question: Required information Problem 13-54 (LO 13-1) (Static) [The following information applies to the questions displayed below.] Javier recently graduated and started his career with DNL

![to the questions displayed below.] Javier recently graduated and started his career](https://s3.amazonaws.com/si.experts.images/answers/2024/08/66ac026f5e9fa_84666ac026ee1fde.jpg)

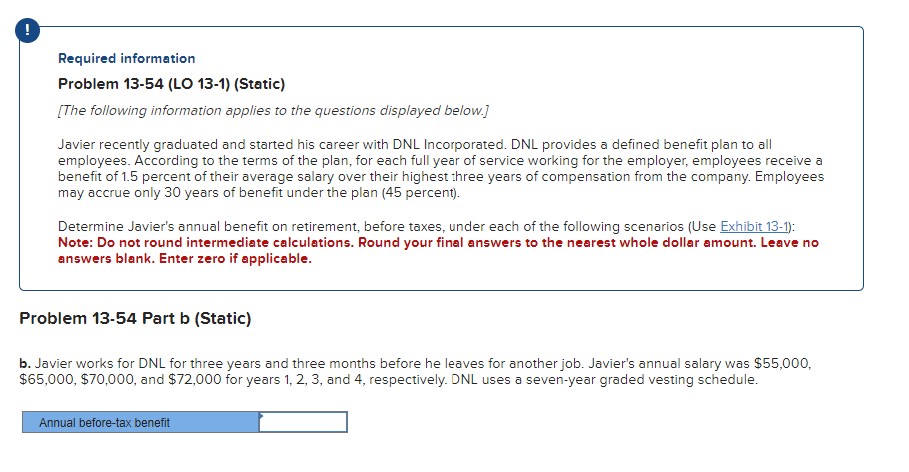

Required information Problem 13-54 (LO 13-1) (Static) [The following information applies to the questions displayed below.] Javier recently graduated and started his career with DNL Incorporated. DNL provides a defined benefit plan to all employees. According to the terms of the plan, for each full year of service working for the employer, employees receive a benefit of 1.5 percent of their average salary over their highest three years of compensation from the company. Employees may accrue only 30 years of benefit under the plan ( 45 percent). Determine Javier's annual benefit on retirement, before taxes, under each of the following scenarios (Use Exhibit 13-1): Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable. roblem 13-54 Part b (Static) Javier works for DNL for three years and three months before he leaves for another job. Javier's annual salary was $55,000, 65,000,$70,000, and $72,000 for years 1,2,3, and 4 , respectively. DNL uses a seven-year graded vesting schedule. EXHIBIT 13-1 Defined Benefit Plans Minimum Vesting Schedules* * Percent of employee benefit no longer subject to forfeiture. Source: $411(a). Required information Problem 13-54 (LO 13-1) (Static) [The following information applies to the questions displayed below.] Javier recently graduated and started his career with DNL Incorporated. DNL provides a defined benefit plan to all employees. According to the terms of the plan, for each full year of service working for the employer, employees receive a benefit of 1.5 percent of their average salary over their highest three years of compensation from the company. Employees may accrue only 30 years of benefit under the plan ( 45 percent). Determine Javier's annual benefit on retirement, before taxes, under each of the following scenarios (Use Exhibit 13-1): Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable. roblem 13-54 Part b (Static) Javier works for DNL for three years and three months before he leaves for another job. Javier's annual salary was $55,000, 65,000,$70,000, and $72,000 for years 1,2,3, and 4 , respectively. DNL uses a seven-year graded vesting schedule. EXHIBIT 13-1 Defined Benefit Plans Minimum Vesting Schedules* * Percent of employee benefit no longer subject to forfeiture. Source: $411(a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts