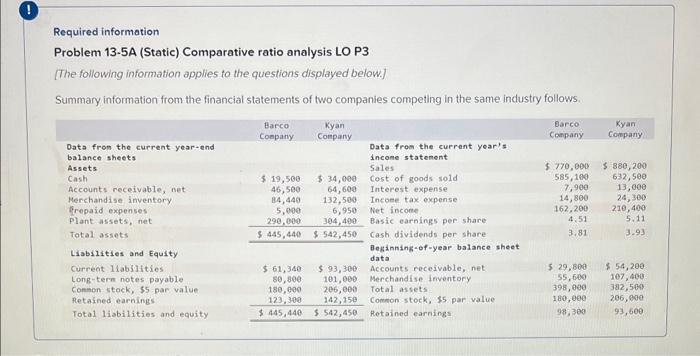

Question: Required information Problem 13-5A (Static) Comparative ratio analysis LOP3 [The following information applies to the questions displayed below.] Summary information from the financial statements of

![information applies to the questions displayed below.] Summary information from the financial](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e6b155efc07_70966e6b15592aad.jpg)

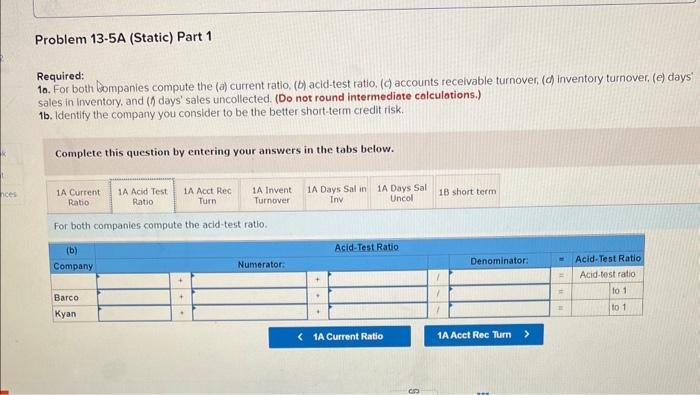

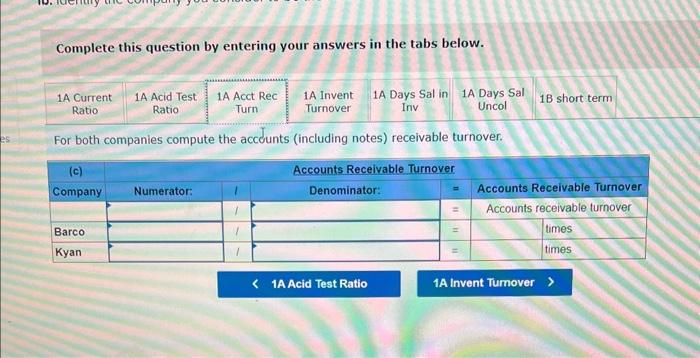

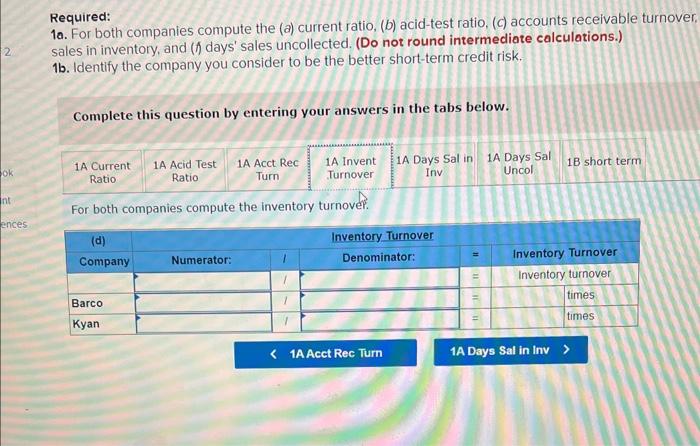

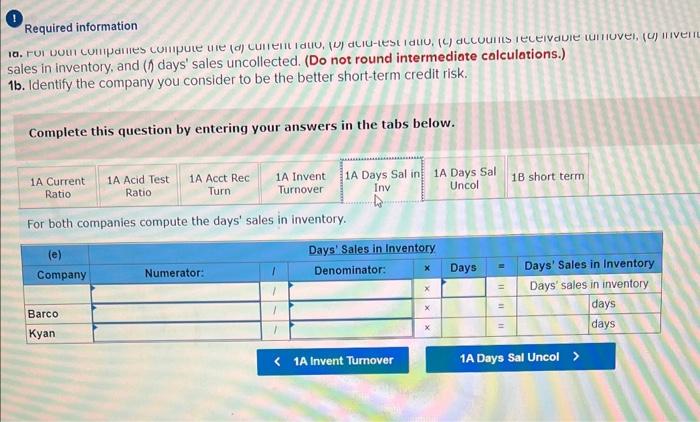

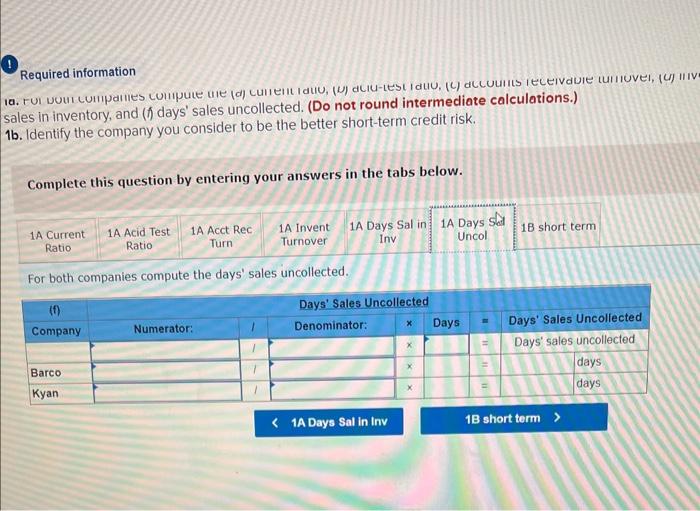

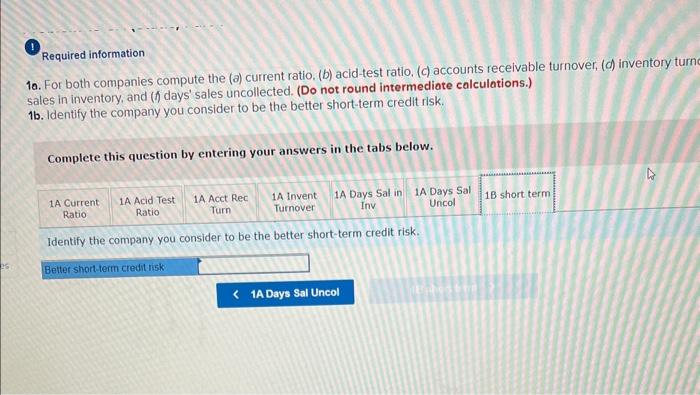

Required information Problem 13-5A (Static) Comparative ratio analysis LOP3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Required: 10. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (o) inventory turnover, (e) days' sales in inventory, and ( days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the current ratio. Required: 1o. For both bompanies compute the (a) current ratio, (b) acid-test ratio, (c) accounts recelvable turnover, (o) inventory turnover, (e) days" sales in inventory, and (f) days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the acid-test ratio. Complete this question by entering your answers in the tabs below. For both companies compute the accounts (including notes) receivable turnover. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, sales in inventory, and (f) days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the inventory turnover. (1) Required information sales in inventory, and ( days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales in inventory. Required information sales in inventory, and ( f ) days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales uncollected. Required information 10. For both companies compute the (a) current ratio. (b) acid-test ratio. (c) accounts receivable turnover, (d) inventory turn sales in inventory, and ( t ) days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. Identify the company you consider to be the better short-term credit risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts