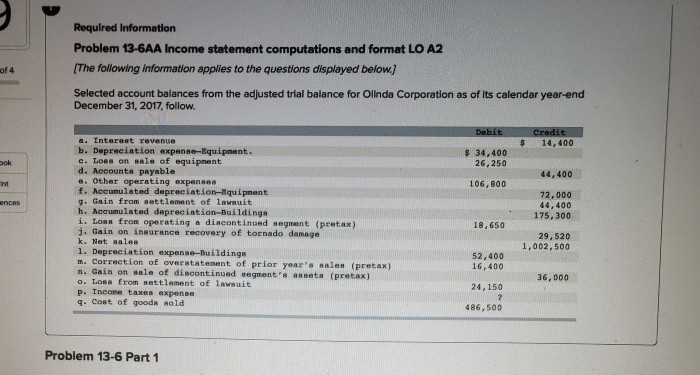

Question: Required Information Problem 13-6AA Income statement computations and format LO A2 [The following information applies to the questions displayed below.) Selected account balances from the

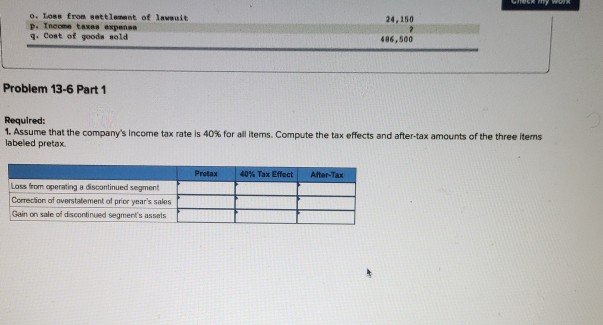

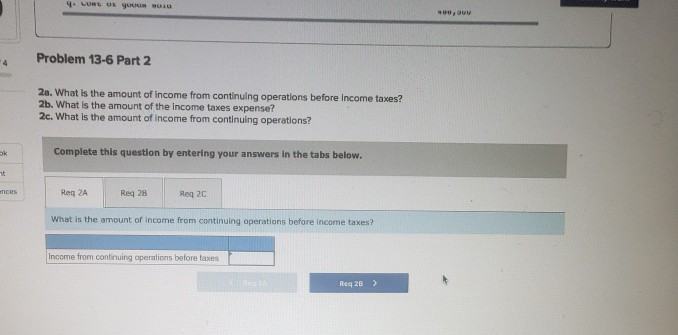

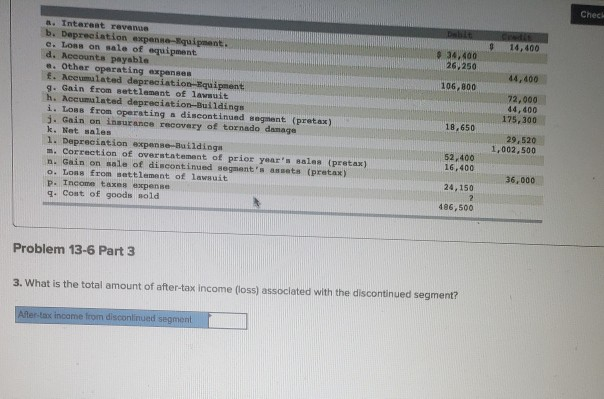

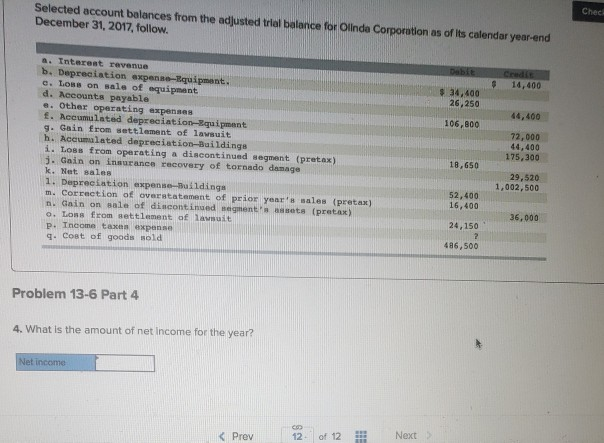

Required Information Problem 13-6AA Income statement computations and format LO A2 [The following information applies to the questions displayed below.) Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31, 2017, follow. of 4 Debit Credit 14,400 $ 34,400 26,250 bok 44,400 ht 106,800 ences a. Interest revenue b. Depreciation expense-Equipment. c. Loss on sale of equipment d. Accounts payable e. Other operating expenses f. Accumulated depreciation-Equipment 9. Gain from settlement of lawsuit h. Accumulated depreciation-Buildings i. Lons from operating a discontinued segment (pretax) j. Gain on insurance recovery of tornado damage k. Net sales 1. Depreciation expense-Buildings m. Correction of overstatement of prior year's sales (pretax) n. Gain on sale of discontinued segment's assets (pretax) o. Loss from settlement of lawsuit p. Income taxes expense 9. Cost of goods sold 72,000 44,400 175,300 18,650 29,520 1,002,500 52,400 16,400 36,000 24,150 2 486,500 Problem 13-6 Part 1 EN MM o. Lose from settlement of lawsuit p. Income taxes expense 9. Coat of goods sold 24,150 2 486,500 Problem 13-6 Part 1 Required: 1. Assume that the company's Income tax rate is 40% for all items. Compute the tax effects and after-tax amounts of the three items labeled pretax Protax 40% Tax Effect After Tax Loss from operating a discontinued segment Correction of overstatement of prior year's sales Gain on sale of discontinued segment's asses 4. NL UYU 400, 4 Problem 13-6 Part 2 2a. What is the amount of income from continuing operations before Income taxes? 2b. What is the amount of the income taxes expense? 2c. What is the amount of income from continuing operations? Sk Complete this question by entering your answers in the tabs below. ECOS Reg 2A Reg 28 Reg 20 What is the amount of income from continuing operations before income taxes? Income from continuing operations before taxes R2B > Check 14,400 $ 34,400 26,250 44,400 106,800 3. Interest revenue b. Depreciation expense-Equipment. e. Loss on sale of equipment d. Accounts payable .. Other operating expenses t. Leeumalated depreciation Equipment 9. Gain from settlement of lawsuit h. Accumulated depreciation Buildings i. Lons from operating a discontinued segment (pretax) 1. Gain on insurance recovery of tornado damage k. Nat sales 1. Depreciation expense-Buildings m. Correction of overstatement of prior year's sales (pretax) n. Gain on sale of discontinued segment's assets (pretax) 0. Los from settlement of lawsuit p. Income tax expense 9. Cont of goods sold 72.000 44,400 175,300 18,650 29,520 1,002,500 52,400 16,400 36,000 24,150 2 486,500 Problem 13-6 Part 3 3. What is the total amount of after-tax income (loss) associated with the discontinued segment? After-tax income from discontinued segment Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31, 2017, follow Chec Dabit $ 14,400 $ 34,400 26,250 44,400 106,800 a. Interest revenue b. Depreciation expense-Equipment. e. Loss on sale of equipment d. Accounts payable e. Other operating expenses f. Accumulated depreciation Equipment 9. Gain from settlement of lawsuit h. Accumulated depreciation-Buildings i. Loss from operating a discontinued segment (pretax) 1. Gain on Insurance recovery of tornado damage k. Net sales 1. Depreciation expense-Buildings m. Correction of overstatement of prior year's sales (pretax) n. Gain on sale of discontinued segment's assets (pretax) o. Los from settlement of lanuit p. Tncome taxon expense 9. Cost of goods old 72,000 44,400 175,300 18,650 29,520 1,002,500 52,400 16,400 36.000 24,150 2 486,500 Problem 13-6 Part 4 4. What is the amount of net income for the year? Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts