Question: ! Required information Problem 14-43 (LO 14-2) (Static) (The following information applies to the questions displayed below.] Sarah (single) purchased a home on January 1,

![applies to the questions displayed below.] Sarah (single) purchased a home on](https://s3.amazonaws.com/si.experts.images/answers/2024/07/669fd48bcf14b_667669fd48b6bb29.jpg)

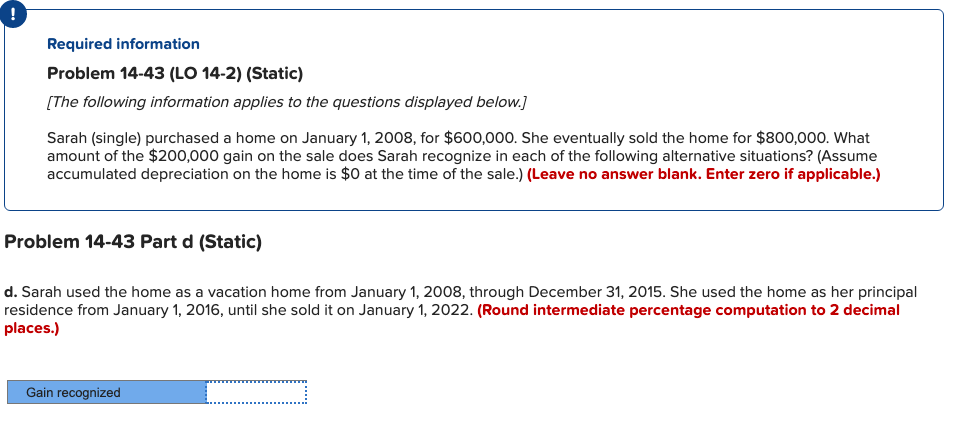

! Required information Problem 14-43 (LO 14-2) (Static) (The following information applies to the questions displayed below.] Sarah (single) purchased a home on January 1, 2008, for $600,000. She eventually sold the home for $800,000. What amount of the $200,000 gain on the sale does Sarah recognize in each of the following alternative situations? (Assume accumulated depreciation on the home is $0 at the time of the sale.) (Leave no answer blank. Enter zero if applicable.) Problem 14-43 Part d (Static) d. Sarah used the home as a vacation home from January 1, 2008, through December 31, 2015. She used the home as her principal residence from January 1, 2016, until she sold it on January 1, 2022. (Round intermediate percentage computation to 2 decimal places.) Gain recognized [The following information applies to the questions displayed below.] Sarah (single) purchased a home on January 1, 2008, for $600,000. She eventually sold the home for $800,000. What amount of the $200,000 gain on the sale does Sarah recognize in each of the following alternative situations? (Assume accumulated depreciation on the home is $0 at the time of the sale.) (Leave no answer blank. Enter zero if applicable.) Problem 14-43 Part b (Static) b. Sarah used the property as a vacation home through December 31, 2018. She then used the home as her principal residence from January 1, 2019, until she sold it on January 1, 2022. (Round intermediate percentage computation to 2 decimal places.) Gain recognized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts