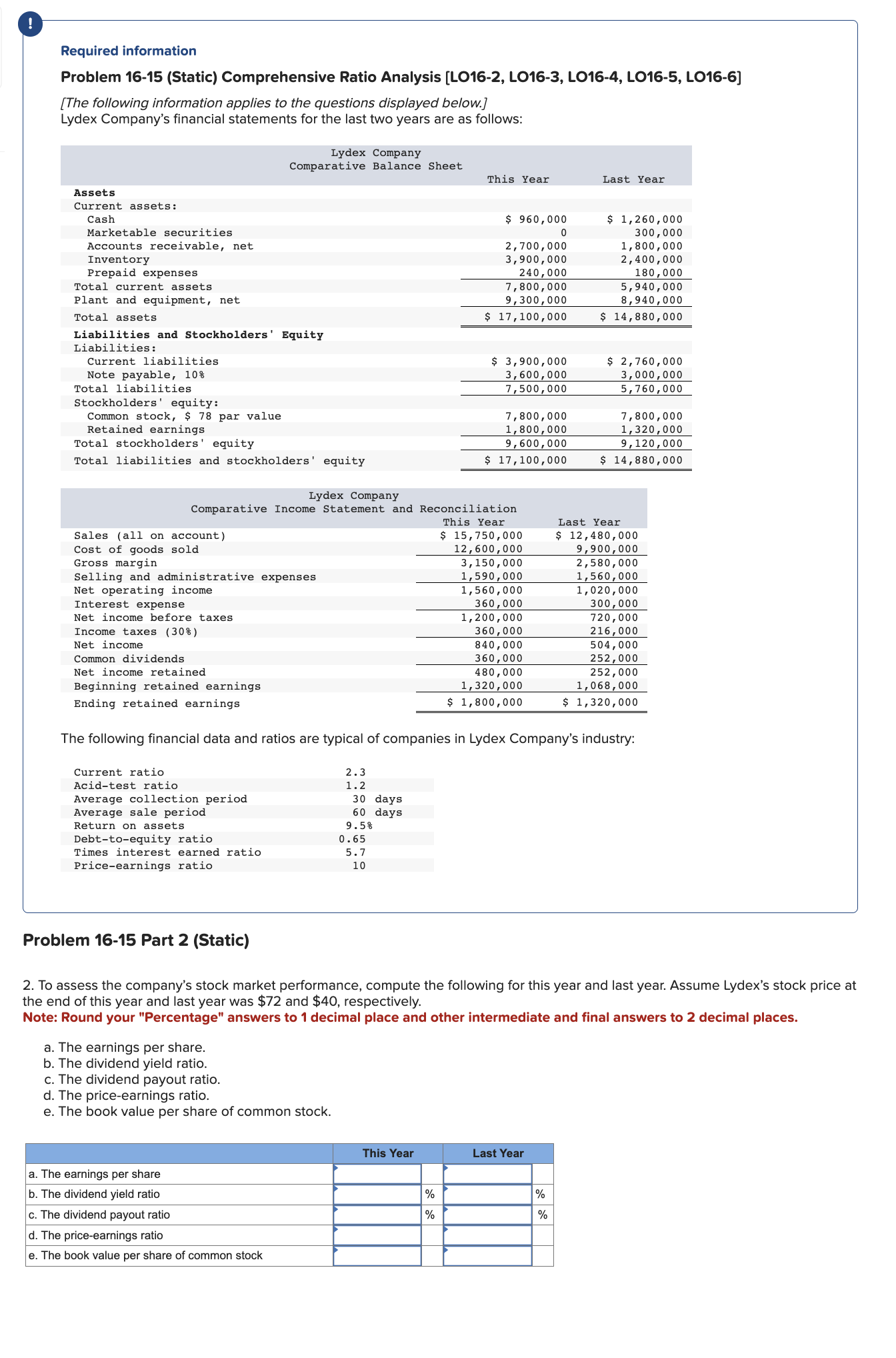

Question: Required information Problem 16-15 (Static) Comprehensive Ratio Analysis [LO16-2, L016-3, L016-4, L016-5, L016-6] [The following information applies to the questions displayed below.] Lydex Company's financial

Required information Problem 16-15 (Static) Comprehensive Ratio Analysis [LO16-2, L016-3, L016-4, L016-5, L016-6] [The following information applies to the questions displayed below.] Lydex Company's financial statements for the last two years are as follows: The following financial data and ratios are typical of companies in Lydex Company's industry: Problem 16-15 Part 2 (Static) 2. To assess the company's stock market performance, compute the following for this year and last year. Assume Lydex's stock price at the end of this year and last year was $72 and $40, respectively. Note: Round your "Percentage" answers to 1 decimal place and other intermediate and final answers to 2 decimal places. a. The earnings per share. b. The dividend yield ratio. c. The dividend payout ratio. d. The price-earnings ratio. e. The book value per share of common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts