Question: ! Required information Problem 16-2A Weighted average: Cost per equivalent unit; costs assigned to products LO C2, C3 [The following information applies to the questions

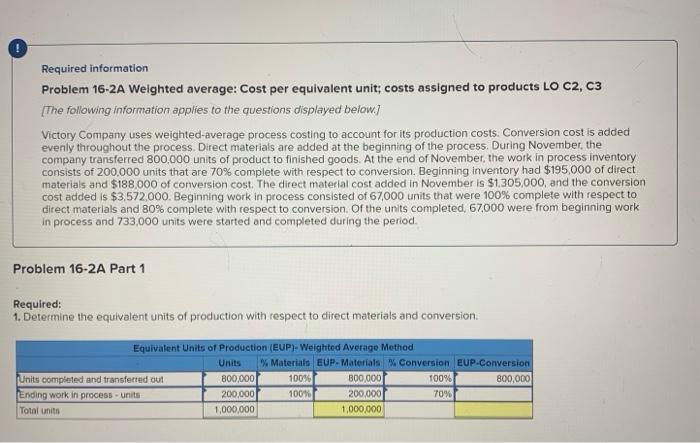

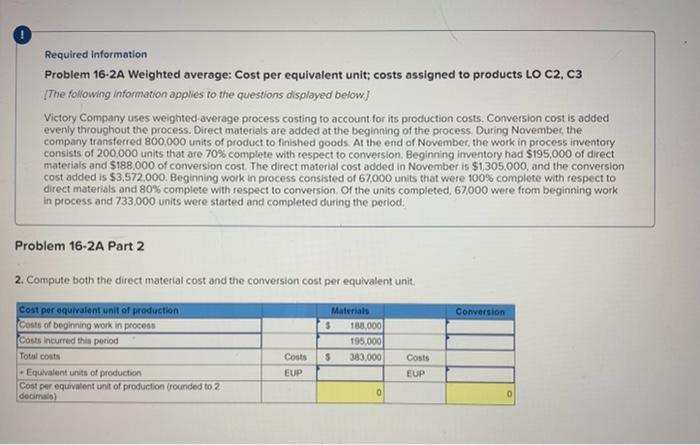

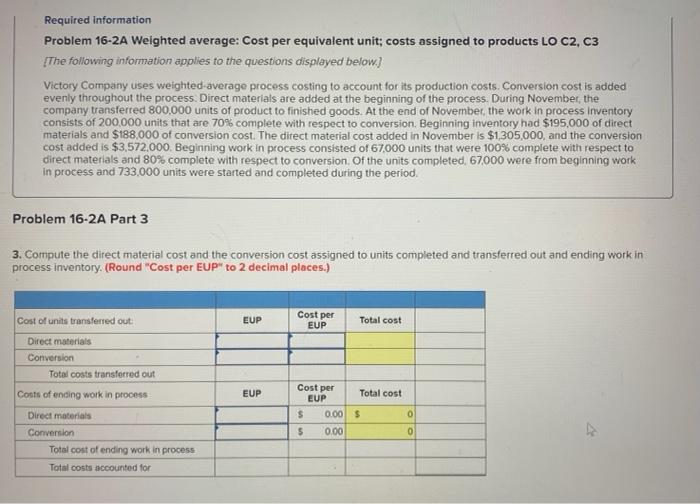

! Required information Problem 16-2A Weighted average: Cost per equivalent unit; costs assigned to products LO C2, C3 [The following information applies to the questions displayed below.) Victory Company uses weighted-average process costing to account for its production costs. Conversion cost is added evenly throughout the process Direct materials are added at the beginning of the process. During November, the company transferred 800,000 units of product to finished goods. At the end of November, the work in process inventory consists of 200.000 units that are 70% complete with respect to conversion. Beginning inventory had $195,000 of direct materials and $188,000 of conversion cost. The direct material cost added in November is $1.305,000, and the conversion cost added is $3,572,000. Beginning work in process consisted of 67,000 units that were 100% complete with respect to direct materials and 80% complete with respect to conversion of the units completed, 67.000 were from beginning work in process and 733,000 units were started and completed during the period. Problem 16-2A Part 1 Required: 1. Determine the equivalent units of production with respect to direct materials and conversion Equivalent Units of Production (EUP) Weighted Average Method Units % Materials EUP. Materials Conversion EUP-Conversion Units completed and transferred out 800,000 100% 300,000 100% 800,000 Ending work in process units 200,000 100% 200,000 70% Total units 1,000,000 1,000,000 Required Information Problem 16-2A Weighted average: Cost per equivalent unit: costs assigned to products LO C2, C3 The following information applies to the questions displayed below) Victory Company uses weighted average process costing to account for its production costs. Conversion cost is added evenly throughout the process. Direct materials are added at the beginning of the process. During November, the company transferred 800,000 units of product to finished goods. At the end of November, the work in process inventory consists of 200.000 units that are 70% complete with respect to conversion Beginning inventory had $195,000 of direct materials and $188,000 of conversion cost. The direct material cost added in November is $1,305,000, and the conversion cost added is $3,572,000. Beginning work in process consisted of 67,000 units that were 100% complete with respect to direct materials and 80% complete with respect to conversion of the units completed, 67,000 were from beginning work in process and 733.000 units were started and completed during the period. Problem 16-2A Part 2 2. Compute both the direct material cost and the conversion cost per equivalent unit Conversion Cost per equivalent unit of production Costs of beginning work in process Costs incurred this period Total costs -Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimal) Materials $ 100.000 195.000 $ 383.000 Costs EUP Costs EUP 0 Required Information Problem 16-2A Weighted average: Cost per equivalent unit; costs assigned to products LO C2, C3 The following information applies to the questions displayed below) Victory Company uses weighted average process costing to account for its production costs. Conversion cost is added evenly throughout the process Direct materials are added at the beginning of the process. During November, the company transferred 800.000 units of product to finished goods. At the end of November, the work in process inventory consists of 200.000 units that are 70% complete with respect to conversion Beginning inventory had $195,000 of direct materials and $188,000 of conversion cost. The direct material cost added in November is $1,305,000, and the conversion cost added is $3,572.000. Beginning work in process consisted of 67.000 units that were 100% complete with respect to direct materials and 80% complete with respect to conversion of the units completed, 67000 were from beginning work in process and 733,000 units were started and completed during the period. Problem 16-2A Part 3 3. Compute the direct material cost and the conversion cost assigned to units completed and transferred out and ending work in process inventory. (Round "Cost per EUP" to 2 decimal places.) Cost per EUP EUP Total cost Cost of units transferred out Direct materials Conversion Total costs transferred out Costs of ending work in process EUP Cost per Total cost EUP $ 0.00 $ 5 0.00 0 0 Direct materials Conversion Total cost of ending work in process Total costs accounted for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts