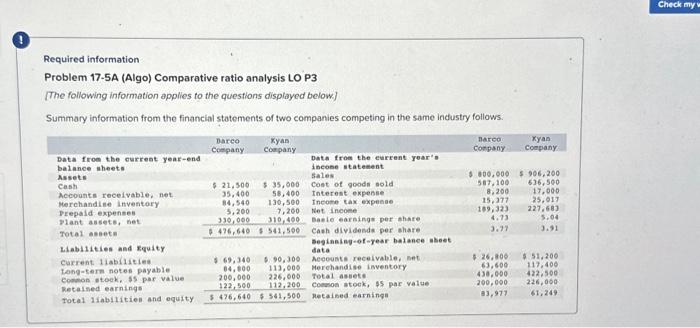

Question: Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below] Summary information from the financial statements

![following information applies to the questions displayed below] Summary information from the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e7e6c70e948_92666e7e6c6a6cd7.jpg)

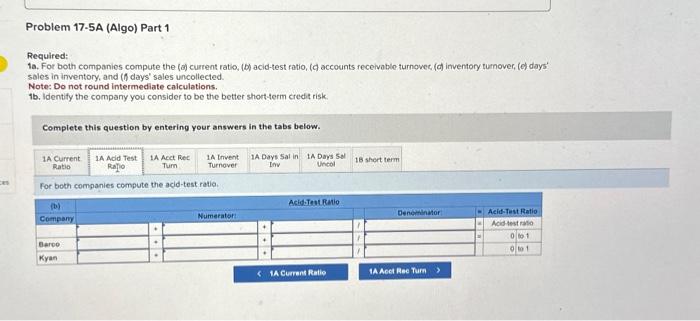

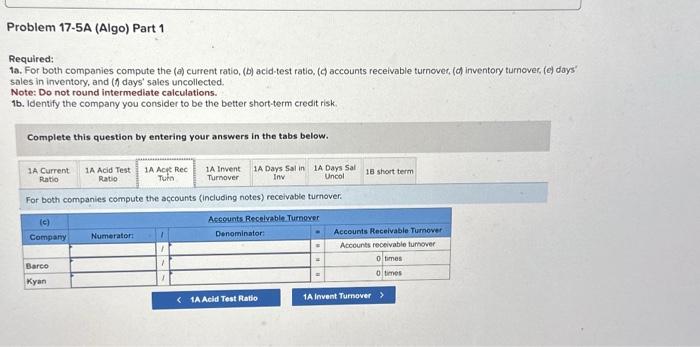

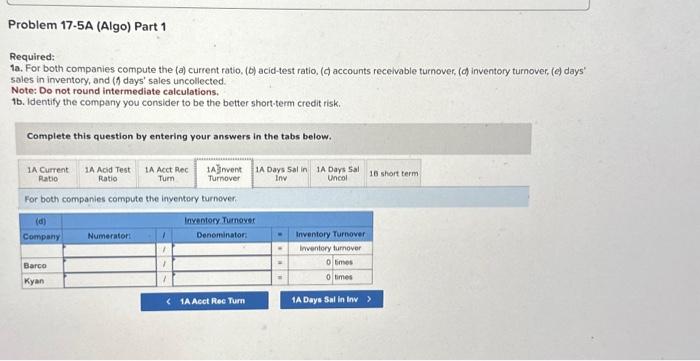

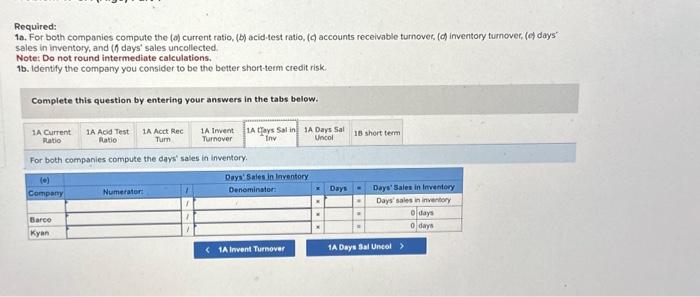

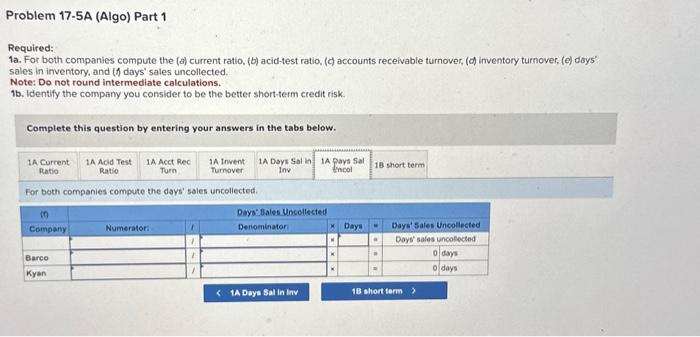

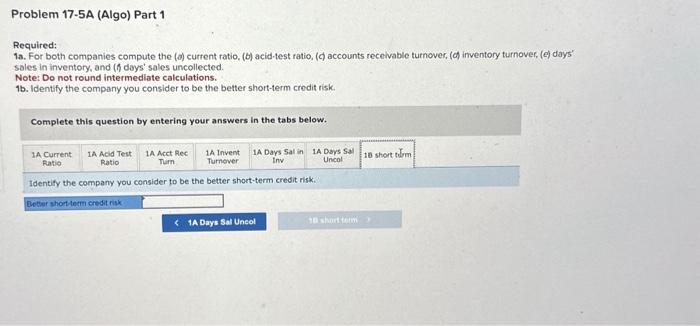

Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below] Summary information from the financial statements of two companies competing in the same industry follows. Required: 1a. For both companies compute the (d) current ratio, (d) acid-test ratio, (d) accounts receivable turnover, ( ( ) inventory turnover, ( ( ) days) sales in inventory, and (i) days' sales uncollected. Note: Do not round intermediate calculations. 1b. identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the current ratio. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test fatio, ( d accounts recelvable turnowec, (d) inventory turnover, (c) days soles in inventory, and (6) days' sales uncollected. Note: Do not round intermediate caiculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the acid-test ratio. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, ( d accounts receivable turnovec, (d) inventory turnover, (e) doys sales in inventory, and ( f ) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the accounts (including notes) receivabie turnover. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, ( d accounts recelvable turnover, (d) inventory turnover, ( ( ) days' sales in inventory, and ( h days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the inyentory turnover. Required: 1a. For both companies compute the (o) current ratio, (b) acid.test ratio, ( ( ) accounts receivable turnovec, ( ( ) inventory tumover, (c) days: sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales in inventory. Required: la. For both companies compute the (a) current ratio, (b) acid-test ratio, ( ( d accounts recelvable turnover, (d) inventory turnover, (c) days' sales in inventory, and ( f ) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales uncoliected. Required: 1a. For both companies compute the (d) current ratio, (b) acid-test ratio, ( ( accounts receivable turnover, (d) inventory turnover, ( () days' sales in inventory, and ( 6 days' sales uncollected. Note: Do not round intermediate calculations. 9b. Identify the company you consider to be the better short-term crodit risk. Complete this question by entering your answers in the tabs below. Identify the company you consider to be the better short-term credit risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts