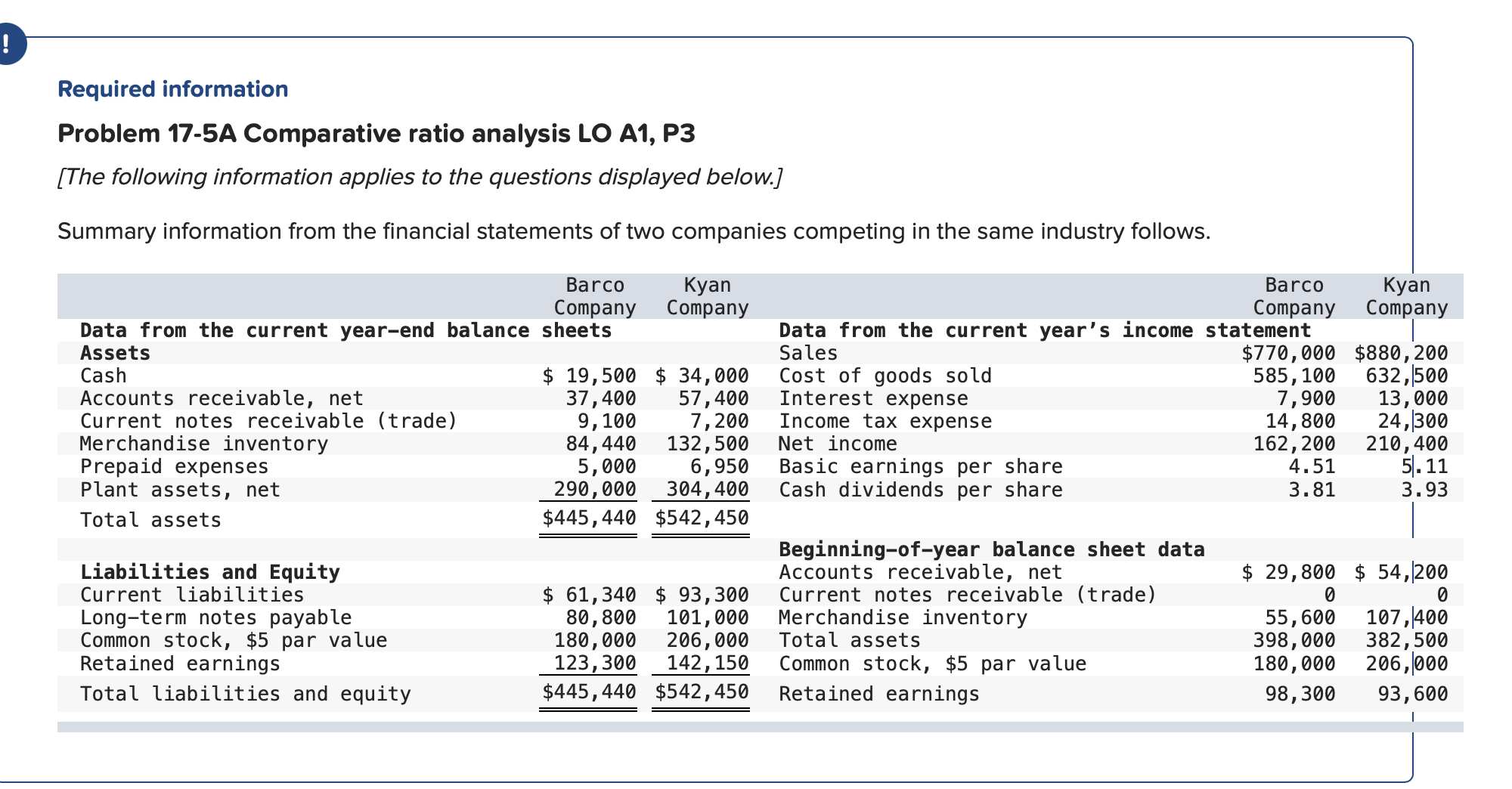

Question: Required information Problem 17-5A Comparative ratio analysis LO A1, P3 [The following information applies to the questions displayed below.] Summary information from the financial statements

![following information applies to the questions displayed below.] Summary information from the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e87653350dd_67466e876529b029.jpg)

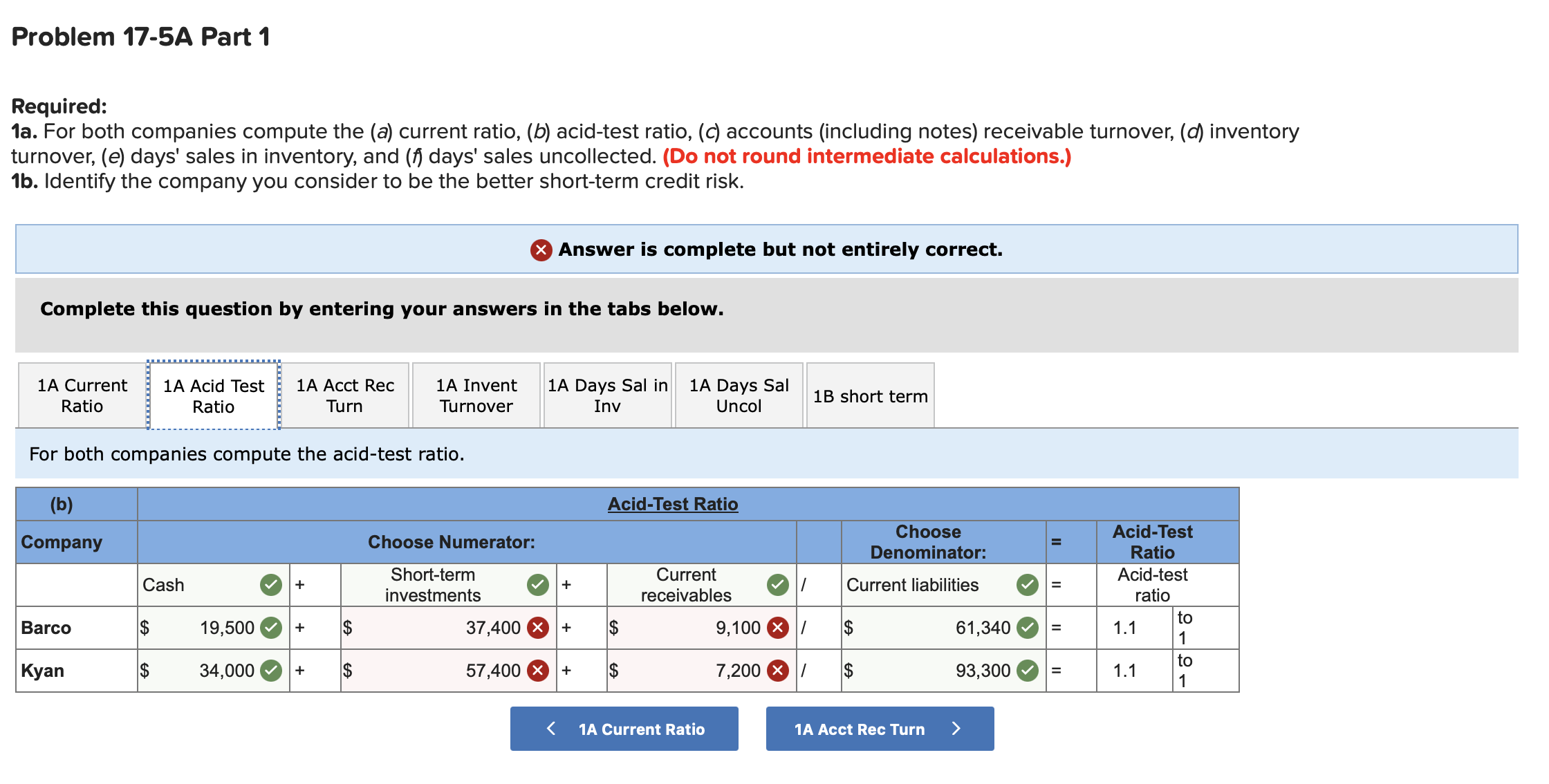

Required information Problem 17-5A Comparative ratio analysis LO A1, P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts (including notes) receivable turnover, ( d ) inventory turnover, (e) days' sales in inventory, and ( f ) days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales uncollected. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts (including notes) receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and ( f days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. For both companies compute the acid-test ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts