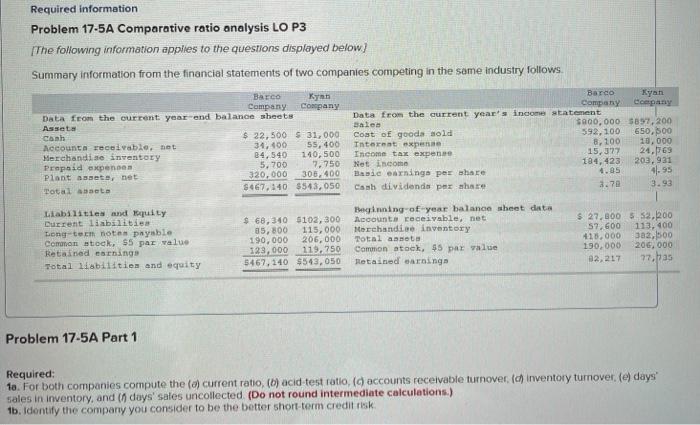

Question: Required information Problem 17-5A Comparative ratio analysis LO P3 The following information applies to the questions displayed below) Summary information from the financial statements of

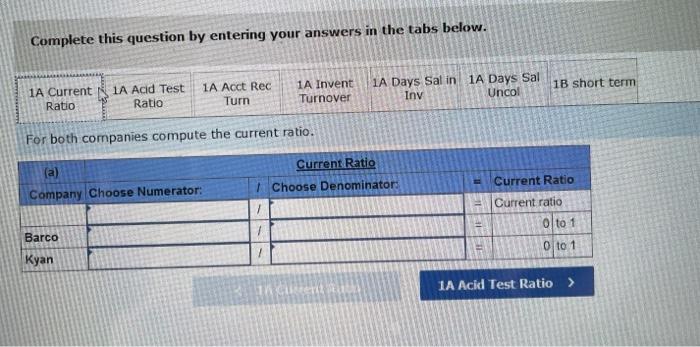

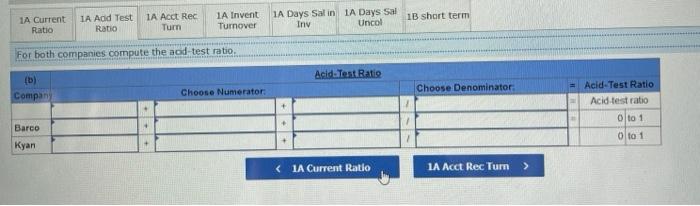

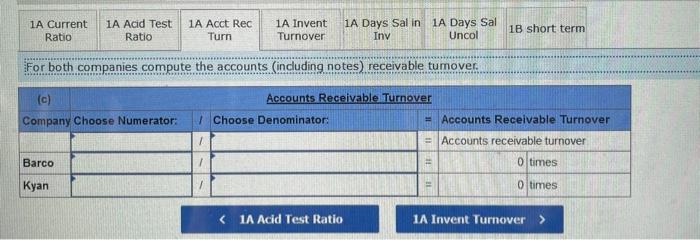

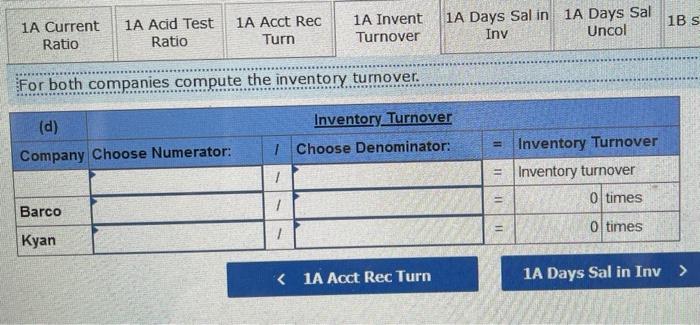

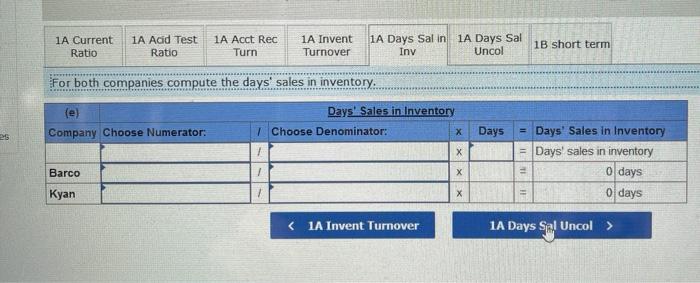

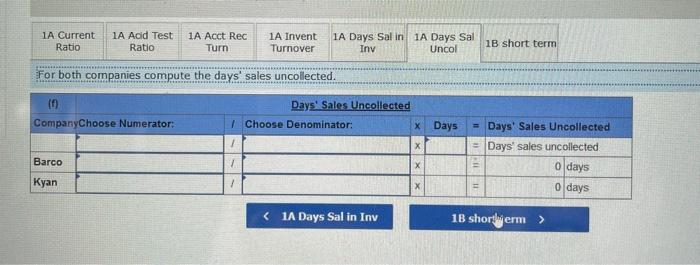

Required information Problem 17-5A Comparative ratio analysis LO P3 The following information applies to the questions displayed below) Summary information from the financial statements of two companies competing in the same industry follows Barco Xynn Company Company Data from the current year and balance sheets Asset Canh $ 22,500 $ 31,000 Accounts receivable et 34,400 55,400 Merchandise inventory 84,540 140,500 Prepaid expensen 5,700 7.750 Plant sete, net 320,000 308,400 Total aseta $467.140 $543.050 Bardo Kyan Company Company Data from the current year's income statement Bales 3900,000 $897,200 Coat of goods sold 592,100 650.00 Internnt expen 8,100 10.000 Income tax expense 15,327 24.169 Net income 184,423 203, 931 Basie arnings per share 4.95 Camb dividende per whate 8.70 3.93 Liabilities and quity Durrent liabilities Dong-term notas payable Common stock, $5 par value Retained earnings Total liabilities and equity $ 68,340 $102, 300 35,800 115,000 190,000 206,000 123,000 119,750 5467,240 $543,050 Beginning of year balance sheet data Accounts receivable, net Merchandise inventory Total assets Camion stock, $5 pawalue Metained earnings $ 27.800 552,200 57,600 113.400 418.000 302,500 190,000 206,000 32,217 77.has Problem 17-5A Part 1 Required: 10. For both companies compute the current ratio, (o) acid test ratio, (d accounts receivable turnover (ch) inventory turnover (e) days sales in inventory, and (days' sales uncollected (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk Complete this question by entering your answers in the tabs below. 1B short term 1A Current Ratio 1A Acid Test Ratio 1A Acct Rec Turn 1A Invent Turnover 1A Days Sal in 1A Days Sal Inv Uncol For both companies compute the current ratio. Current Ratio Choose Denominator: Company Choose Numerator: 1 Current Ratio Current ratio o to 1 Oto 1 Barco # 111 Kyan IA Acid Test Ratio > 1A Current Ratio IA Add Test Ratio 1A Acct Rec Tum 1A Invent Turnover 1A Days Salin 1A Days Sal 1B short term Iny Uncol For both companies compute the add-test ratio. Acid Test Ratio (5) Company Choose Numerator: Choose Denominator = Acid-Test Ratio Acid test ratio Barco Kyan 0 to 1 O to 1 1A Current Ratio 1A Acid Test Ratio 1A Acct Rec Turn 1A Invent Turnover 1A Days Sal in 1A Days Sal Iny Uncol 1B short term For both companies compute the accounts (including notes) receivable tumover. (c) Company Choose Numerator: Accounts Receivable Turnover 1 Choose Denominator: - Accounts Receivable Turnover = Accounts receivable turnover 1 Barco O times Kyan O times ( 1A Acid Test Ratio 1A Invent Turnover > 1A Current Ratio 1A Acid Test Ratio 1B S 1A Acct Rec Turn 1A Invent Turnover 1A Days Sal in Inv 1A Days Sal Uncol For both companies compute the inventory turnover. (d) Inventory Turnover Company Choose Numerator: 1 Choose Denominator: = Inventory Turnover Inventory turnover 1 = Barco 1 0 times 11 0 times Kyan 1A Current Ratio 1A Acid Test Ratio 1A Acct Rec Turn 1A Invent Turnover 1A Days Salin Iny 1A Days Sal Uncol 1B short term For both companies compute the days' sales in inventory. (e) Company Choose Numerator: Days Sales in Inventory 1 Choose Denominator: X Days es X IT = Days' Sales In Inventory Days' sales in inventory 0 days 0 days Barco Kyan X 1A Current Ratio IA Acid Test Ratio 1A Acct Rec Turn 1A Invent Turnover 1A Days Sal in 1A Days Sal Iny Uncol 1B short term For both companies compute the days' sales uncollected. Days' Sales Uncollected 1 Choose Denominator: x Days CompanyChoose Numerator: = Days Sales Uncollected 1 = Days' sales uncollected Barco 1 Kyan XX 1 o days o days 11

Step by Step Solution

There are 3 Steps involved in it

To analyze the financial ratios for Barco and Xynn Companies Ill walk you through the calculations step by step for each required ratio Step 1 Current ... View full answer

Get step-by-step solutions from verified subject matter experts