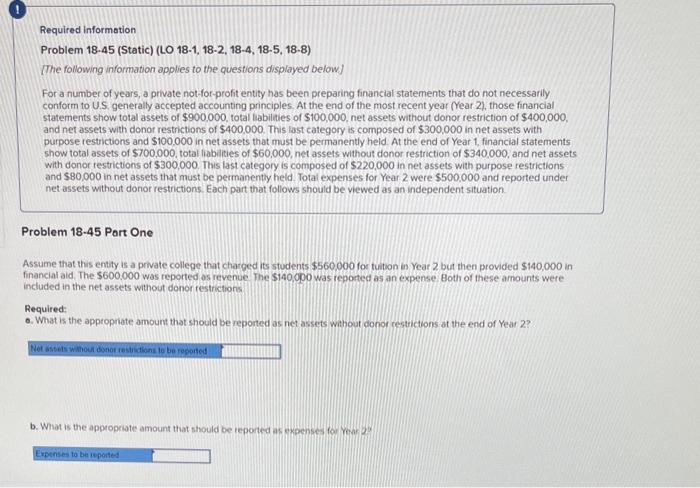

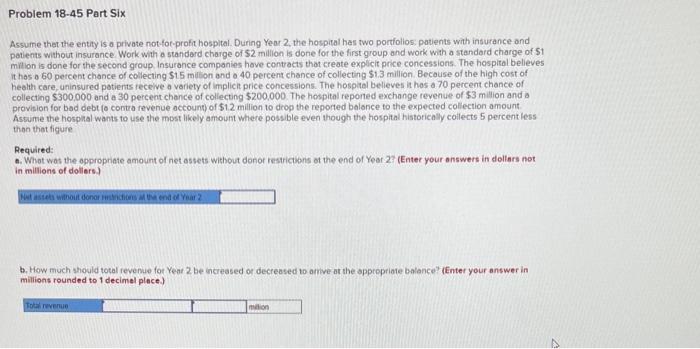

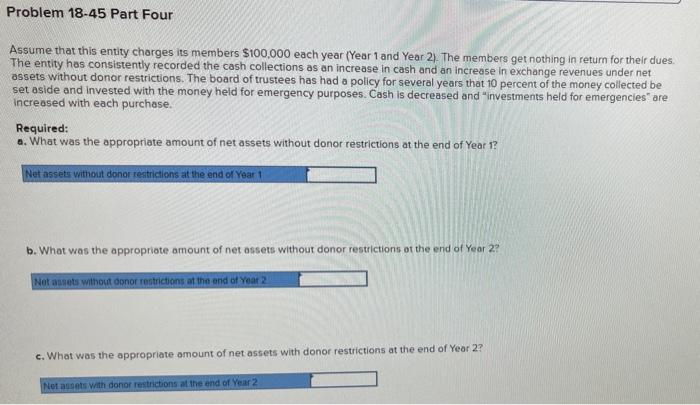

Question: Required information Problem 18-45 (Static) (LO 18-1, 18-2, 18-4, 18-5, 18-8) [The following information applies to the questions displayed below] For a number of years,

![[The following information applies to the questions displayed below] For a number](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e3e38869dfb_95266e3e388097ab.jpg)

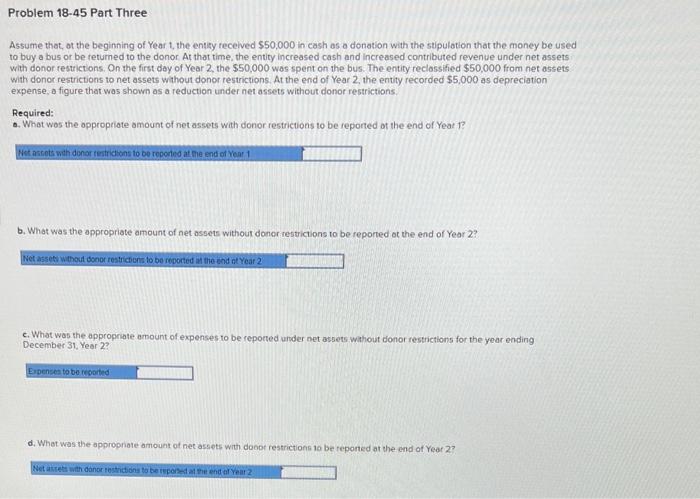

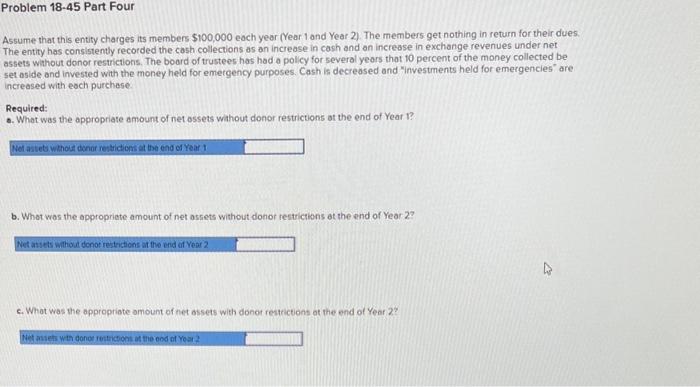

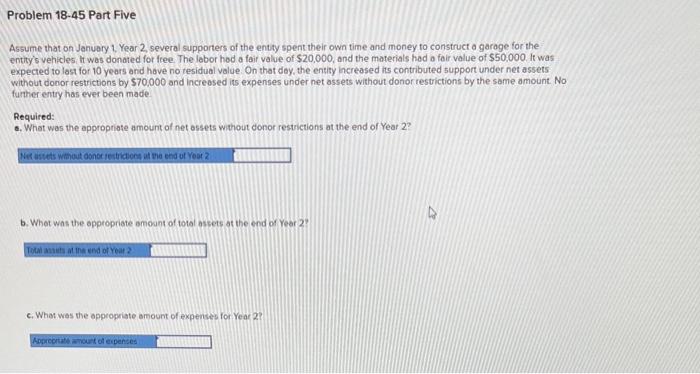

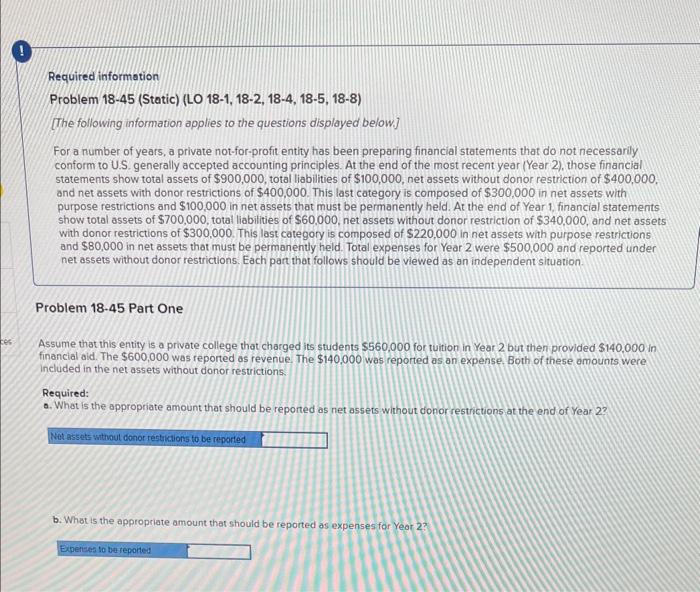

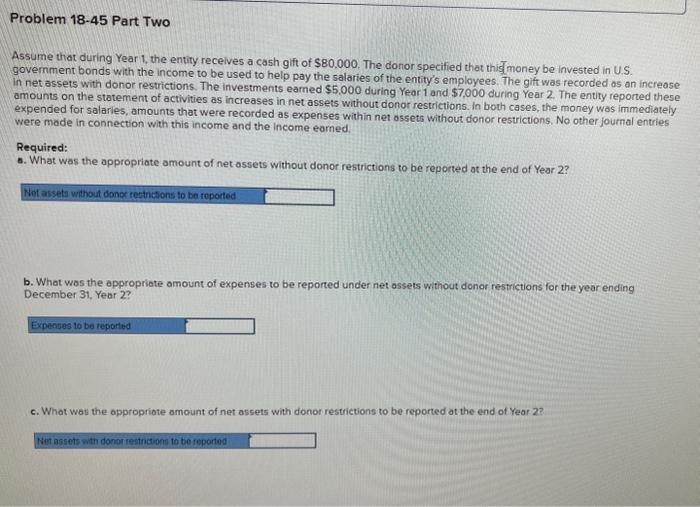

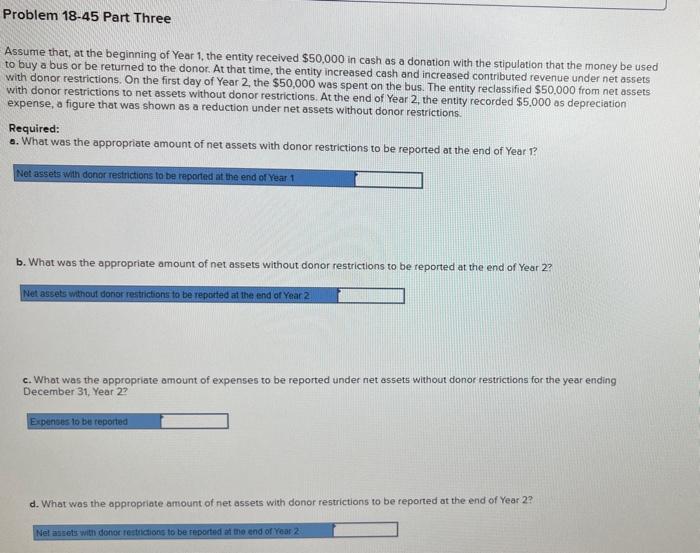

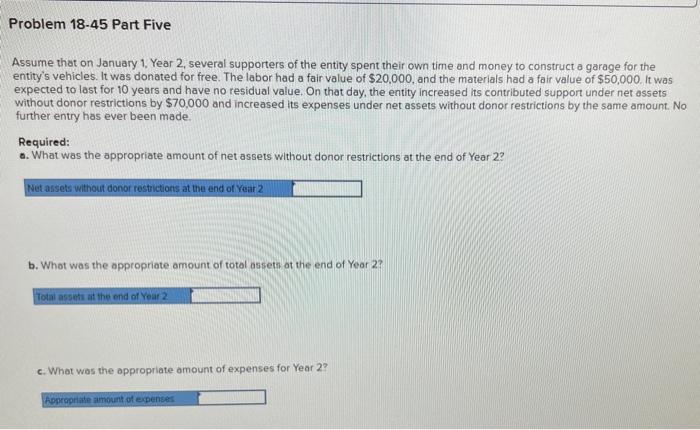

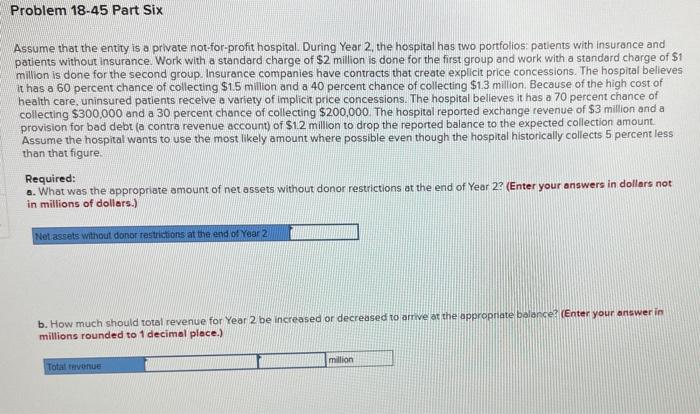

Required information Problem 18-45 (Static) (LO 18-1, 18-2, 18-4, 18-5, 18-8) [The following information applies to the questions displayed below] For a number of years, a private not-for-profit entity has been preparing financial statements that do not necessarily conform to U.S. generally accepted accounting principles. At the end of the most recent year (Year 2), those financial statements show total assets of $900,000, total labilaies of $100,000, net assets without donor restriction of $400,000, and net assets with donor restrictions of $400,000. This last category is composed of $300,000 in net assets with purpose restrictions and $100.000 in net assets that must be permanently heid. At the end of Year 1 , financial statements show total assets of $700,000, total liabilies of $60,000, net assets without donor restriction of $340,000, and net assets with donor restrictions of $300,000. This last category is composed of $220,000 in net assets with purpose restrictions and $80,000 in net assets that must be permanently held. Total expenses for Year 2 were $500.000 and reported under net assets without donor restrictions. Fach part that follows should be viewed as an independent situation. Problem 18-45 Part One Assume that this entity is a private college that charged its students $560,000 for futinon in Ycar 2 but then provided $140,000 in financial aid, The $600.000 was reported os revenue the $140,000 was teported as an expense. Both of these amounts were included in the net assets without donor restrictions. Required: 0. What is the appropriate amount that should be reponted as net assets wahout donor restrictions at the end of Year 2? b. What is the appropriate amount that should be teported as expenses for yoar 6 : roblem 1845 Part Two Assume that during Year 1. the entity receives a cash gift of $80,000. The donor specified that this money be invested in U.S government bonds with the income to be used to help pay the salaries of the entity's employees. The gift was recorded as an increase in net assets with donor restrictions. The investments earned $5,000 during Year 1 and $7,000 during Year 2 . The entity reported these amounts on the statement of activities as increases in net assets without donor restrictions. In both cases, the money was immediately expended for salaries, amounts that were recorded as expenses within net assets without donor restrictions. No other journal entries were made in connection with this income and the income eamed. Required: 0. What was the appropriate amount of net assets without donor restrictions to be reported at the end of Year 2 ? b. What was the appropriate amount of expenses to be reported under net assets without donor restrictions for the year ending December 31, Year 2? c. What was the appropriate amount of net assets with donor restictions to be reported at the end of Year 2 ? Problem 18-45 Part Three Assume that, ot the beginning of Year t, the entity received $50,000 in cash as a donation with the stipulation that the money be used to buy a bus or be retumed to the donor. At that time, the entity increased cash and increased contributed revenue under net assets with donor restrictions. On the first day of Year 2, the $50,000 was spent on the bus. The entity reclassified $50,000 from net assets with donor restrictions to net assets without donor restrictions. At the end of Year 2, the entity recorded $5,000 as depreciation expense, a figure that was shown as a reduction under net assets without donor restrictions. Required: 0. What was the opproptiate amount of net assets with donor restrictions to be reported of the end of Yeat 1 ? b. What was the appropriate amount of net assets without doner restrictions to be reported of the end of Year 2? c. What was the appropriate amount of expenses to be reported under net assets wathout donor restrictions for the year ending December 31 , Year 2 ? d. What was the appropnate amount of net assets with doobt restrictions 10 be reponted at the end of Year 2 ?. Assume that this entify charges its members $100,000 each year (Year 1 and Year 2). The members. get nothing in return for their dues. The entity has consistently recorded the cash collections as an increase in cash and an increase in exchange revenues under net assets without donor restrictions. The board of trustees has had a policy for several years that 10 percent of the money collected be set aside and invested with the money held for emergency purposes. Cash is decreased and "investments held for emergencies" are increased with each purchase. Required: a. What was the appropriate amount of net ossets wahout donor restrictions at the end of Year 1 ? b. What was the appropriate amount of net assets without donot restrictions at the and of Year 2? c. Whot was the appropriate amount of net assets with donor restrictions at the end of Year 2 ? Assume that on January 1, Year 2, several supporters of the entty spent their own time and money to construct a garage for the entity's vehicles, It was donated for free. The labor had a fair value of $20,000, and the materials had a fair value of $50,000. It was expected to last for 10 years and hove no tesidual value. On that day, the entity increased its contributed support under net assets without donor restrictions by $70.000 and increosed its expenses under net assets without donor restrictions by the same amount. No further entry has ever been made Required: c. What was the appropriate amount of net assets without donor restrictions at the end of Year 2 ? b. Whet was the appropriate amoant of total aspets at the end of Year 2 ? c. What was the appropriate amount of expenses for Year 2? Problem 18-45 Part Six Assume that the entity is a private not-fot-profit hospital. During Yeor 2, the hospital has two portfolios: patients with insurance and patients without insurance. Work with a standerd charge of $2 million is done for the first group and work with a standard charge of $1 milion is done for the second group. Insurance companies hove contracts that create explicit price concessions. The hospital believes it has a 60 percent chance of collecting $15 mition and a 40 percent chance of collecting $1.3 million. Because of the high cost of health care, uninsured patients receive a variety of implici price concessions. The hospital believes it has a 70 percent chance of collecting $300,000 and a 30 percent chance of collecting $200.000. The hospital reponed exchange revenue of $3million and a provision for bad debt (o contra revenue occount) of $1.2 million to drop the reported balance to the expected collection amount: Assume the hospial wants to use the most likely amount where possible even though the hospital historically collects 5 percent less thon that figure Required: a. What was the opproprate amount of net assets without donor restrictons of the end of Year 2? (Enter your answers in dollars not in millions of dollers] b. How much should total revenue for Year 2 be increased or decreased to amive at the appropriate balance? (Enter your answer in millions rounded to 1 decimel place.) Required information Problem 18-45 (Static) (LO 18-1, 18-2, 18-4, 18-5, 18-8) [The following information applies to the questions displayed below] For a number of years, a private not-for-profit entity has been preparing financial statements that do not necessarily conform to U.S. generally accepted accounting principles. At the end of the most recent year (Year 2), those financial statements show total assets of $900,000, total liabilities of $100,000, net assets without donor restriction of $400,000, and net assets with donor restrictions of $400,000. This last category is composed of $300,000 in net assets with purpose restrictions and $100,000 in net assets that must be permanently held. At the end of Year 1, financial statements show total assets of $700,000, total liabilities of $60,000, net assets without donor restriction of $340,000, and net assets with donor restrictions of $300,000. This last category is composed of $220,000 in net assets with purpose restrictions and $80,000 in net assets that must be permanenty held. Total expenses for Year 2 were $500,000 and reported under net assets without donor restrictions. Each part that follows should be viewed as an independent situation. Problem 18-45 Part One Assume that this entity is a private college that charged its students $560,000 for tuition in Year 2 but then provided $140,000 in financial aid. The $600,000 was reported as revenue. The $140,000 was reported as an expense. Both of these amounts were. included in the net assets without donor restictions. Required: a. What is the appropriate amount that should be reported as net assets without donor restrictions at the end of Year 2 ? b. Whot is the appropriate amount that should be reported as expenses for Year 2? Assume that during Year 1, the entity recelves a cash gift of $80.000. The donor specified that this money be invested in U.S. government bonds with the income to be used to help pay the salaries of the entity's employees. The gift was recorded as an increose in net assets with donor restrictions. The investments eamed $5.000 during Year 1 and $7,000 during Year 2 . The entity reported these amounts on the statement of activities as increases in net assets without donor restrictions. In both cases, the money was immediately expended for salaries, amounts that were recorded as expenses within net ossets without donor restrictions, No other journal entries: were made in connection with this income and the income earned. Required: a. What was the appropriate amount of net assets without donor restrictions to be reported at the end of Year 2 ? b. What wos the appropriate amount of expenses to be reported under net assets without donor restrictions for the year ending December 31, Year 2? c. What was the oppropriate amount of net assets with donor restrictions to be reported at the end of Year 2 ? Problem 18-45 Part Three Assume that, at the beginning of Year 1, the entity received $50,000 in cash as a donation with the stipulation that the money be used to buy a bus or be returned to the donor. At that time, the entity increased cash and increased contributed revenue under net assets with donor restrictions. On the first day of Year 2 , the $50,000 was spent on the bus. The entity reclassified $50,000 from net assets with donor restrictions to net assets without donor restrictions. At the end of Year 2, the entity recorded $5,000 as depreciation expense, a figure that was shown as a reduction under net assets without donor restrictions. Required: 0. What was the appropriate amount of net assets with donor restrictions to be reported at the end of Year 1 ? b. What was the appropriate amount of net assets without donor restrictions to be reported at the end of Year 2? c. What was the appropriate amount of expenses to be reported under net assets without donor restrictions for the year ending December 31, Year 2? d. What was the appropriate amount of net assets with donor restrictions to be reported at the end of Year 2 ? Assume that this entity charges its members $100,000 each year (Year 1 and Year 2). The members get nothing in return for their dues. The entity has consistently recorded the cash collections as an increase in cash and an increase in exchange revenues under net assets without donor restrictions. The board of trustees has had a policy for several years that 10 percent of the money collected be set aside and invested with the money held for emergency purposes. Cash is decreased and "investments held for emergencies" are increased with each purchase. Required: a. What was the appropriate amount of net assets without donor restrictions at the end of Year 1 ? b. What was the appropriate amount of net assets without donor restrictions of the end of Year 2 ? c. What was the oppropriate amount of net assets with donor restrictions at the end of Year 2 ? Assume that on January 1, Year 2, several supporters of the entity spent their own time and money to construct a garage for the entity's vehicles. It was donated for free. The labor had a fair value of $20.000, and the materials had a fair value of $50,000. It was expected to last for 10 years and have no residual value. On that day, the entity increased its contributed support under net assets without donor restrictions by $70,000 and increased its expenses under net assets without donor restrictions by the same amount. No further entry has ever been made. Required: a. What was the appropriate amount of net assets without donor restrictions at the end of Year 2 ? b. What was the appropriate amount of total assets at the end of Year 2? c. What was the appropriate omount of expenses for Year 2? Assume that the entity is a private not-for-profit hospital. During Year 2, the hospital has two portfolios: patients with insurance and patients without insurance. Work with a standard charge of $2 million is done for the first group and work with a standard charge of $1 million is done for the second group. Insurance companies have contracts that create explicit price concessions. The hospital belleves it has a 60 percent chance of collecting $1.5 million and a 40 percent chance of collecting $1.3 million. Because of the high cost of health care, uninsured patients receive a variety of implicit price concessions. The hospital belleves it has a 70 percent chance of collecting $300,000 and a 30 percent chance of collecting $200,000. The hospital reported exchange revenue of $3 million and a provision for bad debt (a contra revenue account) of $1.2 millon to drop the reported balance to the expected collection amount. Assume the hospital wants to use the most likely amount where possible even though the hospital historically collects 5 percent less than that figure. Required: 0. What was the appropriate amount of net assets without donor restrictions at the end of Year 2? (Enter your answers in dollars not in millions of dollers.) b. How much should total revenue for Year 2 be increased or decreased to arrive at the appropnate balance? (Enter your answer in millions rounded to 1 decimal plece.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts