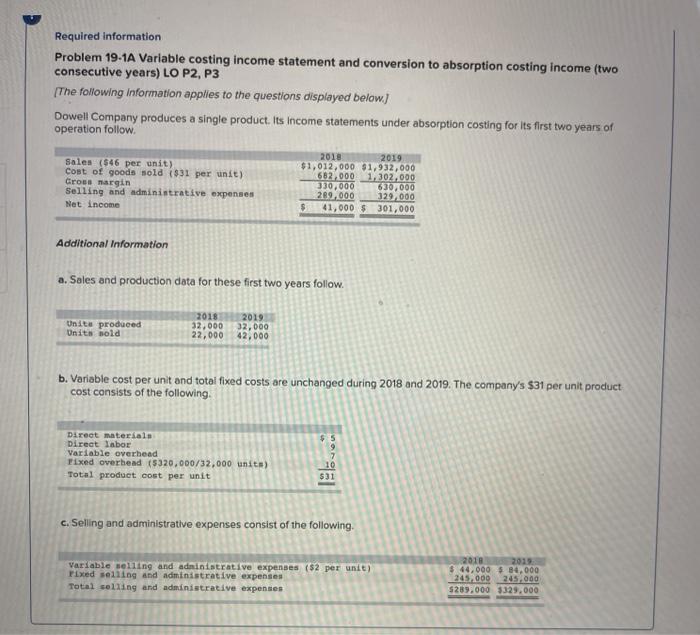

Question: Required information Problem 19-1A Variable costing income statement and conversion to absorption costing Income (two consecutive years) LO P2, P3 [The following Information applies to

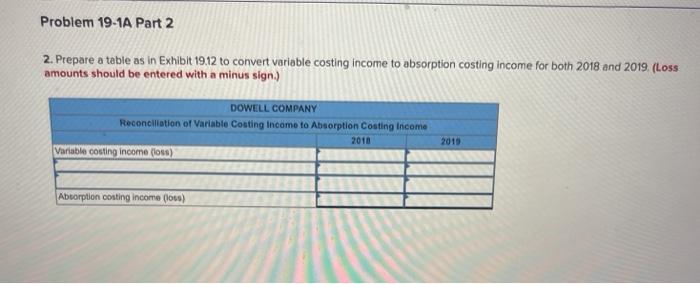

Required information Problem 19-1A Variable costing income statement and conversion to absorption costing Income (two consecutive years) LO P2, P3 [The following Information applies to the questions displayed below! Dowell Company produces a single product. Its Income statements under absorption costing for its first two years of operation follow Sales ($46 per unit) Cost of goods sold ($31 per unit) Cross margin Selling and administrative expenses Net income 2018 2019 $1,012,000 $1,932,000 682000 1,302,000 330,000 630,000 289,000 329.000 $ 41,000 $ 301,000 Additional Information a. Soles and production data for these first two years follow. Unitu produced Units sold 2018 32,000 22,000 2019 32,000 42,000 b. Variable cost per unit and total fixed costs are unchanged during 2018 and 2019. The company's $31 per unit product cost consists of the following Direct materials Direct labor Variable overhead Fixed overhead (5320,000/32,000 units) Total product cost per unit 10 $31 c. Selling and administrative expenses consist of the following. variable rolling and administrative expenses (52 per unit) Fixed selling and administrative expenses Total selling and administrative expenses 2018 2019 $ 44,000 $ 84,000 245.000 245.000 $289.000 3329.000 Problem 19-1A Part 2 2. Prepare a table as in Exhibit 1912 to convert variable costing income to absorption costing income for both 2018 and 2019. (Loss amounts should be entered with a minus sign.) DOWELL COMPANY Reconciliation of Variable Costing Income to Absorption Costing Income Variable couting income (104) 2010 2010 Absorption costing income (los)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts