Question: Required information Problem 20-3 (Algo) Change in inventory costing methods; comparative income statements [LO20-2, 20-3] [The following information applies to the questions displayed below] Shown

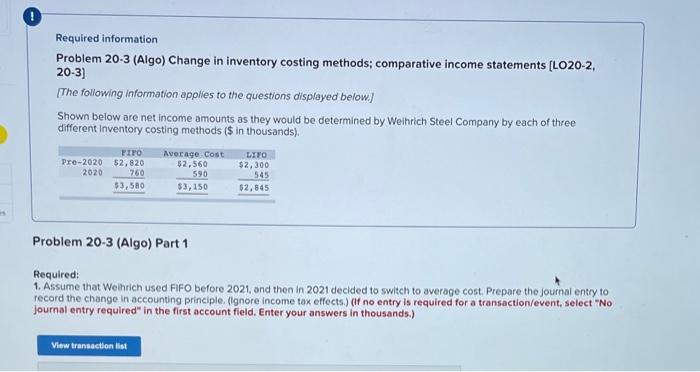

Required information Problem 20-3 (Algo) Change in inventory costing methods; comparative income statements [LO20-2, 20-3] [The following information applies to the questions displayed below] Shown below are net income amounts as they would be determined by Weihrich Steel Company by each of three different inventory costing methods (\$ in thousands). Problem 20-3 (Algo) Part 1 Required: 1. Assume that Weihrich used FIFO before 2021, and then in 2021 decided to switch to average cost. Prepare the journal entry to record the change in accounting principle. (lgnore income tax effects.) (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in thousands.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts