Question: Required information Problem 2-1A (Static) Computing job costs and overhead rate; assigning costs to inventory LO C1, P3 (The following information applies to the questions

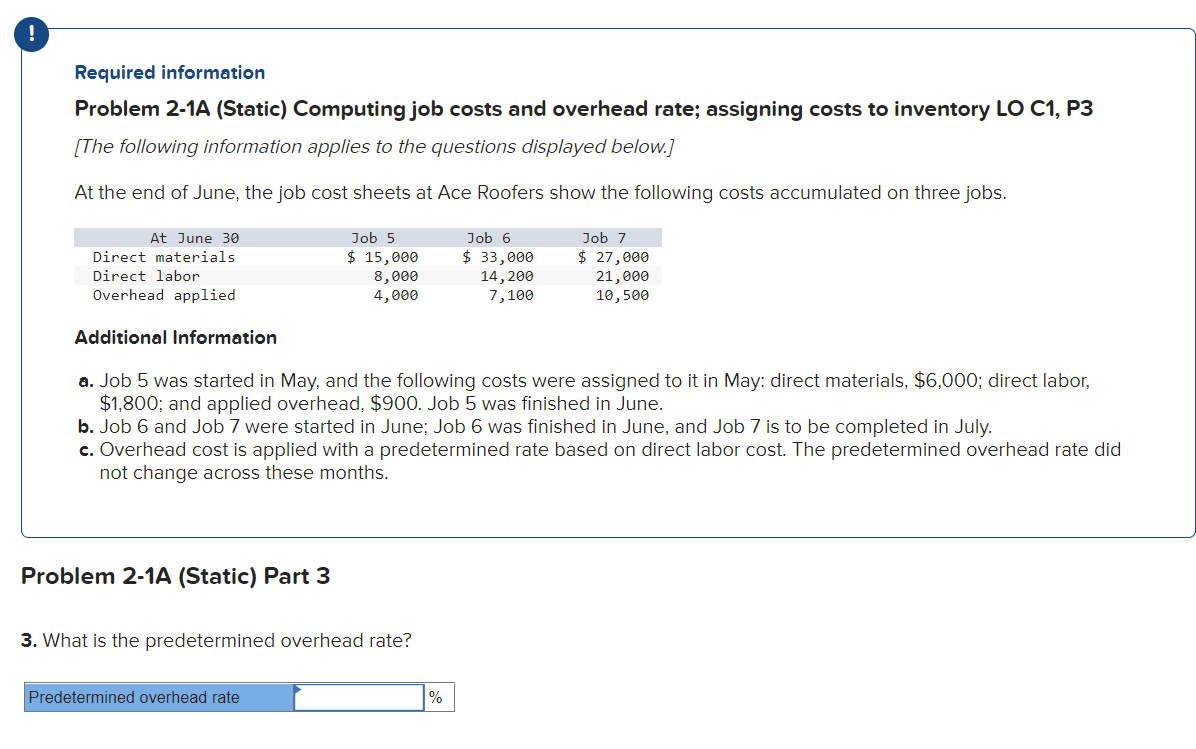

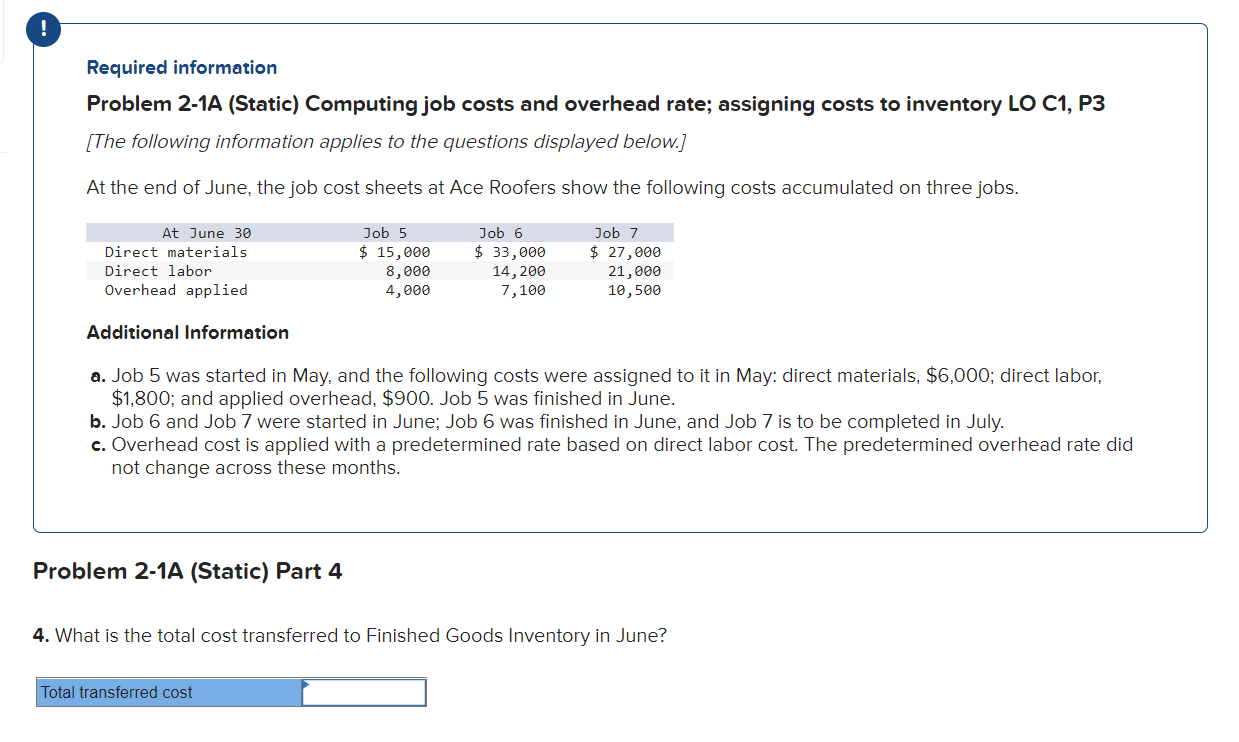

Required information Problem 2-1A (Static) Computing job costs and overhead rate; assigning costs to inventory LO C1, P3 (The following information applies to the questions displayed below.) At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three jobs. At June 30 Direct materials Direct labor Overhead applied Job 5 $ 15,000 8,000 4,000 Job 6 $ 33,000 14,200 7,100 Job 7 $ 27,000 21,000 10,500 Additional Information a. Job 5 was started in May, and the following costs were assigned to it in May: direct materials, $6,000; direct labor, $1,800; and applied overhead, $900. Job 5 was finished in June. b. Job 6 and Job 7 were started in June; Job 6 was finished in June, and Job 7 is to be completed in July. c. Overhead cost is applied with a predetermined rate based on direct labor cost. The predetermined overhead rate did not change across these months. Problem 2-1A (Static) Part 3 3. What is the predetermined overhead rate? Predetermined overhead rate % ! Required information Problem 2-1A (Static) Computing job costs and overhead rate; assigning costs to inventory LO C1, P3 (The following information applies to the questions displayed below.) At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three jobs. At June 30 Direct materials Direct labor Overhead applied Job 5 $ 15,000 8,000 4,000 Job 6 $ 33,000 14,200 7,100 Job 7 $ 27,000 21,000 10,500 Additional Information a. Job 5 was started in May, and the following costs were assigned to it in May: direct materials, $6,000; direct labor, $1,800; and applied overhead, $900. Job 5 was finished in June. b. Job 6 and Job 7 were started in June; Job 6 was finished in June, and Job 7 is to be completed in July. c. Overhead cost is applied with a predetermined rate based on direct labor cost. The predetermined overhead rate did not change across these months. Problem 2-1A (Static) Part 4 4. What is the total cost transferred to Finished Goods Inventory in June? Total transferred cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts