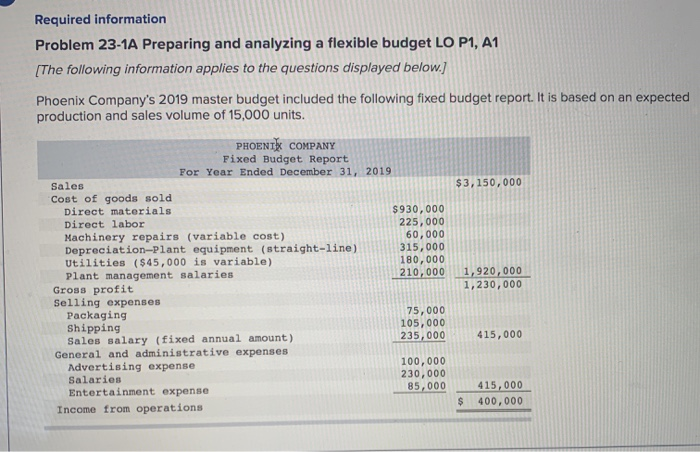

Question: Required information Problem 23-1A Preparing and analyzing a flexible budget LO P1, A1 [The following information applies to the questions displayed below.] Phoenix Company's 2019

![P1, A1 [The following information applies to the questions displayed below.] Phoenix](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ea70430407a_19466ea704240c79.jpg)

Required information Problem 23-1A Preparing and analyzing a flexible budget LO P1, A1 [The following information applies to the questions displayed below.] Phoenix Company's 2019 master budget included the following fixed budget report. It is based on an expected production and sales volume of 15,000 units. PHOENT COMPANY Fixed Budget Report For Year Ended December 31, 2019 Sales $3,150,000 Cost of goods sold Direct materials $930,000 Direct labor 225,000 Machinery repairs (variable cost) 60,000 Depreciation-Plant equipment (straight-line) 315,000 Utilities ($45,000 is variable) 180,000 Plant management salaries 210,000 1,920,000 Gross profit 1,230,000 Selling expenses Packaging 75,000 Shipping 105,000 Sales salary (fixed annual amount) 235,000 415,000 General and administrative expenses Advertising expense 100,000 Salaries 230,000 Entertainment expense 85,000 415,000 Income from operations $ 400,000 PHOENIX COMPANY Flexible Budgets For Year Ended December 31, 2019 Flexible Budget Variable Amount Total Fixed Cost Flexible Budget for: Units Sales Unit Sales of of 14,000 16,000 per Unit Variable costs Fixed costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts