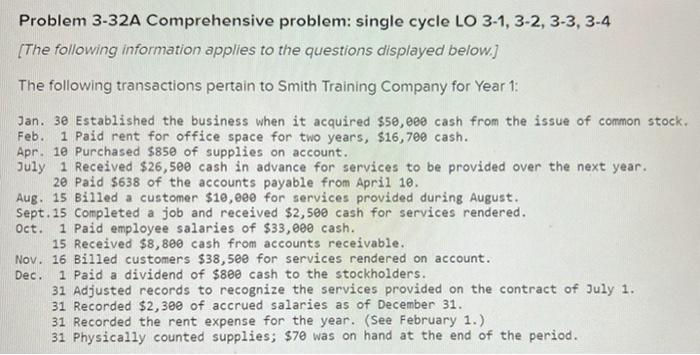

Question: Required Information Problem 3-32A Comprehensive problem: single cycle LO 3-1, 3-2, 3-3, 3-4 [The following information apples to the questions displayed below.] The following transactions

![[The following information apples to the questions displayed below.] The following transactions](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67182172ec698_674671821725cb18.jpg)

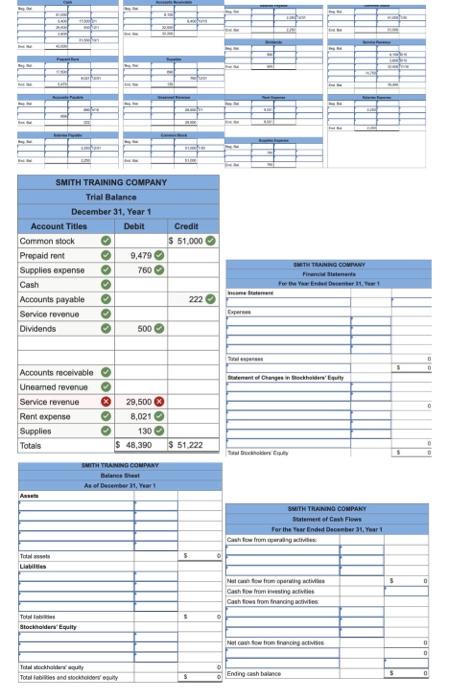

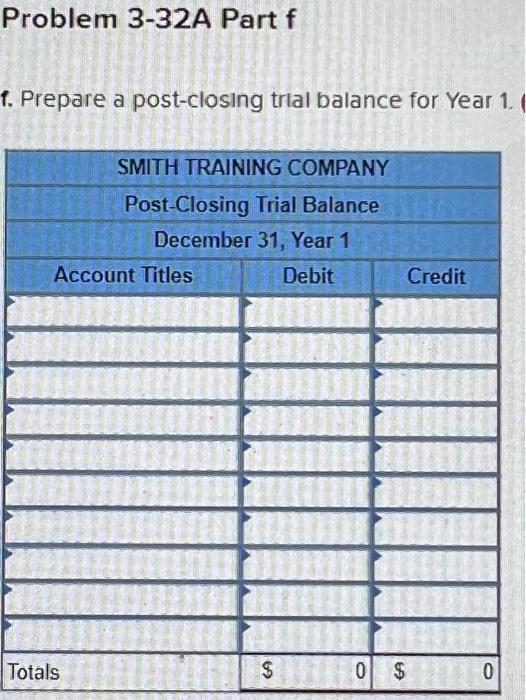

RE SMITH TRAINING COMPANY Trial Balance December 31, Year 1 Account Titles Debit Credit Common stock $ 51,000 Prepaid rent 9,479 Supplies expense 760 Cash Accounts payable 222 Service revenue Dividends 500 IMT TNING COMINY OOOOO Free 11. 3 tenente Change Bochor Egy Accounts receivable Uneamed revenue Service revenue Rent expense Supplies Totals OOOOO 0 29,500 8,021 130 $ 48,390 $ 51 222 SITY TRAINING COMPANY Delane As of December Year A SMITH TRANING COMPANY Statement of Cash Flow For the Tor Ended December Cashow from 5 Tot Las 5 0 Nastow from powing we Cashowing advies Cashows from facing as To Stockholders' Equity Nel com tow to fino a 0 Total Total addresu $ Ending cash race 5 Problem 3-32A Partf 1. Prepare a post-closing trial balance for Year 11 SMITH TRAINING COMPANY Post-Closing Trial Balance December 31, Year 1 Account Titles Debit Credit Totals GA 0 $ 0 Problem 3-32A Partf 1. Prepare a post-closing trial balance for Year 11 SMITH TRAINING COMPANY Post-Closing Trial Balance December 31, Year 1 Account Titles Debit Credit Totals GA 0 $ 0 Problem 3-32A Comprehensive problem: single cycle LO 3-1, 3-2, 3-3, 3-4 [The following information applies to the questions displayed below.] The following transactions pertain to Smith Training Company for Year 1: Jan. 3e Established the business when it acquired $50, eee cash from the issue of common stock. Feb. 1 Paid rent for office space for two years, $16,700 cash. Apr. 1e Purchased $850 of supplies on account. July 1 Received $26,500 cash in advance for services to be provided over the next year. 2e Paid $638 of the accounts payable from April 10. Aug. 15 Billed a customer $10,000 for services provided during August. Sept. 15 Completed a job and received $2,500 cash for services rendered. Oct. 1 Paid employee salaries of $33,000 cash. 15 Received $8,800 cash from accounts receivable. Nov. 16 Billed customers $38,5ee for services rendered on account. Dec. 1 Paid a dividend of $800 cash to the stockholders. 31 Adjusted records to recognize the services provided on the contract of July 1. 31 Recorded $2,300 of accrued salaries as of December 31. 31 Recorded the rent expense for the year. (See February 1.) 31 Physically counted supplies; $70 was on hand at the end of the period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts