Question: Required information Problem 4-3B Prepare the bank reconciliation and record cash adjustments (LO4-5) Skip to question [The following information applies to the questions displayed below.]

Required information

Problem 4-3B Prepare the bank reconciliation and record cash adjustments (LO4-5)

Skip to question

[The following information applies to the questions displayed below.]

The cash records and bank statement for the month of July for Glover Incorporated are shown below.

| GLOVER INCORPORATED | ||||||||||||||||||

| Cash Account Records | ||||||||||||||||||

| July 1, 2021, to July 31, 2021 | ||||||||||||||||||

| Cash Balance | Cash Balance | |||||||||||||||||

| July 1, 2021 | + | Cash Receipts | Cash Disbursements | = | July 31, 2021 | |||||||||||||

| $7,110 | $8,420 | $9,160 | $6,370 | |||||||||||||||

| Cash Receipts | Cash Disbursements | |||||||||||||||||

| Date | Desc. | Amount | Date | Check# | Desc. | Amount | ||||||||||||

| 7/9 | Sales | $ | 2,560 | 7/7 | 531 | Rent | $ | 1,500 | ||||||||||

| 7/21 | Sales | 3,140 | 7/12 | 532 | Salaries | 1,960 | ||||||||||||

| 7/31 | Sales | 2,720 | 7/19 | 533 | Equipment | 3,500 | ||||||||||||

| 7/22 | 534 | Utilities | 900 | |||||||||||||||

| 7/30 | 535 | Advertising | 1,300 | |||||||||||||||

| $ | 8,420 | $ | 9,160 | |||||||||||||||

| P.O. Box 123878 | FIDELITY UNION | Member FDIC | |||||||||||||||||||||||||

| Gotebo, OK 73041 | You Can Bank On Us | ||||||||||||||||||||||||||

| (580) 377-OKIE | |||||||||||||||||||||||||||

| Account Holder: | Glover Incorporated | Account Number: | 2252790471 | ||||||||||||||||||||||||

| 519 Main Street | |||||||||||||||||||||||||||

| Gotebo, OK 73041 | Statement Date: | July 31, 2021 | |||||||||||||||||||||||||

| Beginning Balance | Deposits and Credits | Withdrawals and Debits | Ending Balance | ||||||||||||||||||||||||

| July 1, 2021 | NO. | Total | NO. | Total | July 31, 2021 | ||||||||||||||||||||||

| $7,700 | 3 | $5,750 | 7 | $ 8,800 | $ 4,650 | ||||||||||||||||||||||

| Deposits and Credits | Withdrawals and Debits | Daily Balance | |||||||||||||||||||||||||

| Date | Amount | Desc. | Date | No. | Amount | Desc. | Date | Amount | |||||||||||||||||||

| 7/10 | $ | 2,560 | DEP | 7/2 | 530 | $ | 590 | CHK | 7/2 | $ | 7,110 | ||||||||||||||||

| 7/22 | 3,140 | DEP | 7/10 | 531 | 1,500 | CHK | 7/10 | 8,170 | |||||||||||||||||||

| 7/31 | 50 | INT | 7/14 | 532 | 1,960 | CHK | 7/14 | 6,210 | |||||||||||||||||||

| 7/18 | 400 | NSF | 7/18 | 5,810 | |||||||||||||||||||||||

| 7/22 | 533 | 3,800 | CHK | 7/22 | 5,150 | ||||||||||||||||||||||

| 7/26 | 500 | EFT | 7/26 | 4,650 | |||||||||||||||||||||||

| 7/30 | 50 | SF | 7/30 | 4,600 | |||||||||||||||||||||||

| 7/31 | $ | 4,650 | |||||||||||||||||||||||||

| $ | 5,750 | $ | 8,800 | ||||||||||||||||||||||||

| Desc. | DEP Customer deposit | INT Interest earned | SF Service fees |

| NOTE Note collected | CHK Customer check | NSF Nonsufficient funds | |

| EFT Electronic funds transfer |

Additional information:

The difference in the beginning balances in the companys records and the bank statement relates to check #530, which is outstanding as of June 30, 2021.

Check #533 is correctly processed by the bank.

The EFT on July 26 relates to the purchase of office supplies.

Problem 4-3B Part 1

Required:

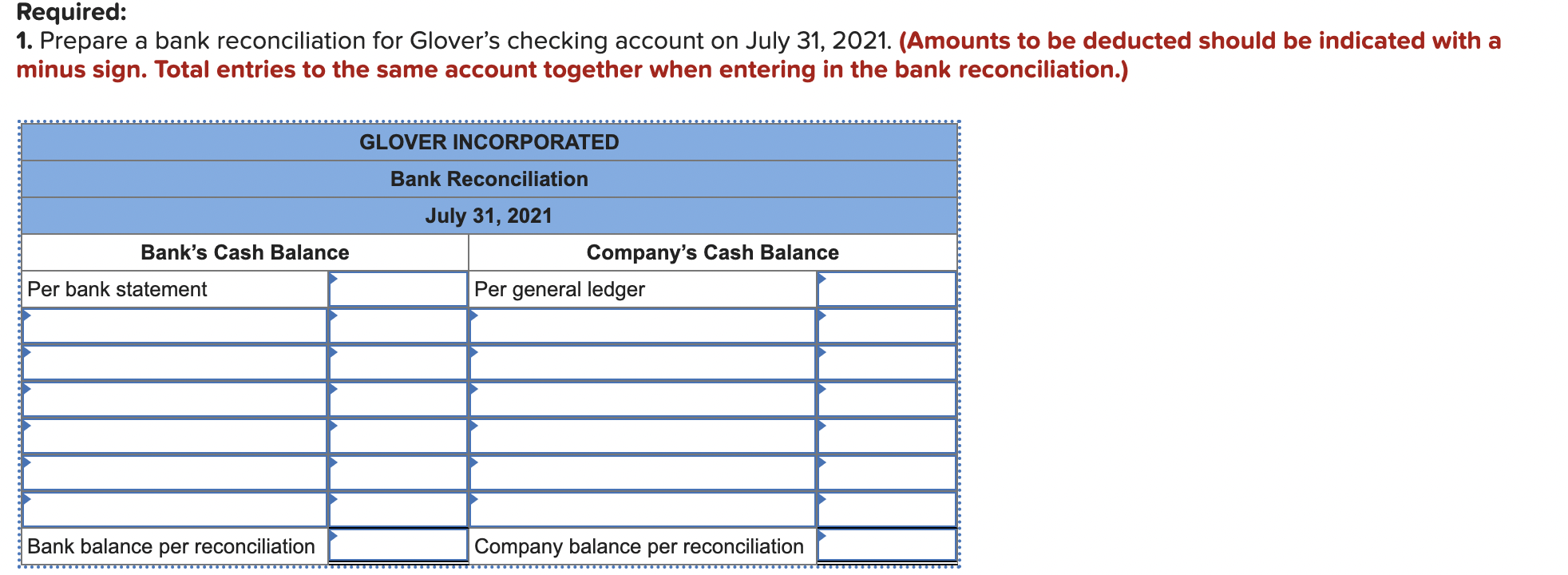

1. Prepare a bank reconciliation for Glovers checking account on July 31, 2021. (Amounts to be deducted should be indicated with a minus sign. Total entries to the same account together when entering in the bank reconciliation.)

1. Prepare a bank reconciliation for Glover's checking account on July 31, 2021. (Amounts to be deducted should be indicated with a minus sign. Total entries to the same account together when entering in the bank reconciliation.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts