Question: Required information Problem 4-5A Preparing adjusting entries and income statements; computing gross margin, acid-test, and current ratios LO A1, A2, P3, P4 (The following information

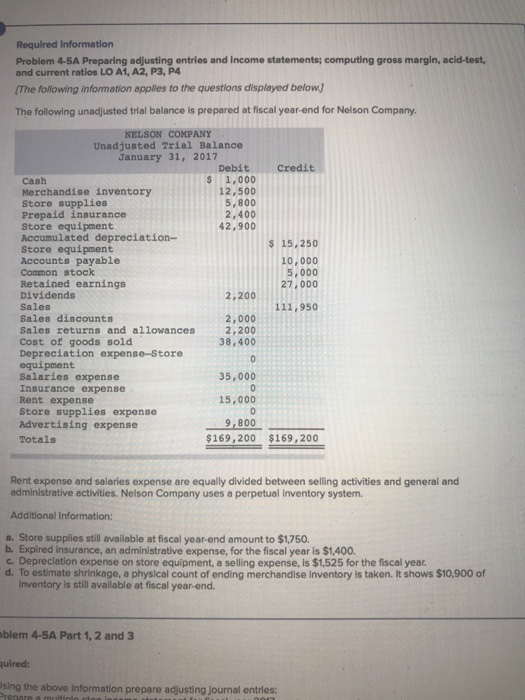

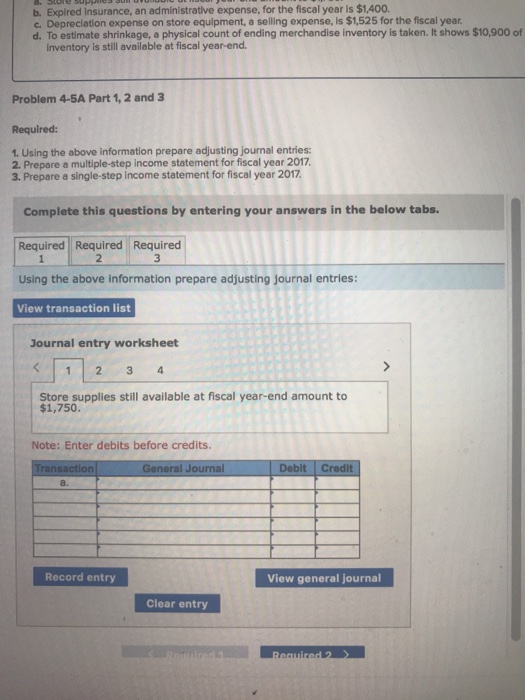

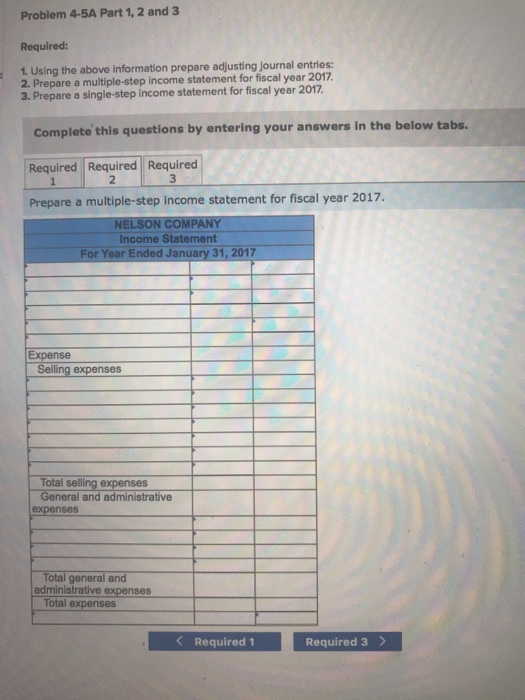

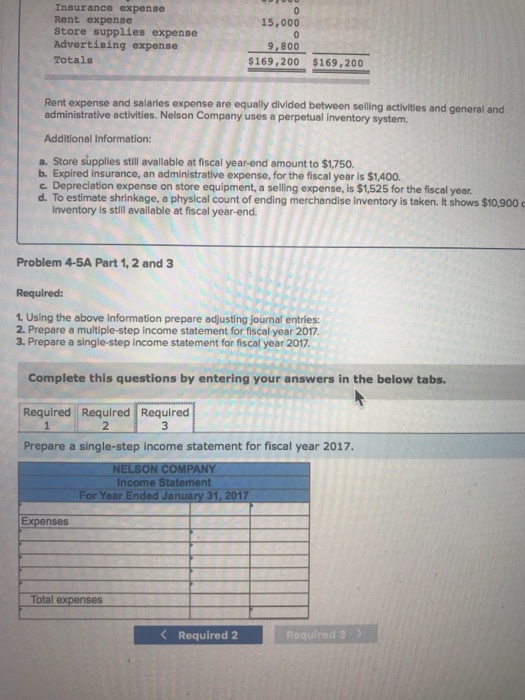

Required information Problem 4-5A Preparing adjusting entries and income statements; computing gross margin, acid-test, and current ratios LO A1, A2, P3, P4 (The following information applies to the questions displayed below The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. NELSON COMPANY Unadjusted Trial Balance January 31, 2017 Debit Credit 1,000 12,500 5,800 2,400 42,900 Cash Merchandise inventory Store supplies Prepaid insurance Store equ i pment Accumulated depreciation- Store equipment Accounts payable Common stock Retained earnings Dividends Sales Sales discounts Sales returns and allowances Cost of goods sold Depreciation expense-Store equipment Salaries expense Insurance expense Rent expense Store supplies expense Advertising expense Totals 15,250 10,000 5,000 27,000 2,200 111,950 2,000 2,200 38,400 35,000 15,000 9,800- $169,200 $169,200 Rent expense and salaries expense are equally divided between selling activities and general and edministrative activities. Nelson Company uses a perpetual inventory system Additional Information: a. Store supplies still available at fiscal year-end amount to $1,750 b. Expired insurance, an administrative expense, for the fiscal year is $1,400. c Depreclation expense on store equipment, a selling expense, is $1,525 for the fiscal year d. To estimate shrinkage, a physical count of ending merchandise Inventory is taken. It shows $10,900 of inventory is still avallable at fiscal year-end. blem 4-5A Part 1, 2 and 3 uired: sing the above information prepare adjusting journal entrles

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts