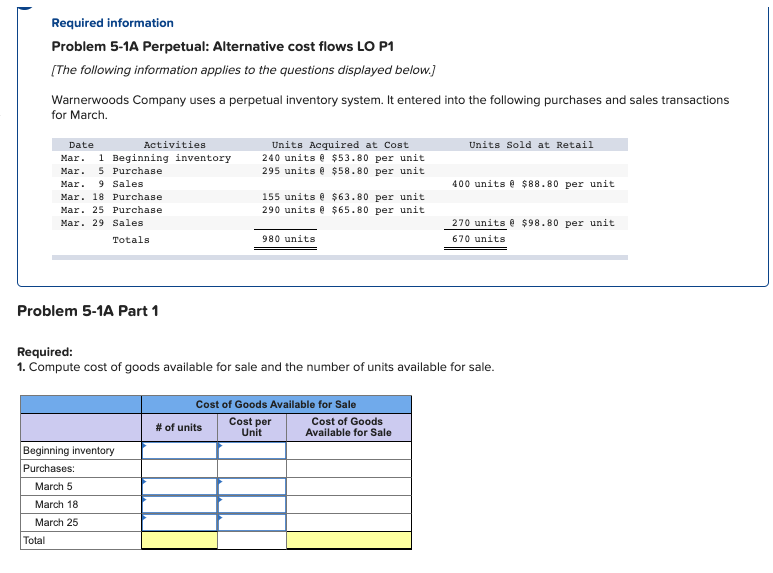

Question: Required information Problem 5-1A Perpetual: Alternative cost flows LO P1 [The following information applies to the questions displayed below.) Warnerwoods Company uses a perpetual inventory

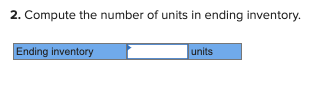

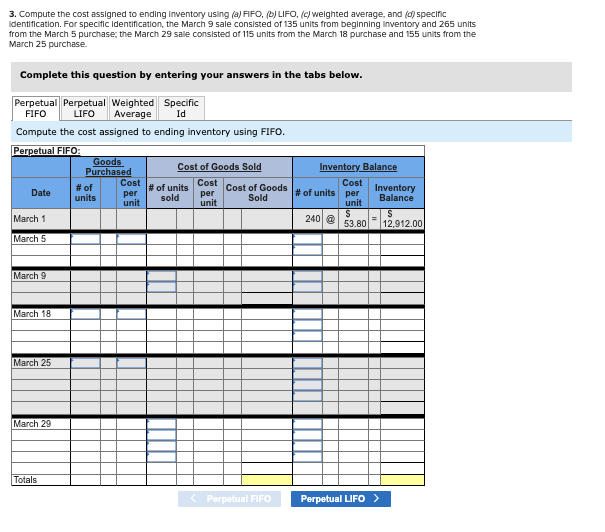

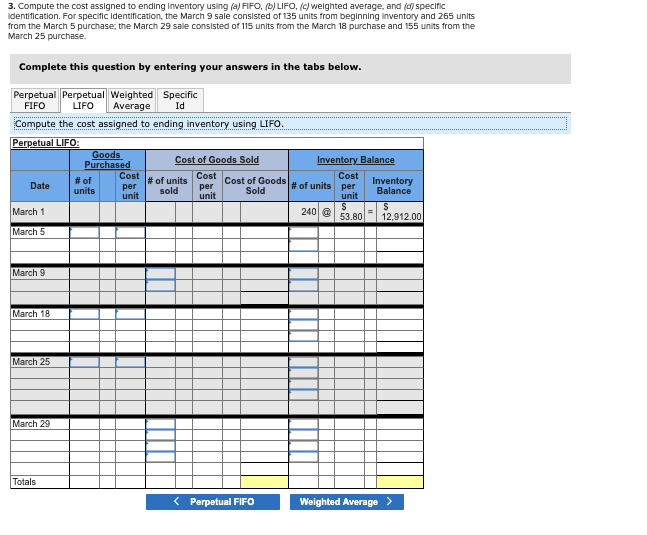

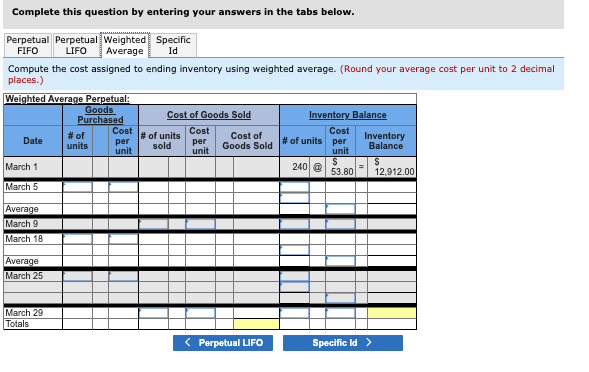

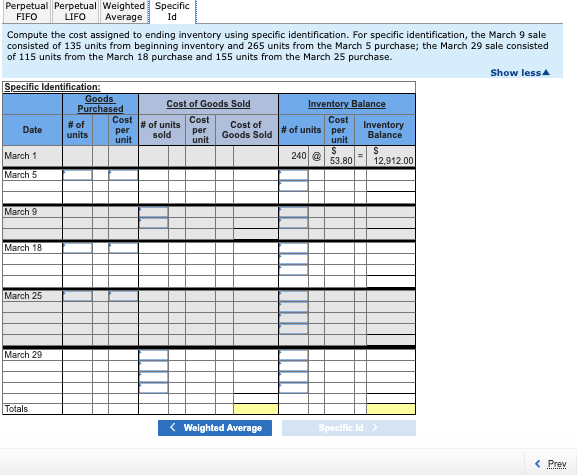

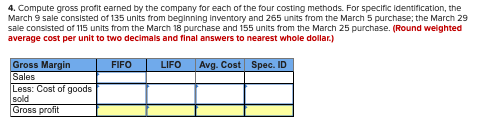

Required information Problem 5-1A Perpetual: Alternative cost flows LO P1 [The following information applies to the questions displayed below.) Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March Units sold at Retail Date Activities Mar. 1 Beginning inventory Mar. 5 Purchase Mar. 9 Sales Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales Units Acquired at Cost 240 units @ $53.80 per unit 295 units @ $58.80 per unit 155 units @ $63.80 per unit 290 units @ $65.80 per unit 400 units @ $88.80 per unit 270 units @ $98.80 per unit 670 units Totals 980 units Problem 5-1A Part 1 Required: 1. Compute cost of goods available for sale and the number of units available for sale. Cost of Goods Available for Sale Cost per Cost of Goods # of units Unit Available for Sale Beginning inventory Purchases: March 5 March 18 March 25 Total 2. Compute the number of units in ending inventory. Ending inventory units 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. For specific identification, the March 9 sale consisted of 135 units from beginning inventory and 265 units from the March 5 purchase: the March 29 salle consisted of 115 units from the March 18 purchase and 155 units from the March 25 purchase Complete this question by entering your answers in the tabs below. Perpetual Perpetual Weighted Specific FIFO LIFO Average Id Compute the cost assigned to ending inventory using FIFO. Perpetual FIFO: Goods Purchased Cost of Goods Sold Cost # of Date # of units Cost Cost of Goods units per sold per unit unit Sold March 1 Inventory_Balance Cost # of units per Inventory Balance unit S S 240 @ 53.80 12,912.00 March 5 March 9 March 18 March 25 March 29 Totals 3. Compute the cost assigned to ending Inventory using (a) FIFO, (b) LIFO. (c) weighted average, and (d) specific Identification. For specific Identification, the March 9 sale consisted of 135 units from beginning inventory and 265 units from the March 5 purchase, the March 29 sale consisted of 115 units from the March 18 purchase and 155 units from the March 25 purchase. Complete this question by entering your answers in the tabs below. Perpetual Perpetual Weighted Specific FIFO LIFO Average Id Compute the cost assigned to ending inventory using LIFO. Perpetual LIFO: Goods Purchased Cost of Goods Sold Inventory Balance # of Cost # of units Cost Date Cost Cost of Goods per units per Inventory # of units per unit sold Sold Balance unit March 1 S S 240 @ 53.80 12,912.00 March 5 unit March 9 March 18 March 25 March 29 Totals Complete this question by entering your answers in the tabs below. Perpetual Perpetual Weighted Specific FIFO LIFO Average Id Compute the cost assigned to ending inventory using weighted average. (Round your average cost per unit to 2 decimal places.) Weighted Average Perpetual: Goods Purchased Cost of Goods Sold Inventory Balance # of Cost Cost # of units Date Cost Cost of units Inventory per sold per # of units per unit unit Goods Sold Balance unit March 1 S S 2401 53.80 12,912.00 March 5 Average March 9 March 18 Average March 25 March 29 Totals Perpetual Perpetual Weighted Specific FIFO LIFO Average Id Compute the cost assigned to ending inventory using specific identification. For specific identification, the March 9 sale consisted of 135 units from beginning inventory and 265 units from the March 5 purchase; the March 29 sale consisted of 115 units from the March 18 purchase and 155 units from the March 25 purchase. Show less Specific Identification: Goods Purchased Cost of Goods Sold Inventory Balance # of Cost Cost Date # of units Cost of units per Inventory per # of units per Goods Sold sold unit Balance unit unit March 1 240 @ S S 53.80 12,912.00 March 5 Cost March 9 March 18 March 25 March 29 Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts