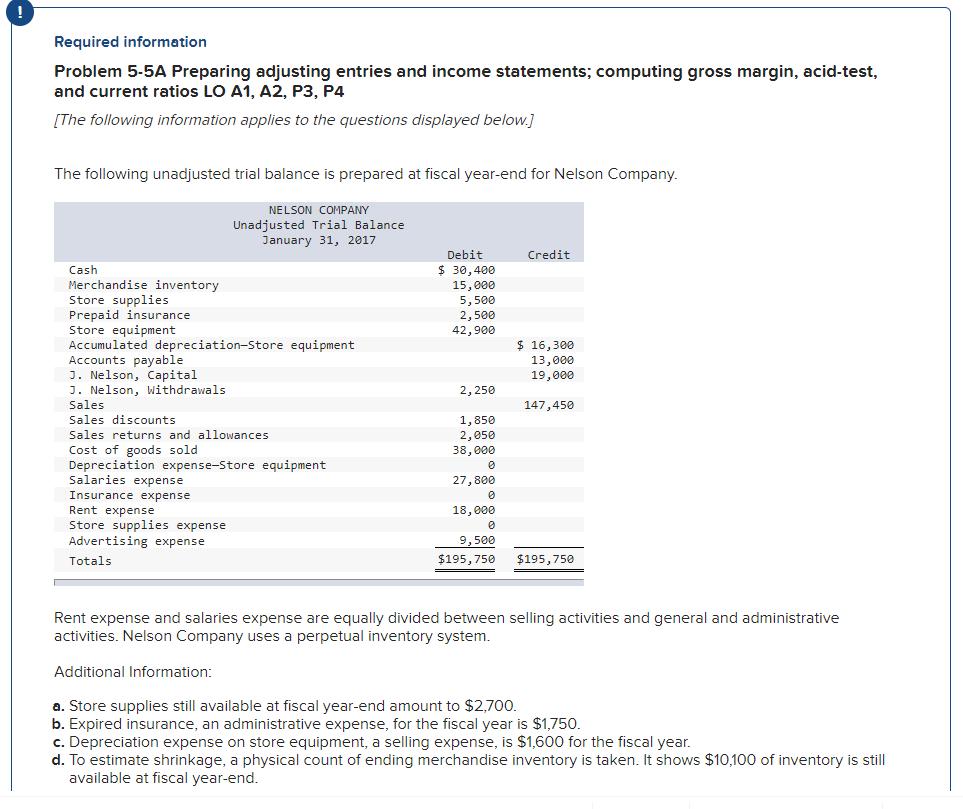

Question: ! Required information Problem 5-5A Preparing adjusting entries and income statements; computing gross margin, acid-test, and current ratios LO A1, A2, P3, P4 [The following

![[The following information applies to the questions displayed below.] The following unadjusted](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e89ef7cc938_07966e89ef76a080.jpg)

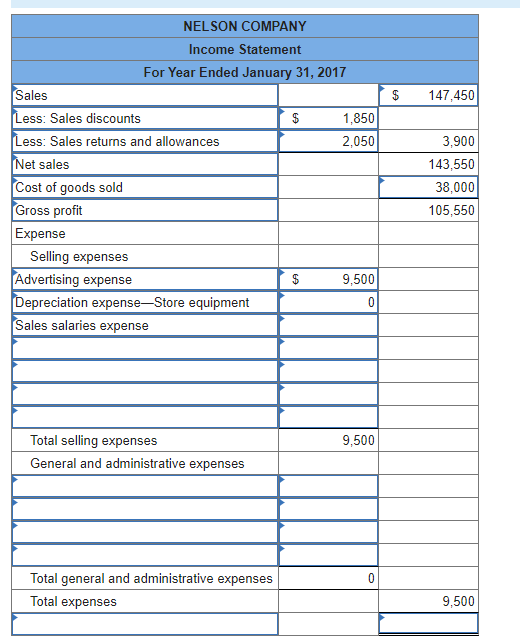

! Required information Problem 5-5A Preparing adjusting entries and income statements; computing gross margin, acid-test, and current ratios LO A1, A2, P3, P4 [The following information applies to the questions displayed below.] The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. NELSON COMPANY Unadjusted Trial Balance January 31, 2017 Credit Debit $ 30,400 15,000 5,500 2,500 42,900 $ 16,300 13,000 19,000 2,250 147,450 Cash Merchandise inventory Store supplies Prepaid insurance Store equipment Accumulated depreciation-store equipment Accounts payable 3. Nelson, Capital 3. Nelson, Withdrawals Sales Sales discounts Sales returns and allowances Cost of goods sold Depreciation expense-Store equipment Salaries expense Insurance expense Rent expense Store supplies expense Advertising expense Totals 1,850 2,05 38,000 27,800 18,000 9,500 $195,750 $195,750 Rent expense and salaries expense are equally divided between selling activities and general and administrative activities. Nelson Company uses a perpetual inventory system. Additional Information: a. Store supplies still available at fiscal year-end amount to $2,700. b. Expired insurance, an administrative expense, for the fiscal year is $1,750. c. Depreciation expense on store equipment, a selling expense, is $1,600 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $10,100 of inventory is still available at fiscal year-end. $ 147,450 NELSON COMPANY Income Statement For Year Ended January 31, 2017 Sales Less: Sales discounts $ 1,850 Less: Sales returns and allowances 2,050 Net sales Cost of goods sold Gross profit Expense Selling expenses Advertising expense $ 9,500 Depreciation expenseStore equipment 0 Sales salaries expense 3,900 143,550 38,000 105,550 9,500 Total selling expenses General and administrative expenses 0 Total general and administrative expenses Total expenses 9,500 Required: 1. Using the above information prepare adjusting journal entries: 2. Prepare a multiple-step income statement for fiscal year 2017. 3. Prepare a single-step income statement for fiscal year 2017. Complete this questions by entering your answers in the below tabs. Required 1 Required 2 Required 3 Prepare a single-step income statement for fiscal year 2017. NELSON COMPANY Income Statement For Year Ended January 31, 2017 Expenses Total expenses 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts