Question: ! Required Information Problem 5-62 (LO 5-3) (Algo) [The following information applies to the questions displayed below.] Fred currently earns $10,700 per month. Fred has

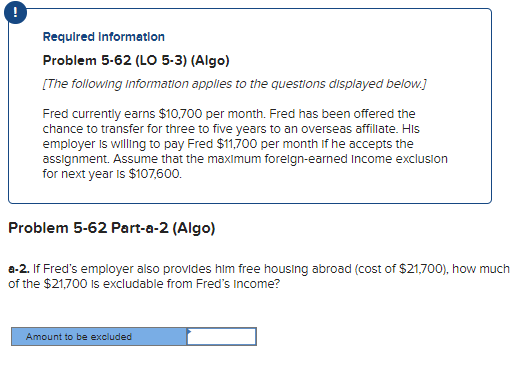

! Required Information Problem 5-62 (LO 5-3) (Algo) [The following information applies to the questions displayed below.] Fred currently earns $10,700 per month. Fred has been offered the chance to transfer for three to five years to an overseas affillate. His employer is willing to pay Fred $11,700 per month if he accepts the assignment. Assume that the maximum forelgn-earned Income exclusion for next year is $107,600. Problem 5-62 Part-a-2 (Algo) a-2. If Fred's employer also provides him free housing abroad (cost of $21,700), how much of the $21,700 is excludable from Fred's Income? Amount to be excluded

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock