Question: Required information Problem 6 - 2 7 ( LO 6 - 1 ) ( Static ) [ The following information applies to the questions displayed

Required information

Problem LO Static

The following information applies to the questions displayed below.

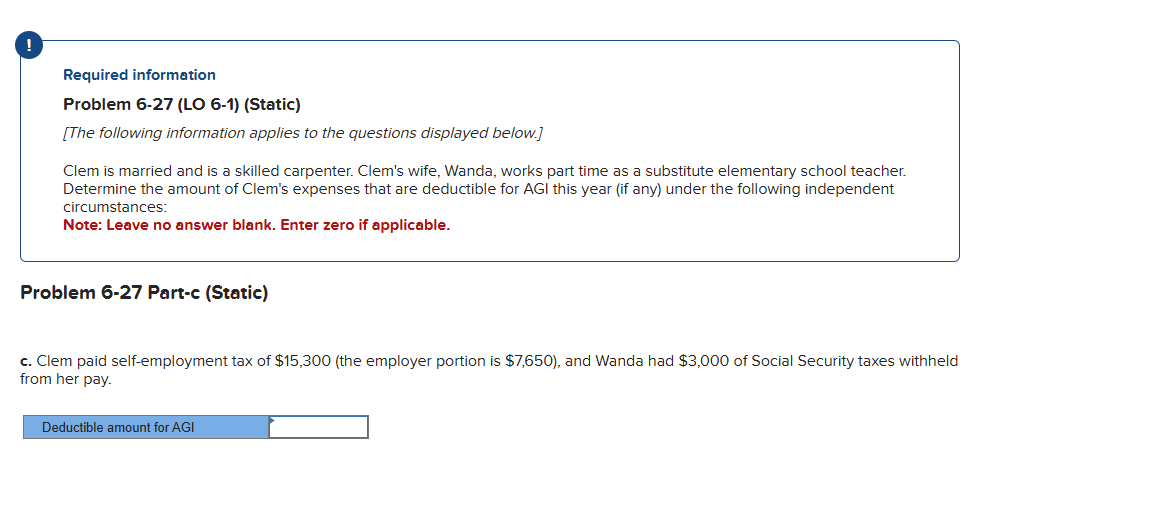

Clem is married and is a skilled carpenter. Clem's wife, Wanda, works part time as a substitute elementary school teacher. Determine the amount of Clem's expenses that are deductible for AGl this year if any under the following independent circumstances:

Note: Leave no answer blank. Enter zero if applicable.

Problem Partc Static

c Clem paid selfemployment tax of $ the employer portion is $ and Wanda had $ of Social Security taxes withheld from her pay.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock