Question: Required information Problem 6 - 3 2 Part a 1 ( LO 6 - 1 ) ( Static ) [ The following information applies to

Required information

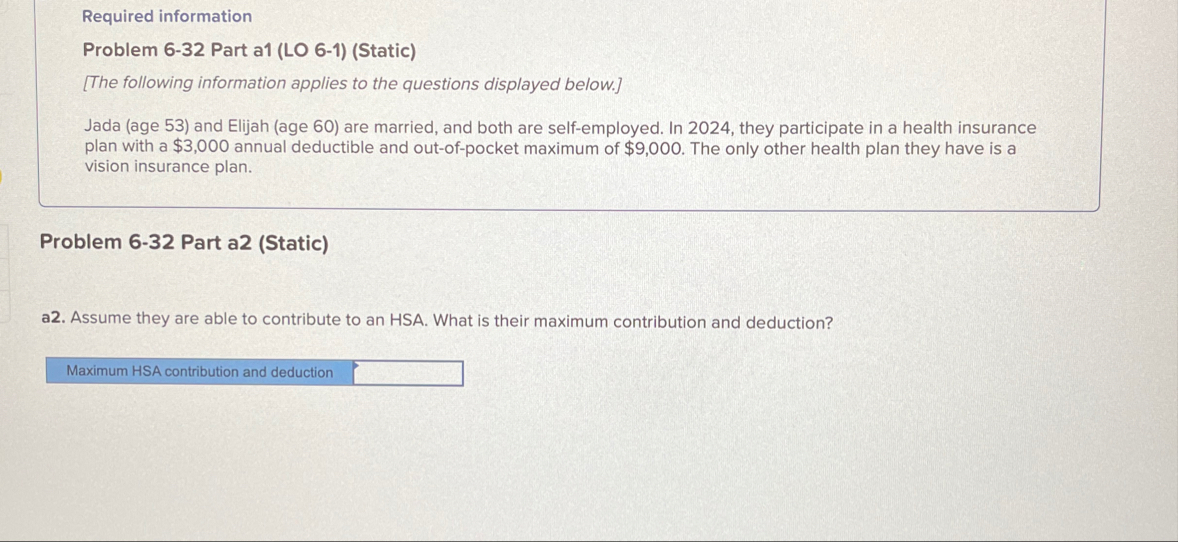

Problem Part aLO Static

The following information applies to the questions displayed below.

Jada age and Elijah age are married, and both are selfemployed. In they participate in a health insurance plan with a $ annual deductible and outofpocket maximum of $ The only other health plan they have is a vision insurance plan.

Problem Part aStatic

a Assume they are able to contribute to an HSA. What is their maximum contribution and deduction?

Maximum HSA contribution and deduction

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock