Question: Required information Problem 6 - 3 3 ( LO 6 - 1 ) ( Algo ) [ The following information applies to the questions displayed

Required information

Problem LO Algo

The following information applies to the questions displayed below.

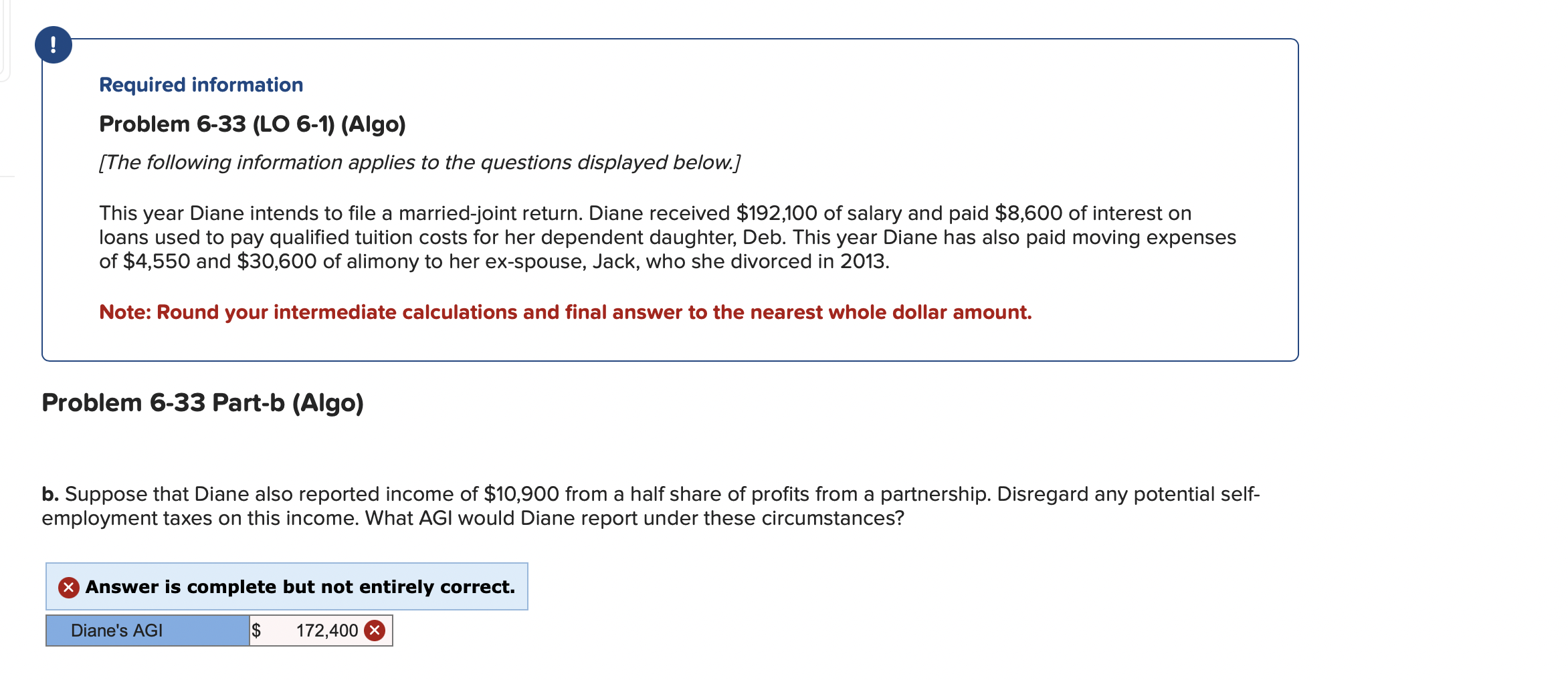

This year Diane intends to file a marriedjoint return. Diane received $ of salary and paid $ of interest on loans used to pay qualified tuition costs for her dependent daughter, Deb. This year Diane has also paid moving expenses of $ and $ of alimony to her exspouse, Jack, who she divorced in

Note: Round your intermediate calculations and final answer to the nearest whole dollar amount.

Problem Partb Algo

b Suppose that Diane also reported income of $ from a half share of profits from a partnership. Disregard any potential selfemployment taxes on this income. What AGI would Diane report under these circumstances?

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock