Question: ! Required information Problem 6 - 7 7 ( LO 6 - 5 ) ( Algo ) [ The following information applies to the questions

Required information

Problem LO Algo

The following information applies to the questions

displayed below.

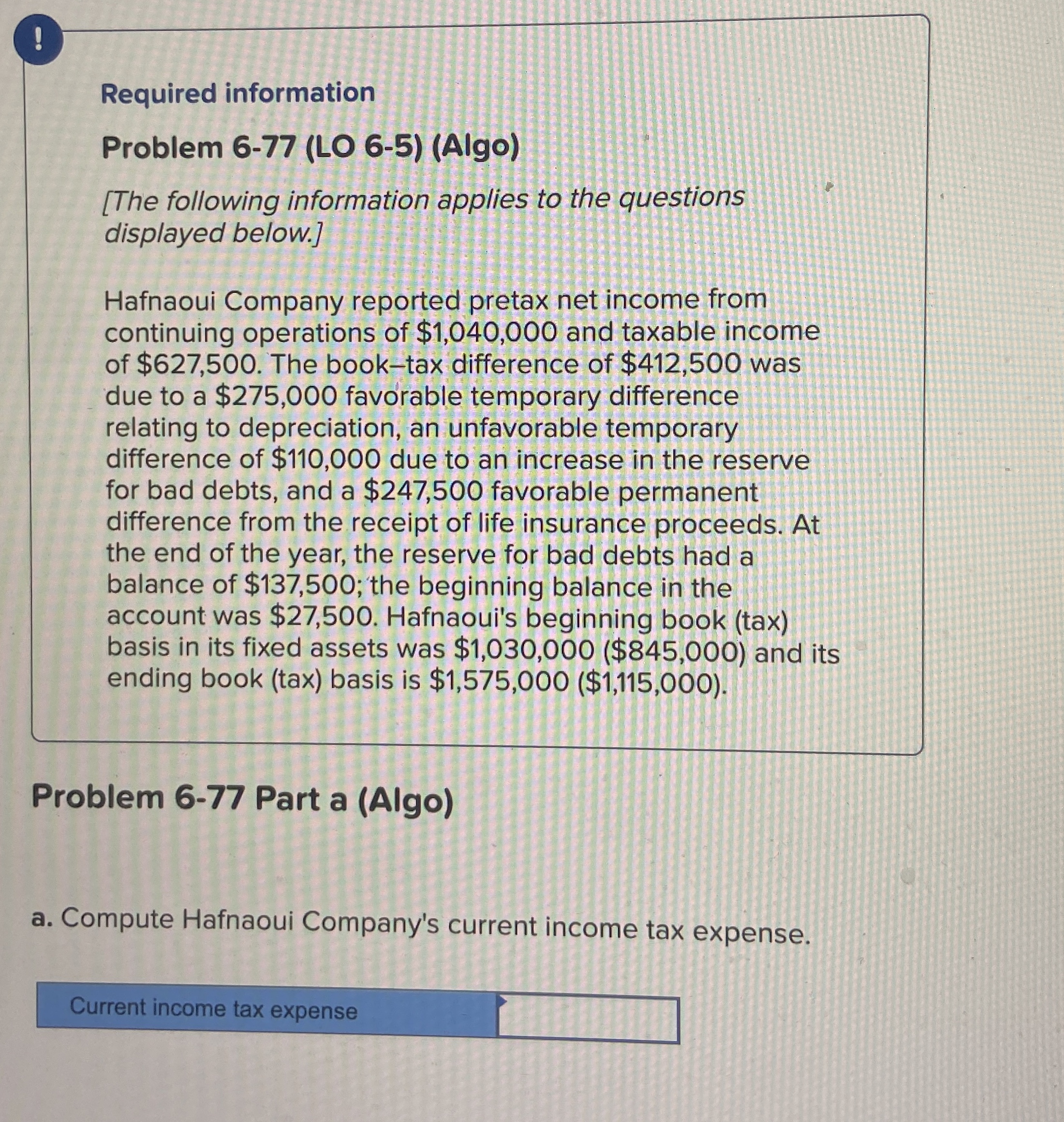

Hafnaoui Company reported pretax net income from

continuing operations of $ and taxable income

of $ The booktax difference of $ was

due to a $ favorable temporary difference

relating to depreciation, an unfavorable temporary

difference of $ due to an increase in the reserve

for bad debts, and a $ favorable permanent

difference from the receipt of life insurance proceeds. At

the end of the year, the reserve for bad debts had a

balance of $; the beginning balance in the

account was $ Hafnaoui's beginning book tax

basis in its fixed assets was $$ and its

ending book tax basis is $ $

Problem Part a Algo

a Compute Hafnaoui Company's current income tax expense.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock